Key Takeaways

- Strong international growth, proprietary content, and brand leadership drive customer loyalty and profitability while expanding geographic diversification and distribution.

- Supply chain flexibility and reduced reliance on third-party content support resilience, margin expansion, and protection against geopolitical risk.

- Heavy exposure to supply chain risks, digital competition, licensing costs, and macroeconomic pressures could undermine profitability and constrain growth if unaddressed.

Catalysts

About tonies- Through its subsidiaries, develops, produces, and distributes audio systems in Germany, the United States, the United Kingdom, and internationally.

- Tonies is benefitting from growing parental demand for screen-free, experiential play and interactive edutainment, as shown by deep engagement (average of 270 minutes per week) and high Net Promoter Scores; this trend supports sustained revenue growth and strong customer loyalty, positively impacting both top line and LTV.

- Accelerated international expansion—with especially strong performance in North America (+37%) and Rest of World (+79%), plus successful new market entries like Australia and New Zealand—unlocks meaningful new revenue and earnings growth opportunities through geographic diversification and scaling distribution channels.

- Increasing success of proprietary content (e.g., Sleepy Friends and Pocket Tonies) and shift toward owned IP enhances gross margin and reduces dependency on third-party licensors, supporting margin expansion and profitability in coming years.

- Supply chain diversification and proactive tariff mitigation (e.g., new Vietnam facility, production flexibility outside China) provide resilience against geopolitical risks and enable cost management, protecting net margins and ensuring stable earnings despite volatility.

- Tonies’ category leadership and brand strength, combined with continued innovation in formats and content, position the company to further capture share as the edutainment sector structurally grows and as concerns over screen time drive ongoing demand for its audio-first, “safe haven” products—fueling long-term revenue and protecting market share.

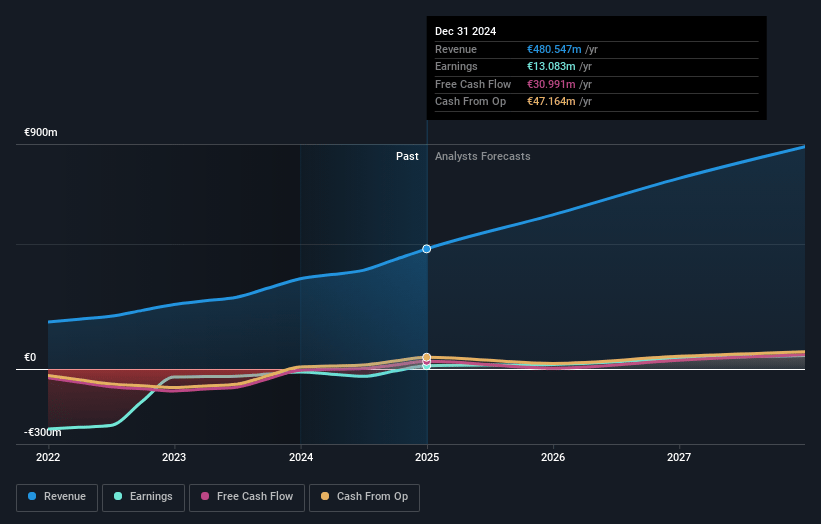

tonies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming tonies's revenue will grow by 22.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 6.6% in 3 years time.

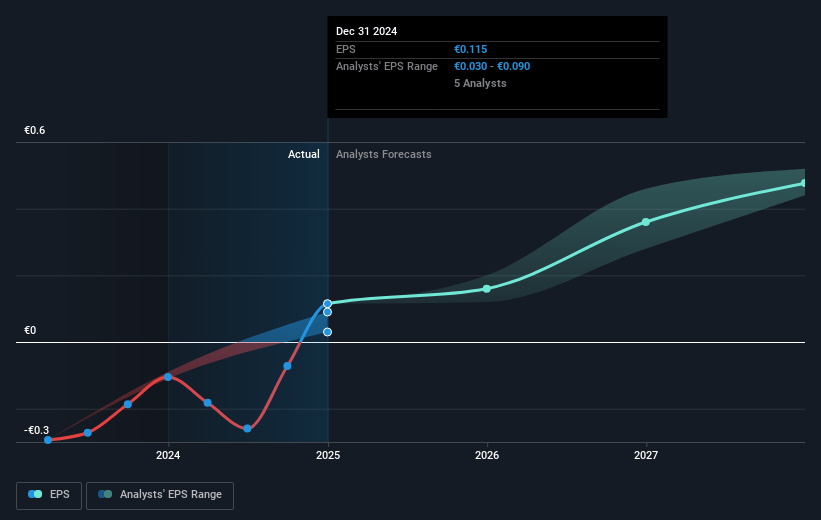

- Analysts expect earnings to reach €58.5 million (and earnings per share of €0.51) by about July 2028, up from €13.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €69.1 million in earnings, and the most bearish expecting €47.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, down from 49.9x today. This future PE is lower than the current PE for the DE Leisure industry at 91.9x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.78%, as per the Simply Wall St company report.

tonies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High volatility and uncertainty regarding U.S.–China tariffs create unpredictable cost structures and potential disruptions to Tonies’ supply chain, which could negatively impact gross margins and profitability if tariffs remain elevated or escalate further.

- Significant reliance on physical products in an industry increasingly favoring subscription-based, all-digital children’s media solutions exposes Tonies to risk of declining long-term demand, potentially curtailing revenue growth if digital alternatives outpace hardware adoption.

- Ongoing international expansion requires continuous investment in new markets and adaptation to local content and retail dynamics; any missteps or inability to efficiently scale outside core markets could limit revenue potential and pressure earnings.

- Dependence on licensed IP for popular figurines introduces risk of rising royalty costs or loss of licenses, which could compress net margins and undermine profitability if Tonies is unable to adequately shift toward owned content at scale.

- Macroeconomic headwinds—including currency fluctuations, inflation, and potential declines in discretionary consumer spending—could reduce demand for premium non-essential products, leading to softer sales growth and impacting both top-line revenue and bottom-line earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €10.62 for tonies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €12.0, and the most bearish reporting a price target of just €8.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €886.6 million, earnings will come to €58.5 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 4.8%.

- Given the current share price of €5.71, the analyst price target of €10.62 is 46.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.