Key Takeaways

- Achievements in key projects and long-term contracts ensure stable and growing revenue due to proven technological capabilities and predictable cash flows.

- Increased European defense budgets and commitments to local projects provide favorable conditions for Hensoldt's revenue growth and market expansion.

- Geopolitical risks related to the Ukraine conflict could affect revenue due to heavy reliance on defense orders.

Catalysts

About Hensoldt- HENSOLDT AG, together with its subsidiaries, provides defense and security electronic sensor solutions worldwide.

- The successful milestone achievements in key projects like the PEGASUS program and the certification of Twinvis passive radar for civil use demonstrate Hensoldt's technological capabilities, which are likely to drive future revenue growth through expanded market potential in both military and civil sectors.

- Long-term contracts, such as the 20-year sustainment plan with Space Center Australia for air surveillance radar systems, ensure stable revenue and margin improvements as these provide predictable cash flows.

- The commitment from Germany to increase defense spending to €80 billion by 2028, alongside confirmed procurement projects like Eurofighters and Leopard tanks, indicates a favorable environment for increased order intake and revenue growth for Hensoldt due to the direct and indirect participation in these projects.

- The integration of ESG into Hensoldt's operations presents opportunities for revenue and cost synergies, ultimately enhancing net margins through economies of scale and improved operational efficiencies.

- The rising defense budgets in Europe, especially from countries like Germany, the U.K., and France, along with the drive to reduce reliance on U.S. defense systems, could present incremental revenue opportunities as European nations enhance their defense capabilities, further boosting Hensoldt's earnings potential.

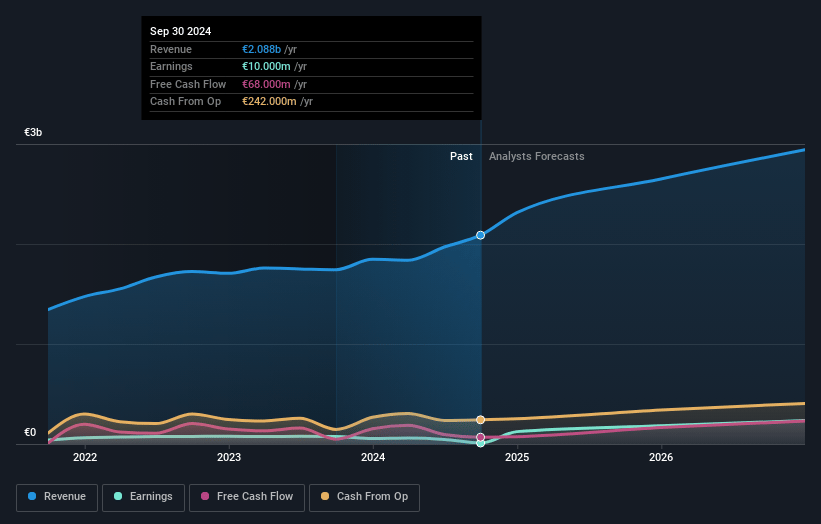

Hensoldt Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hensoldt's revenue will grow by 15.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.5% today to 11.3% in 3 years time.

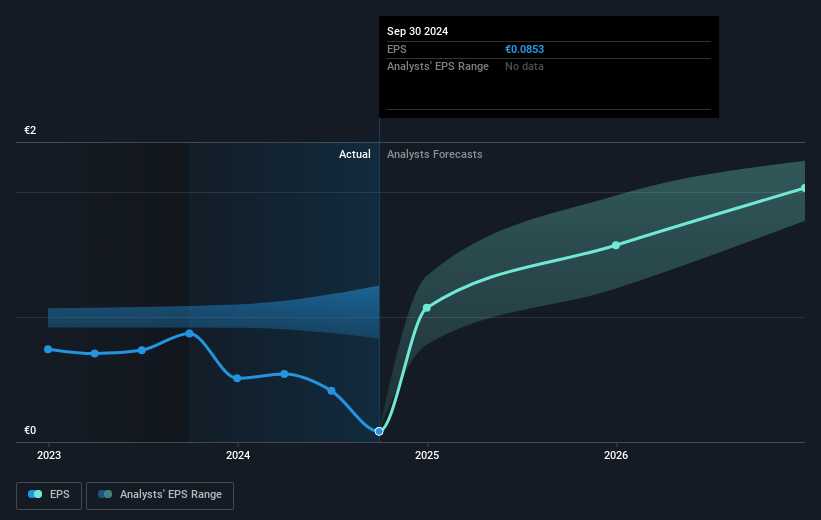

- Analysts expect earnings to reach €363.3 million (and earnings per share of €3.15) by about December 2027, up from €10.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2027 earnings, down from 407.7x today. This future PE is lower than the current PE for the DE Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

Hensoldt Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delay and uncertainty in the Eurofighter rebaselining order could impact the company's book-to-bill ratio, affecting revenue expectations.

- The reliance on high-interest loans for acquisitions such as ESG has increased finance costs, potentially impacting net margins due to additional interest expenses.

- Operational challenges and low volume in the South African entity within the Optronics segment might affect revenue and margins if not resolved.

- The fluctuating tax charges might lead to unexpected costs, affecting earnings predictability for the company.

- Direct and indirect dependency on defense orders linked to the Ukraine conflict exposes the company to geopolitical risks, potentially affecting revenue if these tensions de-escalate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €39.53 for Hensoldt based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €52.0, and the most bearish reporting a price target of just €27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be €3.2 billion, earnings will come to €363.3 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 4.9%.

- Given the current share price of €35.3, the analyst's price target of €39.53 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives