Key Takeaways

- Expansion into new markets and successful diversification into non-auto sectors are expected to significantly boost future revenues and profits.

- Strategic divestments and initiatives in high-growth segments will likely enhance efficiencies, stabilize net margins, and improve cash flow.

- Mutares SE's growth strategy of acquiring and restructuring loss-making businesses is high-risk and capital-intensive, impacting net margins and overall profitability if turnaround plans falter.

Catalysts

About Mutares SE KGaA- A private equity firm specializing in investments in secondary direct, special situations, bridge financing, recapitalization, distressed/vulture, management succession, reorganization, carve-outs, turnarounds, spin-offs and re-funding.

- The company's growth strategy involves expanding into new markets like China, the US, and India as they become increasingly viable due to geopolitical shifts. This expansion is expected to boost future revenues significantly.

- Mutares SE KGaA's focus on larger acquisitions in non-auto segments such as Magirus and Buderus Edelstahl, which are outperforming expectations, suggests a potential increase in profits and net margins due to diversification into more profitable sectors.

- The success in negotiation power with OEMs in the Automotive & Mobility segment, owing to increased size and consolidation strategies, could stabilize and improve net margins by optimizing capacity and offering better contractual terms.

- Ongoing sell-side transactions, particularly in mature entities within Goods & Services and the strategic split and partial exits of profitable companies like Steyr, suggest an anticipated boost in earnings and cash flow through lucrative divestments.

- The company’s strategic initiatives within specific high-growth segments, such as energy infrastructure, defense, and distribution optimization, are likely to enhance efficiencies and support net margin improvement as these segments trend positively.

Mutares SE KGaA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mutares SE KGaA's revenue will grow by 11.8% annually over the next 3 years.

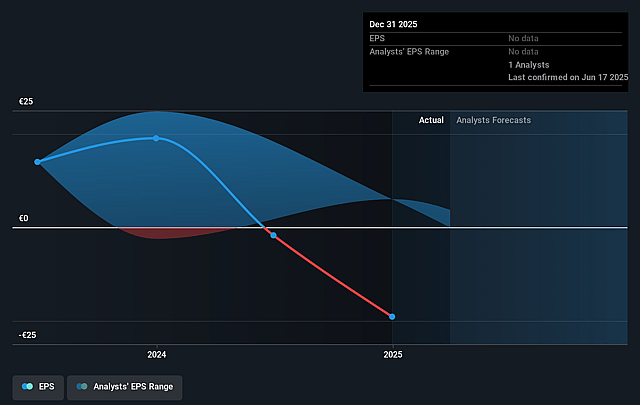

- Analysts are not forecasting that Mutares SE KGaA will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Mutares SE KGaA's profit margin will increase from -1.9% to the average DE Capital Markets industry of 12.3% in 3 years.

- If Mutares SE KGaA's profit margin were to converge on the industry average, you could expect earnings to reach €948.7 million (and earnings per share of €45.18) by about July 2028, up from €-103.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.3x on those 2028 earnings, up from -6.5x today. This future PE is lower than the current PE for the DE Capital Markets industry at 21.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.52%, as per the Simply Wall St company report.

Mutares SE KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Mutares SE faces ongoing documentation and auditing challenges, particularly with complex acquisitions like Serneke, which can affect the timely and accurate representation of their financials, potentially impacting investor confidence and the company’s revenue reporting.

- The automotive segment is experiencing strong headwinds with fluctuations in OEM call-offs and demands, and although Mutares has consolidated this segment, it remains vulnerable to changes in automotive market conditions, potentially affecting its net margins and earnings.

- The company's growth strategy involves acquiring loss-making businesses and restructuring them, which inherently carries high risk. Initial stages are capital-intensive and can negatively impact adjusted EBITDA, posing a risk to net margins and overall profitability if turnaround plans do not proceed as expected.

- The Retail & Food segment is under reassessment due to current market challenges, including careful consumer spending, which could result in continued losses and impact earnings if significant improvements are not made.

- Mutares' strategy to expand in regions like China, India, and the U.S. during uncertain geopolitical climates increases operational risks and costs, potentially affecting the ability to stabilize revenues and achieve projected growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €44.833 for Mutares SE KGaA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €47.5, and the most bearish reporting a price target of just €40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.7 billion, earnings will come to €948.7 million, and it would be trading on a PE ratio of 1.3x, assuming you use a discount rate of 9.5%.

- Given the current share price of €31.6, the analyst price target of €44.83 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.