Key Takeaways

- Global sugar surplus and Ukrainian imports are driving down sugar prices, negatively impacting Südzucker's Sugar segment revenues and net margins.

- Declining ethanol and starch prices, alongside rising production costs, are significantly pressuring Südzucker's CropEnergies segment and overall earnings.

- Enhanced European sugar export attractiveness, operational improvements, and cost efficiencies could positively impact revenues, margins, and overall profitability amid market pressures.

Catalysts

About Südzucker- Produces and sells sugar products in Germany, rest of the European Union, the United Kingdom, the United States, and internationally.

- Südzucker is facing a global sugar surplus expected to continue into the marketing year '24/'25, leading to declining sugar prices in Europe. This is likely to negatively impact revenue and net margins in their Sugar segment.

- With significant imports from Ukraine continuing to pressure European sugar prices, and potential for additional imports in 2025, there’s an expected ongoing negative impact on Südzucker’s pricing, further affecting future revenues.

- The Sugar segment's increase in production costs, coupled with lower sugar prices, is a substantial factor contributing to declining current and expected earnings. Such cost pressures can compress net margins further.

- CropEnergies segment is experiencing pressures from significantly lower ethanol prices, negatively affecting future revenue and operating results. This is compounded by downward price pressure in related Starch segments, further impacting overall earnings.

- Although certain segments like Fruit showed a positive revenue increase, the overall anticipated reductions in earnings guidance and expected losses in major segments such as Sugar suggest future earnings per share might be at risk, with operational challenges impacting overall financial health.

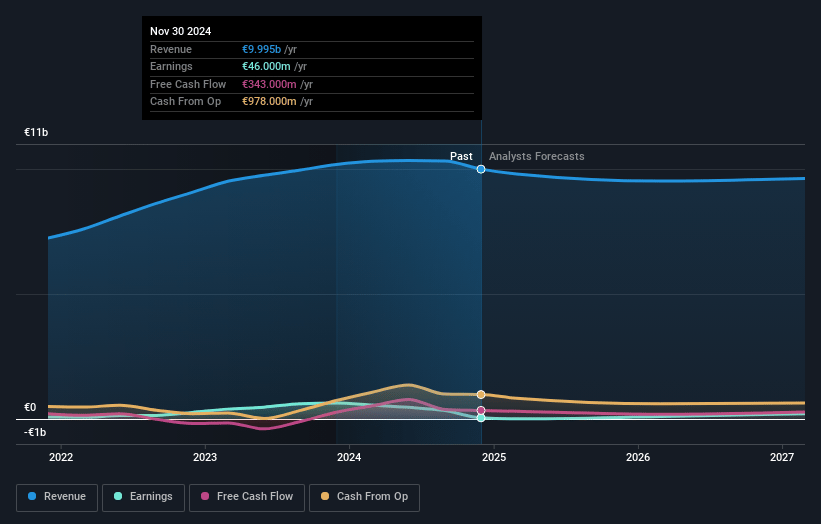

Südzucker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Südzucker's revenue will decrease by -3.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.3% today to 2.0% in 3 years time.

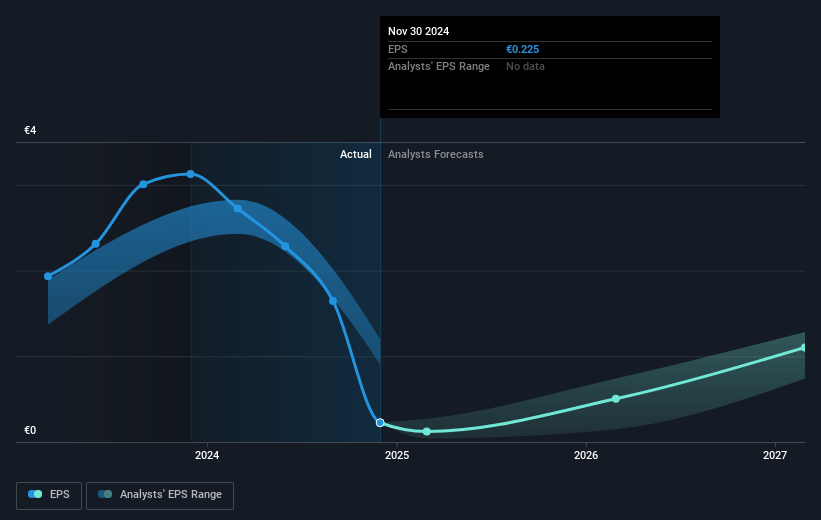

- Analysts expect earnings to reach €187.5 million (and earnings per share of €1.17) by about November 2027, down from €336.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2027 earnings, up from 6.7x today. This future PE is lower than the current PE for the GB Food industry at 17.8x.

- Analysts expect the number of shares outstanding to decline by 7.73% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 4.36%, as per the Simply Wall St company report.

Südzucker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite pressures on sugar prices, European sugar exports have become more attractive, potentially supporting revenues if demand from non-European markets increases.

- Measures to limit duty-free sugar imports from Ukraine and anticipated reduced import volumes could help stabilize and eventually improve sugar prices in the EU, positively impacting revenue and margins.

- Improved operational performance in the Fruit segment is anticipated to contribute positively to earnings, with higher sales volumes and margins likely sustaining growth.

- Stable to improving operating results from the Special Products segment, fueled by higher margins and stable revenues, could bolster overall profitability.

- Anticipated cost improvements, particularly in raw material prices from sugar beet farmers, may enhance margins and reduce losses in forthcoming periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €10.1 for Südzucker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €12.0, and the most bearish reporting a price target of just €9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be €9.4 billion, earnings will come to €187.5 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 4.4%.

- Given the current share price of €11.1, the analyst's price target of €10.1 is 9.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 5 Analysts

Anticipated Sugar Price Rise And Ethanol Price Stabilization Will Improve Future Prospects

Key Takeaways Global sugar deficit could raise prices, boosting Südzucker's future revenues if managed properly amidst EU harvest and inventory challenges. Stabilizing ethanol prices and increased fruit segment profits may enhance Südzucker's overall earnings and competitiveness.

View narrative€10.98

FV

3.2% undervalued intrinsic discount-1.89%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

0users have followed this narrative

8 days ago author updated this narrative