Key Takeaways

- Revised sales expectations and hiring challenges in key markets could constrain revenue and limit growth strategy execution.

- Rising operating costs, without price hikes to support revenue, could pressure margins and cap earnings growth.

- Expanding into emerging markets and utilizing AI for efficiencies, Rational shows potential for significant revenue growth and improved profit margins.

Catalysts

About RATIONAL- Engages in the development, production, and sale of professional cooking systems for industrial kitchens worldwide.

- The company anticipates mid-single-digit sales revenue growth for 2024, revised from an initial expectation of mid

- to high-single-digit growth due to slower developments in key markets like Germany, Southern Europe, North America, and China. This revised expectation may impact revenue growth negatively.

- The company is experiencing hiring challenges, especially in the U.S.A., China, and selected European markets, which impacts its sales force expansion plan crucial for executing its growth strategy. This could constrain revenue growth if sales capacity falls short of targets.

- With price increases from previous periods no longer contributing to growth and no planned price hikes in the short term, the company is heavily relying on organic unit growth, which could limit future revenue growth potential.

- Operating costs, particularly from expansions in sales activities and R&D, are expected to rise over-proportionally. This could put pressure on net margins and earnings if not offset by corresponding revenue growth.

- The company's EBIT margin is guided to stabilize between 25%-26% long-term, suggesting limited room for margin expansion even with positive factors like scale effects or product mix improvements potentially driving down costs or enhancing price realization. This could cap earnings growth.

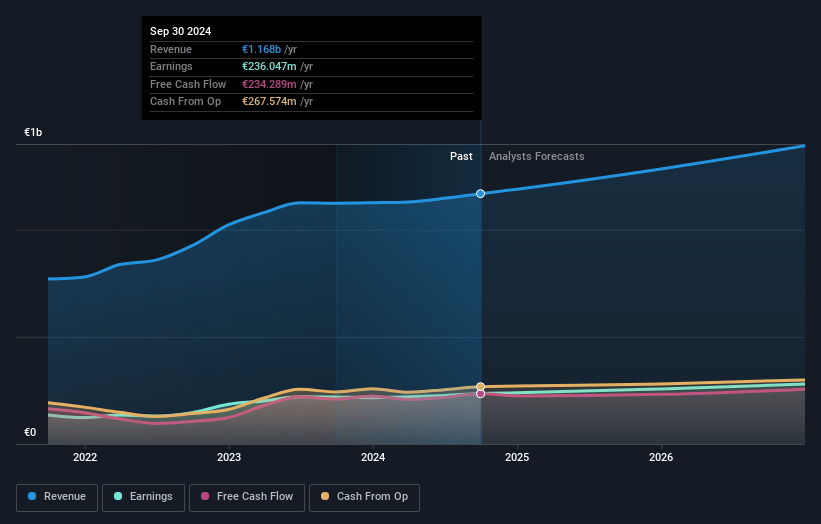

RATIONAL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RATIONAL's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.2% today to 19.9% in 3 years time.

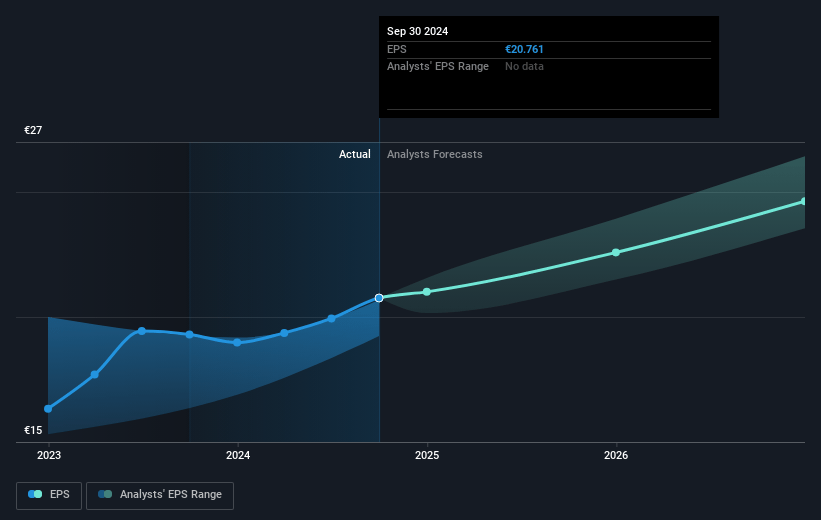

- Analysts expect earnings to reach €294.0 million (and earnings per share of €25.86) by about December 2027, up from €236.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.2x on those 2027 earnings, down from 42.3x today. This future PE is greater than the current PE for the GB Machinery industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.09%, as per the Simply Wall St company report.

RATIONAL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rational's strategic expansion into India and investment in training centers signal growth potential in emerging markets, which could lead to increased sales revenue in the future.

- Strong financial performance in recent quarters, with sales and EBIT growth, suggests operational robustness, indicating that earnings might continue to improve if such trends persist.

- High employee satisfaction and engagement at Rational could lead to sustained operational excellence and efficiency, potentially maintaining or increasing net margins.

- Increasing demand for Rational's products in non-traditional markets such as Latin America, and expanding market share in North America, could result in higher-than-anticipated revenue growth.

- Rational's ability to leverage artificial intelligence for product enhancements and operational efficiencies might lead to cost savings and improved profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €787.38 for RATIONAL based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €995.0, and the most bearish reporting a price target of just €600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be €1.5 billion, earnings will come to €294.0 million, and it would be trading on a PE ratio of 34.2x, assuming you use a discount rate of 5.1%.

- Given the current share price of €879.0, the analyst's price target of €787.38 is 11.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives