Key Takeaways

- Accelerated digital integration and unique customer reach are set to drive above-market growth in revenue, net income, and fee-generating opportunities.

- Structural cost reductions and platform scalability position the company for sustained margin expansion and outsized earnings potential.

- Intensifying competition, rising digital transformation costs, and regional and regulatory risks threaten Grupo Cibest's profitability, margin expansion, and long-term growth potential.

Catalysts

About Grupo Cibest- Provides banking products and services in Colombia and internationally.

- Analysts broadly agree the integration of Nequi and digital banking upgrades will expand reach and drive transaction volumes, but the true upside may be significantly larger as Nequi's breakeven is now likely by year-end 2025, not 2026, with rapid user monetization, five-fold loan growth over 12 months, and digital services paving the way for outsized net margin and earnings surprises over the next two years.

- While analyst consensus sees improvements in cost-to-income ratios via efficiency gains, these projections may still underestimate transformative structural cost reductions; scalable fintech platforms, digital onboarding, and proprietary risk analytics could cumulatively cut long-term operating expenses much faster than peers, stoking sustainable margin expansion and double-digit net income growth.

- Grupo Cibest's unique access to 33 million clients across Colombia and Central America-combined with deep data-driven customer insights-positions it to capture the full economic benefit of rising financial inclusion as the region's middle class accelerates, opening a pathway to compound annual double-digit loan and deposit growth ahead of market expectations, with corresponding uplift in revenue and fee income.

- Ongoing advances in digital assets (via Wenia and COPW stablecoin) and embedded payments (through Wompi) create a proprietary, defensible ecosystem that can anchor Grupo Cibest as the leading financial super-app in the region, allowing for cross-sell of insurance, wealth, and investment products-powering outsized growth in fee and commission revenues and fundamentally increasing average wallet share per customer.

- The company's robust capital position, ample liquidity, and holding structure flexibility enable rapid deployment for accretive acquisitions or partnerships as sector consolidation accelerates, ensuring Grupo Cibest can seize market share and achieve best-in-class ROE and EPS growth, above what the market is pricing.

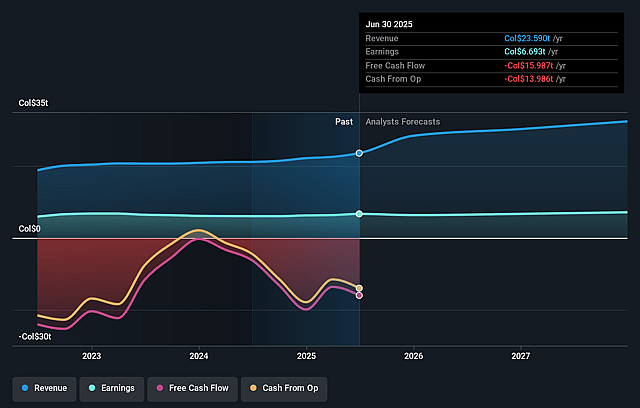

Grupo Cibest Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Grupo Cibest compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Grupo Cibest's revenue will grow by 15.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 28.4% today to 22.3% in 3 years time.

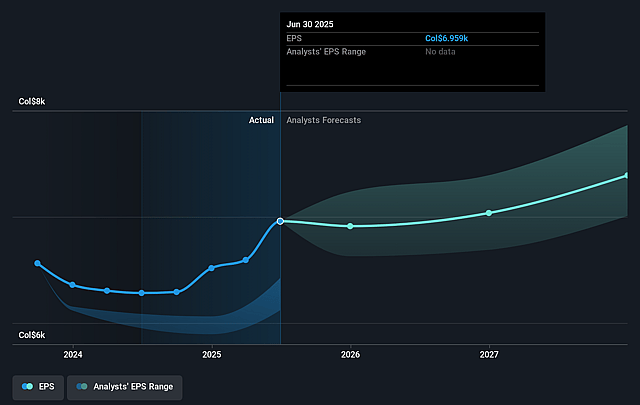

- The bullish analysts expect earnings to reach COP 8014.5 billion (and earnings per share of COP 8026.49) by about September 2028, up from COP 6693.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.3x on those 2028 earnings, up from 8.7x today. This future PE is greater than the current PE for the US Banks industry at 8.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.1%, as per the Simply Wall St company report.

Grupo Cibest Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying fintech and digital banking competition, alongside the rise of decentralized finance solutions, could accelerate fee and margin pressure, curbing the company's future revenue growth from transactional and lending services.

- Ongoing investment requirements in digital transformation and technology-highlighted by rising technology-related expenses-may outpace efficiency gains, potentially resulting in structurally higher cost-to-income ratios and constraining net margins over time.

- Grupo Cibest's continued concentration in Colombia exposes it to long-term regional secular risks such as aging demographics, fiscal instability, political volatility, and sovereign credit downgrades, all of which threaten to dampen credit demand and suppress asset growth and earnings potential.

- Regulatory headwinds in the banking sector, including more stringent capital requirements and sustained elevated compliance costs, are likely to increase operating expenses and limit the company's ability to expand its loan book, directly impacting future net income.

- Persistent margin compression stemming from low-cost deposit competition, stagnant commercial loan demand, and rising cost of risk on consumer lending-especially as digital products like Nequi scale-could undermine profitability, limiting return on equity and slowing shareholder value creation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Grupo Cibest is COP168638.25, which represents two standard deviations above the consensus price target of COP69092.78. This valuation is based on what can be assumed as the expectations of Grupo Cibest's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of COP177522.4, and the most bearish reporting a price target of just COP30604.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be COP35945.8 billion, earnings will come to COP8014.5 billion, and it would be trading on a PE ratio of 33.3x, assuming you use a discount rate of 18.1%.

- Given the current share price of COP60200.0, the bullish analyst price target of COP168638.25 is 64.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Grupo Cibest?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.