Key Takeaways

- Tightening biofuel supply, favorable policy shifts, and global decarbonization targets are driving demand and price improvements, supporting Verbio’s revenue growth and pricing power.

- Strategic cost control, technology-driven efficiency gains, and expansion into specialty chemicals and high-value renewables are set to materially lift margins and strengthen the balance sheet.

- Heavy reliance on favorable regulation, volatile input costs, operational challenges, high leverage, and competition from alternative fuels threaten profitability, financial flexibility, and growth prospects.

Catalysts

About Verbio- Engages in the production and distribution of fuels and finished products in Germany, Europe, North America, and internationally.

- The anticipated tightening of biofuel supply as higher-cost competitors reduce output, combined with gradual policy improvements—such as stricter fraud controls and quota increases—across Europe is likely to support a material recovery in greenhouse gas (GHG) quota prices, directly impacting Verbio’s revenue and EBITDA as each €1 rise in quota price increases annual EBITDA by €1 million.

- Verbio’s technology-led ramp-up in U.S. ethanol and renewable natural gas plants positions the company to capitalize on global market openings (e.g., U.K. opening to U.S. ethanol) and on increasing efficiency, supporting higher utilization, improved net margins, and materially higher EBITDA from North American operations over the next fiscal years.

- Strategic scaling-back of growth CapEx and focus on free cash flow generation, in combination with workforce reductions and enhanced inventory management, should significantly improve net earnings and reduce leverage, strengthening the balance sheet and enabling reinvestment or return of capital in the medium term.

- Long-term global decarbonization targets and increasingly stringent climate-focused regulatory frameworks, particularly in the EU and major growth markets like India and the U.S., are set to drive sustained demand for renewable fuels, providing a tailwind for Verbio's revenue growth and pricing power as policy clarity returns.

- Ongoing technological advancements at Verbio’s new specialty chemicals facility (with partially presold volumes at a green premium) and expansion into high-value biogas and cellulosic ethanol are set to enhance product mix and margin profile, supporting long-term increases in net margins and return on invested capital.

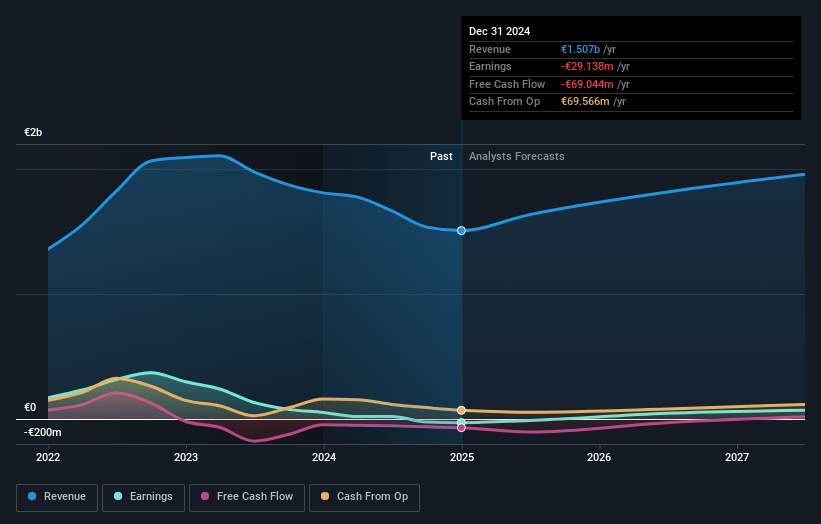

Verbio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Verbio's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.2% today to 6.0% in 3 years time.

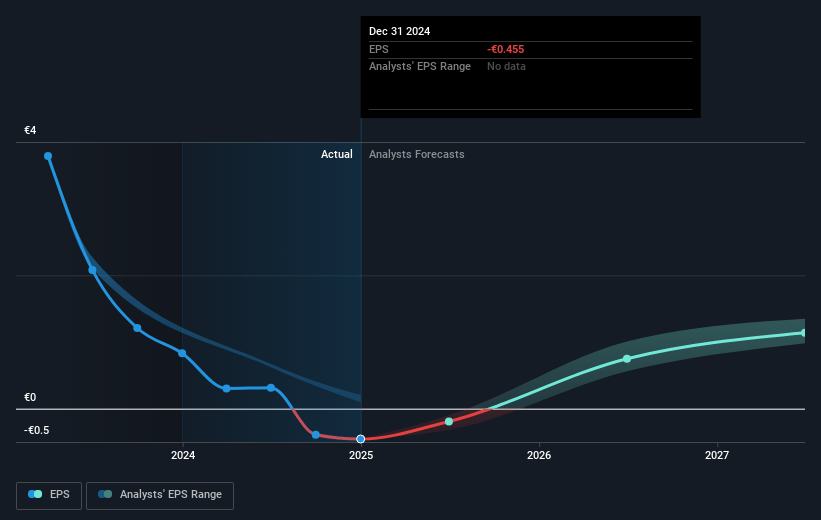

- Analysts expect earnings to reach €129.8 million (and earnings per share of €2.05) by about July 2028, up from €-32.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, up from -22.4x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.04%, as per the Simply Wall St company report.

Verbio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on supportive regulatory frameworks (such as greenhouse gas quotas and tax credits) exposes Verbio to policy risk; lack of decisive or timely government action, ongoing regulatory uncertainty in the US and EU, and persistent quota price weakness could continue to suppress revenues and EBITDA.

- Ongoing margin pressure from volatile feedstock costs (e.g., rapeseed oil, wheat) and flat or weak biofuel prices, despite higher production volumes, indicates sustained risk of margin compression and lower overall profitability.

- Operational ramp-up challenges in newly developed facilities, particularly in the US (Nevada and South Bend plants), are leading to continued start-up losses and delayed positive EBITDA contribution—prolonged ramp-up could further delay earnings improvements and consume cash/resources.

- High net debt levels (€154–190 million) and elevated inventory tie up working capital and could limit financial flexibility; further delays in cash flow improvement or failure to achieve positive free cash flow may increase refinancing or liquidity risk.

- Market competition and macro trends—such as more attractive electrification options for transport, uncertainties around future demand for biofuels versus synthetic fuels or hydrogen, and lackluster growth in GHG pricing—pose long-term risk to Verbio’s addressable market and top-line growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €14.85 for Verbio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.0, and the most bearish reporting a price target of just €9.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.2 billion, earnings will come to €129.8 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 5.0%.

- Given the current share price of €11.31, the analyst price target of €14.85 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.