Key Takeaways

- Strategic expansion in tech, energy, and infrastructure projects promises significant revenue growth and aligns with global sustainability trends.

- Turner's acquisition and efforts in North America aim to boost margins and earnings through synergy and market expansion.

- Reliance on strategic growth markets and tech projects, alongside external uncertainties, poses risks to HOCHTIEF's financial stability, project execution, and profitability.

Catalysts

About HOCHTIEF- Engages in the construction business worldwide.

- Continued strong expansion in the order book, particularly in strategic growth markets like advanced tech, energy transition, and sustainable infrastructure projects, offers substantial revenue growth opportunities going forward.

- Turner's acquisition of Dornan Engineering is expected to generate synergies in advanced tech project markets across Europe, potentially boosting revenue and margins through integrated capabilities and increased market presence.

- The strategic integration of North American businesses to create a leading civil engineering and construction player could result in significant annual synergies, benefitting net margins and overall earnings.

- The rapidly growing data center market and Turner's strong position within it, along with plans for equity involvement in developing data centers, suggest potential revenue growth and enhanced earnings through infrastructure expansion and development.

- The company's involvement in infrastructure investments such as renewable energy projects in Australia and managed lanes in the U.S. indicates future opportunities for cash flow generation and revenue growth, aligning with global megatrends and sustainable infrastructure needs.

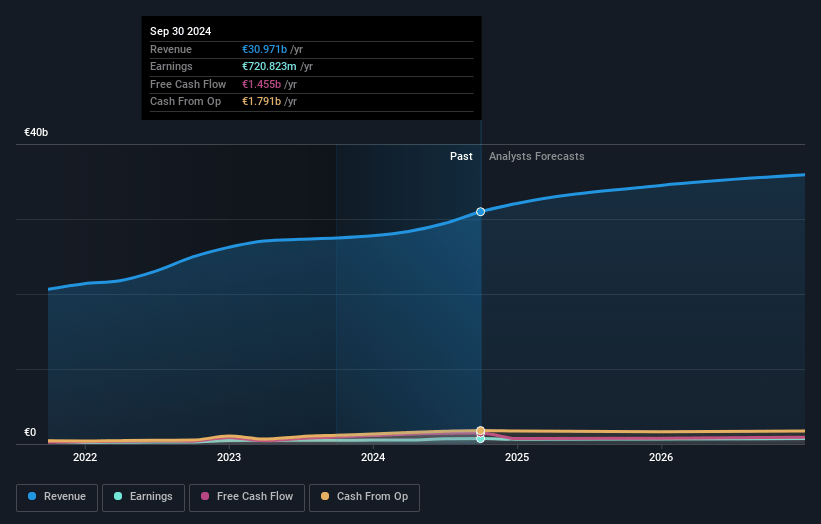

HOCHTIEF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HOCHTIEF's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.3% today to 2.0% in 3 years time.

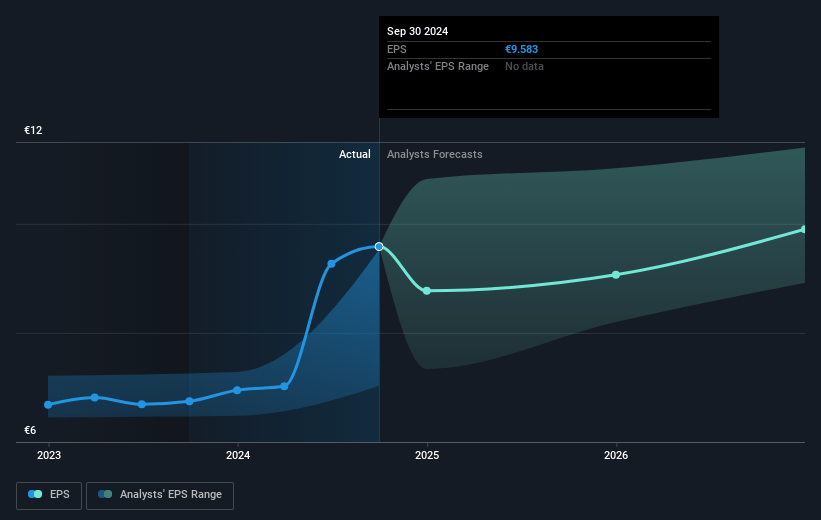

- Analysts expect earnings to reach €750.8 million (and earnings per share of €10.24) by about January 2028, up from €720.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 14.2x today. This future PE is lower than the current PE for the GB Construction industry at 27.9x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

HOCHTIEF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The net debt position of €1.66 billion driven by strategic investment decisions and seasonality may impact HOCHTIEF's financial stability and ability to reduce debt, affecting net margins.

- The company's reliance on strategic growth markets and advanced technology projects presents execution risks that could affect project timelines and profitability, impacting revenue and net earnings.

- Potential changes in the U.S. political landscape and tax policies could pose uncertainties, particularly related to infrastructure and battery investments, potentially impacting future revenue and profits.

- Environmental and regulatory hurdles in energy transition and green investments create uncertainties that could delay project completions and cash flows, affecting overall financial outlook and margins.

- The impact of legacy risks and provisions in the Asia Pacific region due to old and complex projects could negatively affect cash flow and bottom-line earnings, reflecting ongoing operational challenges.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €126.27 for HOCHTIEF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €141.0, and the most bearish reporting a price target of just €96.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €37.1 billion, earnings will come to €750.8 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of €135.8, the analyst's price target of €126.27 is 7.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives