Last Update01 May 25Fair value Increased 2.72%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Volkswagen's focus on BEV innovations and tailored local product strategies aims to boost revenue growth and enhance net margins globally.

- Efforts in localization, restructuring, and efficiency are set to counteract margin dilution and mitigate tariff impacts in key markets.

- Transition to electric vehicles and market challenges in key regions could dilute margins, strain cash flow, and unpredictably impact financial performance.

Catalysts

About Volkswagen- Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

- Volkswagen anticipates robust growth in BEV sales and innovations in battery and engine technology, including the introduction of the ID.EVERY1 in 2027, expected to support revenue growth and improve future margins.

- The company's In China, for China strategy is focused on product development tailored to local demand, reducing material costs, and enhancing time to market, potentially augmenting net margins in the region.

- Volkswagen's commitment to restructuring and efficiency programs, including reducing headcount and overhead costs, aims to counteract BEV margin dilution and support net margin improvements.

- Operational plans to localize more models and components in key markets like the U.S. and China could mitigate tariff impacts, preserve sales revenue, and improve net margins over the mid

- to long term.

- Volkswagen's product offensive with new model launches, such as the urban BEV family and the ID.2, along with an aggressive order intake strategy, is designed to drive revenue growth and expand market share in Europe and other regions.

Volkswagen Future Earnings and Revenue Growth

Assumptions

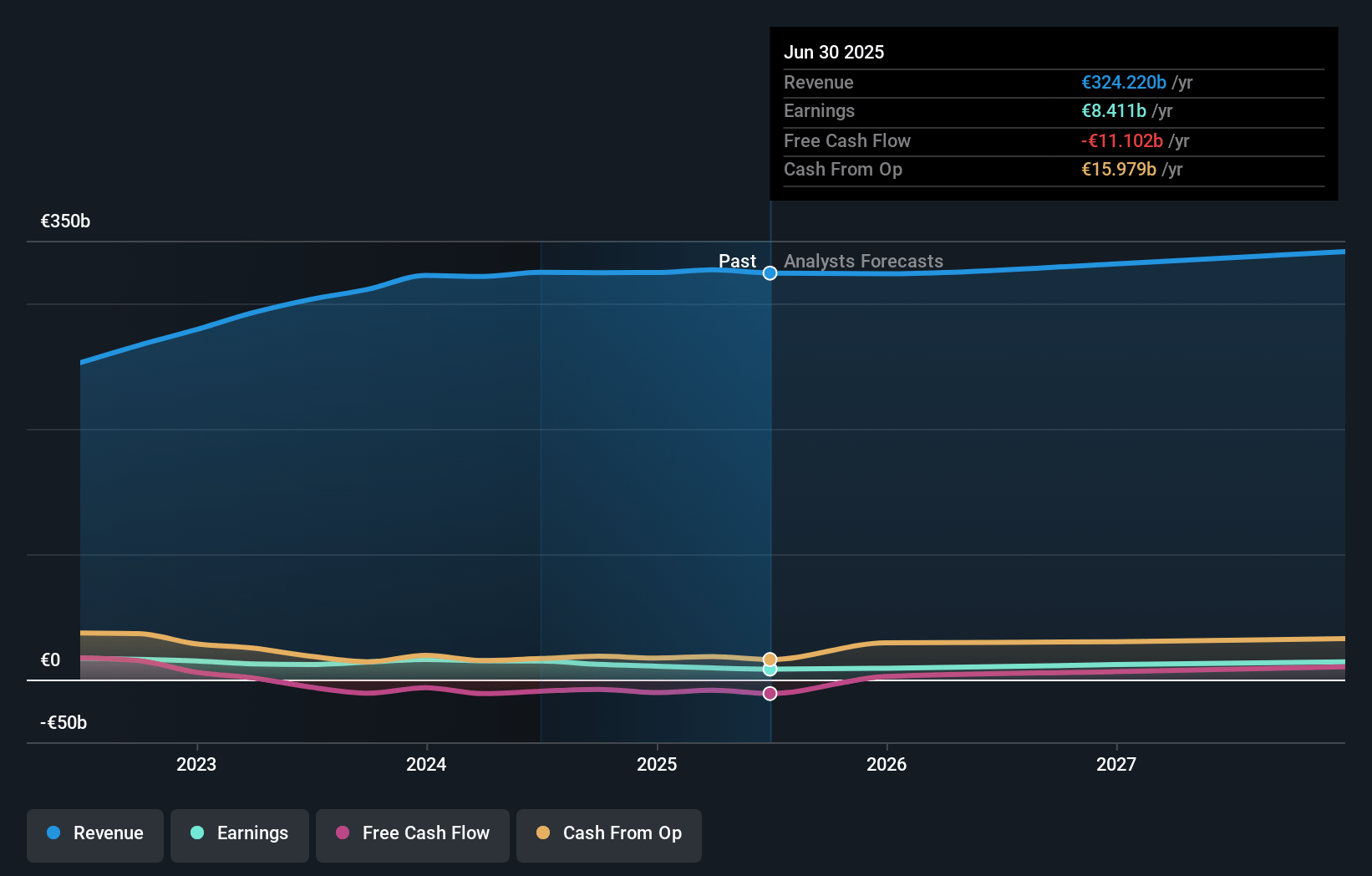

How have these above catalysts been quantified?- Analysts are assuming Volkswagen's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 4.4% in 3 years time.

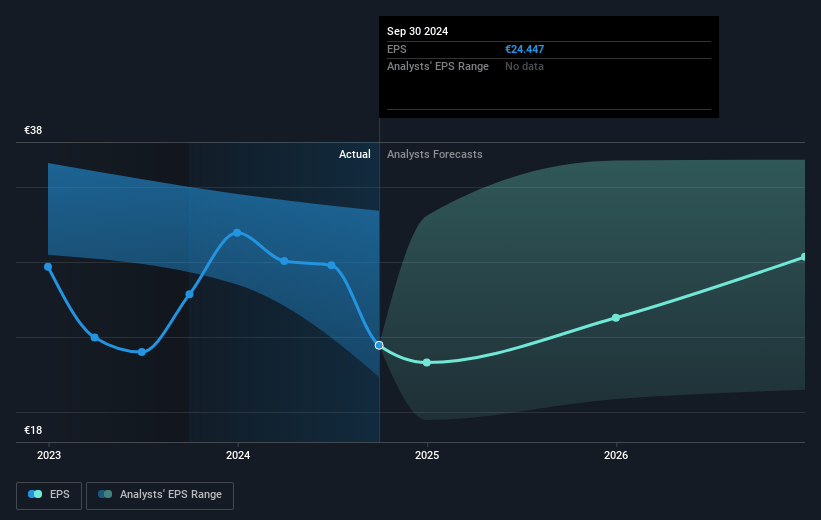

- Analysts expect earnings to reach €15.2 billion (and earnings per share of €29.32) by about May 2028, up from €10.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €18.6 billion in earnings, and the most bearish expecting €10.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, up from 4.5x today. This future PE is lower than the current PE for the GB Auto industry at 5.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

Volkswagen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Volkswagen's operating margin in Q1 2025 was 37% lower year-over-year, with increased sales of lower-margin battery electric vehicles (BEVs) leading to margin dilution. This indicates ongoing pressure on profitability as VW transitions from internal combustion engines to electric vehicles, impacting net margins.

- Special earnings effects in Q1 2025, including CO2 regulation penalties, restructuring costs, and provisions related to the diesel issue, amounted to €1.1 billion, affecting Volkswagen's operating result. Such unforeseen costs can deplete earnings and add unpredictability to financial performance.

- Volkswagen experienced a 7% decrease in deliveries in China, its largest automobile market. Declining market share in China, amidst growing competition and local challenges, could negatively affect revenue and market positioning.

- Challenges in the U.S. market, including potential trade tariffs and a need for increased localization, might raise costs and complicate profit forecasts, potentially hampering revenue growth if not addressed proactively.

- Investment and ramp-up costs for BEV production and infrastructure, alongside current economic uncertainties and supply chain issues, could strain Volkswagen's cash flow and capital expenditures, thereby impacting liquidity and investment capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €118.581 for Volkswagen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €180.5, and the most bearish reporting a price target of just €83.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €343.8 billion, earnings will come to €15.2 billion, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 9.8%.

- Given the current share price of €95.44, the analyst price target of €118.58 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.