Narratives are currently in beta

Key Takeaways

- Strong order intake and rail sector demand, especially in Asia Pacific, indicate potential future revenue growth and positive market positioning.

- Efficiency measures and strategic financing, including sustainability-focused initiatives, are expected to enhance net margins and investor confidence.

- Market volatility and high CapEx could challenge revenue growth and net margins, with risks in truck and rail markets and ongoing global economic uncertainty.

Catalysts

About Knorr-Bremse- Engages in the development, production, marketing, and servicing of braking and other systems for rail and commercial vehicles worldwide.

- Knorr-Bremse's RVS division is experiencing strong order intake supported by demand across all regions, particularly in Asia Pacific, which suggests potential for future revenue growth.

- The company's BOOST 2026 program is implementing efficiency measures across both divisions, expected to enhance net margins as these measures take full effect by 2026.

- The issuance of a €1.1 billion dual tranche bond, including a green bond, highlights strategic financing leveraging sustainability, which could positively influence earnings through increased investor confidence.

- Increasing demand in the rail sector, driven by climate targets and the need for sustainable transportation solutions, is positioned to boost revenue growth, especially in aftermarket services.

- Knorr-Bremse is benefiting from positive pricing in new rail contracts and a favorable revenue mix, which are likely to improve net margins as legacy business diminishes.

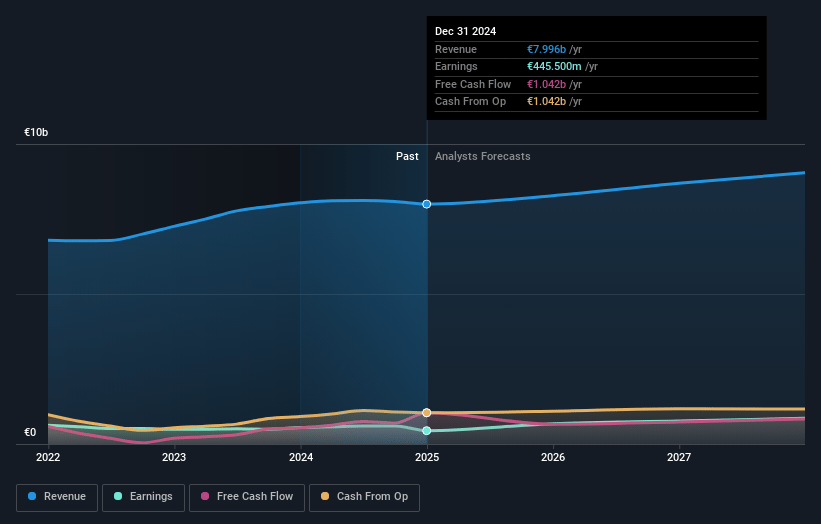

Knorr-Bremse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Knorr-Bremse's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 8.5% in 3 years time.

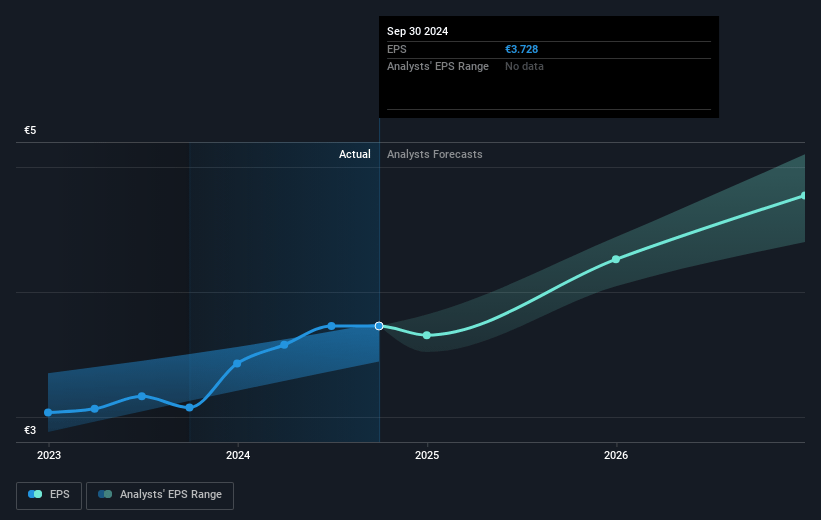

- Analysts expect earnings to reach €777.5 million (and earnings per share of €4.84) by about January 2028, up from €599.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €698 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, down from 18.9x today. This future PE is lower than the current PE for the DE Machinery industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.6%, as per the Simply Wall St company report.

Knorr-Bremse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The cyclical downturn in the European and North American truck market, as acknowledged in the call, indicates a challenging environment for the CVS division, potentially impacting revenue growth and profitability in the near term until at least the first half of 2025.

- The reliance on the Chinese rail market, while performing better than expected in 2024, carries risks of normalization which could reduce revenue growth and impact operating margins in future periods if market dynamics shift negatively.

- FX headwinds and potential continuation of supply chain challenges, particularly with specialist rail suppliers, could negatively impact net margins by increasing costs or constraining revenue growth.

- The ongoing uncertainty in the global economy and truck markets, particularly highlighted for Europe and North America, poses risks to revenue stability and operating leverage, which may affect their financial targets for 2025 and beyond.

- The high level of CapEx relative to revenues (5-6% for the full year) could present a risk to net margins if the anticipated revenue growth fails to materialize, emphasizing the importance of efficiency in capital deployment and realization of projected growth strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €77.64 for Knorr-Bremse based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €92.0, and the most bearish reporting a price target of just €60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €9.1 billion, earnings will come to €777.5 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 5.6%.

- Given the current share price of €70.35, the analyst's price target of €77.64 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives