Key Takeaways

- Strategic focus on high-growth asset classes and division expansion aims to drive revenue, improve margins, and enhance earnings through 2027.

- Diversification, technological efficiency, and capital transition efforts target reduced costs, financial stability, and increased revenue in the real estate finance segment.

- Geopolitical uncertainties, strategic adjustments, and elevated operational expenses could pressure Deutsche Pfandbriefbank's earnings, net margins, and short-term growth amidst shifting market dynamics.

Catalysts

About Deutsche Pfandbriefbank- Provides commercial real estate and public investment finance in Europe and the United States of America.

- Deutsche Pfandbriefbank's strategic focus on high-growth asset classes such as data centers, service living, and senior living is expected to enhance their Real Estate Finance Solutions division, contributing positively to future revenue and earnings.

- The development of the Real Estate Investment Solutions division aims to increase commission and fee income, targeting a contribution of around 10% by 2027, which should positively impact net margins and overall earnings.

- The implementation of the Strategy 2027 to diversify the portfolio and reduce the noncore portfolio, alongside increased efficiency through technology and artificial intelligence, is expected to lower the cost-income ratio to below 45% by the end of 2027, improving net margins.

- Partnerships, such as the one with Starwood Capital, aim to leverage the growing real estate finance market provided by institutional investors, increasing revenue by expanding the value chain for real estate financing with significantly less capital employed.

- The transition to the F-IRB approach under Basel IV rules provides a stable foundation for capital requirements from January 2025, potentially enhancing financial stability and reducing risk, ultimately supporting future earnings.

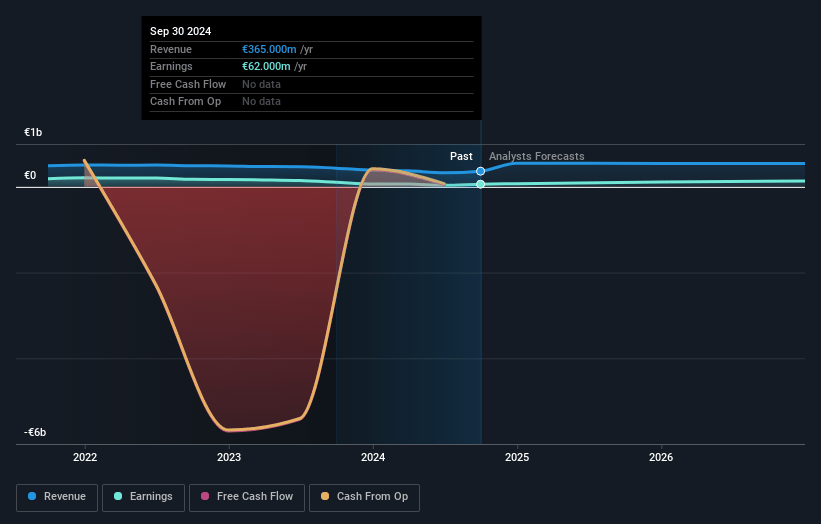

Deutsche Pfandbriefbank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Deutsche Pfandbriefbank's revenue will grow by 18.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.0% today to 29.5% in 3 years time.

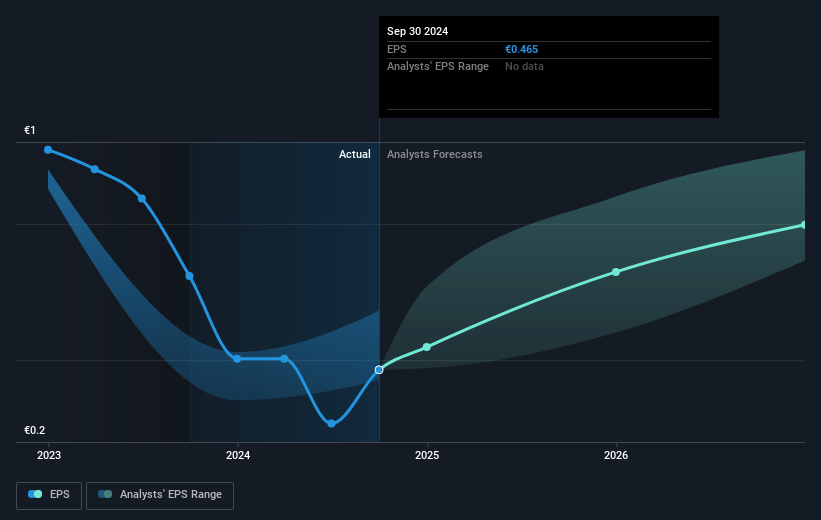

- Analysts expect earnings to reach €179.6 million (and earnings per share of €1.28) by about February 2028, up from €62.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, down from 12.1x today. This future PE is lower than the current PE for the GB Diversified Financial industry at 12.1x.

- Analysts expect the number of shares outstanding to decline by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.2%, as per the Simply Wall St company report.

Deutsche Pfandbriefbank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The heightened level of geopolitical uncertainty related to factors like the U.S. election, the war in Ukraine, and the conflict in the Middle East could impact market stability, leading to increased volatility in financial results and making it challenging for Deutsche Pfandbriefbank to project consistent revenue growth.

- Shifts in U.S. economic policies, such as tariffs on imports and adjustments to energy subsidies, could affect export-oriented economies like Germany, potentially impacting Deutsche Pfandbriefbank's earnings by reducing cross-border financing opportunities.

- Ongoing elevated risk provisioning, particularly related to office properties in the U.S. and German development loans, could continue to pressure net margins and dampen profitability if loan defaults or market downturns increase.

- A decline in business volume from €6 billion to €5.5 billion following strategic portfolio adjustments implies potential pressure on revenue, as the focus shifts towards profitability and margins instead of volume growth.

- Increased operational expenses driven by strategic investments in IT and digitalization, despite cost-saving measures, could temporarily raise the cost-income ratio, leading to narrower net margins and affecting short-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €6.5 for Deutsche Pfandbriefbank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €8.9, and the most bearish reporting a price target of just €5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €607.8 million, earnings will come to €179.6 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of €5.56, the analyst price target of €6.5 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives