Key Takeaways

- Accelerated restructuring activity and strong turnaround capabilities position Mutares for portfolio expansion, operational improvement, and margin growth across diverse sectors and new geographies.

- Increased exit opportunities and demand for transformation services enable higher exit values, improved profitability, and more stable long-term revenue streams.

- Persistent underperformance in key segments, overreliance on asset sales, and risky expansion into distressed sectors threaten profitability, stability, and future acquisition prospects.

Catalysts

About Mutares SE KGaA- A private equity firm specializing in investments in secondary direct, special situations, bridge financing, recapitalization, distressed/vulture, management succession, reorganization, carve-outs, turnarounds, spin-offs and re-funding.

- The ongoing high pace of corporate divestitures and restructuring activity across Europe is expanding the pool of attractive distressed asset opportunities, allowing Mutares to consistently source undervalued acquisition targets and significantly grow its portfolio. This is expected to drive substantial increases in group revenue and portfolio EBITDA as new acquisitions are integrated and restructured.

- Rising institutional demand and liquidity for alternative asset classes, such as special situations and distressed private equity, improves Mutares' environment for exits and supports higher valuation multiples, potentially boosting exit proceeds and overall profitability (net earnings).

- Structural shifts in European manufacturing-like supply chain localization and digitalization-have accelerated demand for operational transformation services, directly aligning with Mutares' core competencies and increasing revenues from turnaround consulting and optimization within the portfolio.

- Mutares' established expertise in operational improvement and a growing track record of successful turnarounds means their ability to quickly reduce costs and stabilize newly acquired companies (e.g., significant cash burn reduction at Magirus) is underappreciated, pointing to significant margin expansion and higher group-level net results as this operating leverage scales.

- Strategic pivoting towards high-potential sectors (infrastructure, logistics, defense, and chemicals) and ongoing geographic expansion (including new offices in Japan) diversifies risk and opens new deal pipelines, setting the stage for sustainable long-term revenue growth and mitigation of earnings volatility.

Mutares SE KGaA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mutares SE KGaA's revenue will grow by 9.5% annually over the next 3 years.

- Analysts are not forecasting that Mutares SE KGaA will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Mutares SE KGaA's profit margin will increase from 0.7% to the average DE Capital Markets industry of 10.7% in 3 years.

- If Mutares SE KGaA's profit margin were to converge on the industry average, you could expect earnings to reach €813.1 million (and earnings per share of €38.72) by about September 2028, up from €38.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.5x on those 2028 earnings, down from 16.2x today. This future PE is lower than the current PE for the DE Capital Markets industry at 16.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

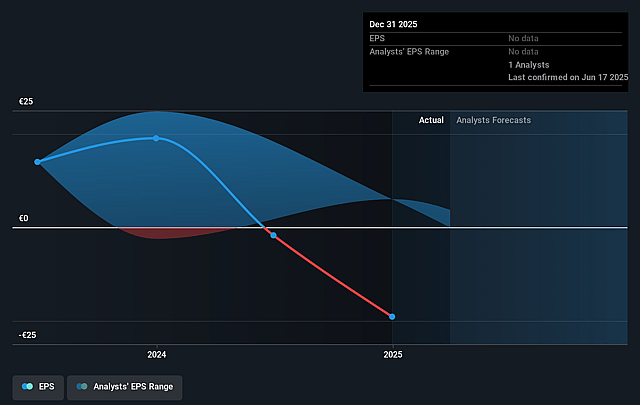

Mutares SE KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent losses in newly acquired portfolio companies, especially in the Engineering & Technology and Retail & Food segments (where negative adjusted EBITDA and failed customer retention are noted), highlight the risk of prolonged turnaround cycles and may suppress group net margins and earnings for extended periods.

- Heavy reliance on bargain purchases and divestments (e.g., Steyr, Locapharm, Terranor IPO) to boost current period earnings may not be sustainable if exit conditions or valuations deteriorate, leading to increased earnings volatility and undermining predictable revenue streams.

- The company's shift away from retail and food due to underperformance and market challenges signals difficulty generating expected returns (7–10x ROI) in this segment and may reflect broader structural headwinds, potentially reducing future revenue diversification and stability.

- Ongoing expansion into distressed and complex industrial sectors (such as logistics, defense, and chemicals) increases exposure to high operational and structural risks-any failure in executing effective turnarounds at scale could result in lower portfolio returns and drag on group profitability.

- The competitive and cyclical nature of acquiring distressed assets (as evidenced by challenges in auto/mobility and selective acquisition strategy) could be exacerbated by rising competition for targets, macroeconomic shocks, or higher financing costs, ultimately dampening acquisition pipeline quality and future EBITDA growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €42.875 for Mutares SE KGaA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €47.5, and the most bearish reporting a price target of just €37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.6 billion, earnings will come to €813.1 million, and it would be trading on a PE ratio of 1.5x, assuming you use a discount rate of 9.8%.

- Given the current share price of €29.3, the analyst price target of €42.88 is 31.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.