Last Update 18 Dec 25

CIBEST: Modest Margin Gains And Buybacks Will Likely Sustain Overvaluation Risk

Analysts have nudged their price target on Grupo Cibest slightly higher, citing modestly faster projected revenue growth, a small improvement in expected profit margins, and a marginally lower forward price to earnings multiple that together support a somewhat richer valuation.

What's in the News

- Grupo Cibest S.A. commenced a share repurchase program on July 17, 2025, authorized by shareholders at the June 9, 2025 Annual General Meeting. The program allows the company to buy back up to COP 1,350,000 million of common shares, preferred shares or ADRs over one year (company filing).

- Between July 17, 2025 and September 30, 2025, the company repurchased 7,252,194 shares, equivalent to 0.75% of its issued share capital, completing the buyback announced on November 6, 2025 (company filing).

Valuation Changes

- Fair Value: Unchanged at COP 51,981.88 per share, indicating no adjustment to the overall intrinsic value estimate.

- Discount Rate: Decreased slightly from 18.07% to 18.05%, reflecting a marginally lower required return on equity.

- Revenue Growth: Increased slightly from 12.83% to 12.87% annually, pointing to a modestly stronger top line outlook.

- Net Profit Margin: Increased slightly from 21.54% to 21.79%, suggesting a small improvement in expected profitability.

- Future P/E: Decreased slightly from 10.44x to 10.31x earnings, implying a marginally cheaper forward valuation multiple.

Key Takeaways

- Aggressive digital expansion and ecosystem development are driving customer growth, fee income diversification, and stronger margins through platforms like Nequi, Wompi, and Wenia.

- Focus on financial inclusion, sustainable finance, and operational efficiency boosts market potential, supports loan growth, and underpins long-term profitability and shareholder value.

- Ongoing macroeconomic uncertainty, rising costs, and intensifying digital competition threaten profitability, margin stability, and long-term earnings sustainability.

Catalysts

About Grupo Cibest- Provides banking products and services in Colombia and internationally.

- The rapid scaling of Nequi, Grupo Cibest's digital bank, is unlocking accelerated customer acquisition (25 million+ clients, 80% activity ratio), strong deposit and loan growth (deposits up 77% YoY, loans up 5x YoY), and is nearing breakeven, positioning the company to capture increased transaction volumes and digital fee income-likely boosting both revenue growth and net margins.

- Sustained effort in digital and payments platforms like Wompi and Wenia is enabling Grupo Cibest to deepen its ecosystem, drive fee/transactional income, and tap into new digital asset opportunities, supporting diversification of revenue streams and improving profitability over time.

- The growing middle class and financial inclusion push in Colombia and Central America, evidenced by robust consumer loan (7% guidance) and savings account growth (16% YoY), is expanding Grupo Cibest's addressable market and supporting long-term revenue and loan growth prospects.

- Expansion in sustainable finance (disbursing COP 324 trillion YTD toward ESG-linked initiatives with a COP 716 trillion target by 2030) positions Grupo Cibest to benefit from the increasing demand for green lending and investment products, which can drive above-industry loan origination and fee income, supporting both top-line and long-term EPS growth.

- Ongoing improvements in asset quality, cost efficiency (cost of risk at 1.6%–1.8%, efficiency improvements in Central America), and capital allocation (buybacks, stable Tier 1 ratios) strengthen Grupo Cibest's capital base and enable further reinvestment into strategic growth areas-likely to support future ROE sustainability, margin stability, and shareholder value creation.

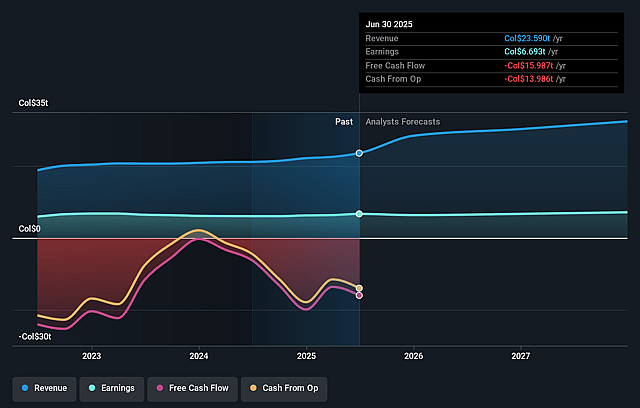

Grupo Cibest Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Cibest's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 28.4% today to 20.4% in 3 years time.

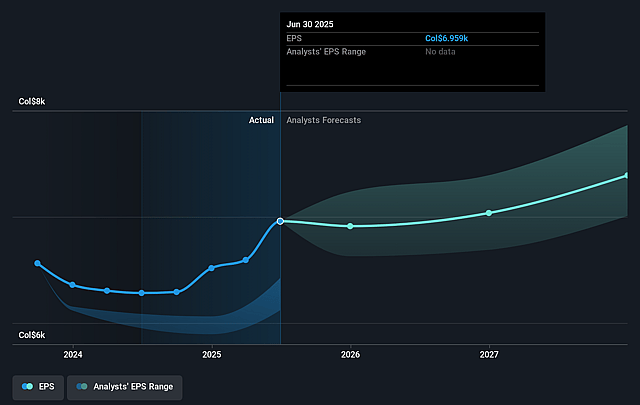

- Analysts expect earnings to reach COP 7122.8 billion (and earnings per share of COP 7388.71) by about September 2028, up from COP 6693.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting COP7835.8 billion in earnings, and the most bearish expecting COP6014.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 8.5x today. This future PE is greater than the current PE for the US Banks industry at 8.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.93%, as per the Simply Wall St company report.

Grupo Cibest Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Macroeconomic and Political Instability: Persistent fiscal deficits, a volatile political landscape ahead of the Colombian elections, and a recent sovereign credit rating downgrade signal long-term macroeconomic and regulatory uncertainty, which could increase risk premiums, impact capital costs, and negatively affect revenue and net margins.

- Pressure on Net Interest Margins (NIM): Management expects NIM compression in the medium term due to normalization of interest rates, possible delays in Central Bank rate cuts, and intensifying competition for low-cost deposits, which could erode profitability and constrain earnings growth.

- Increased Cost of Risk with Consumer Lending: Growth is increasingly driven by consumer and Nequi digital lending, segments that inherently carry higher cost of risk (noted as 9-10% for Nequi), raising the risk of elevated credit losses and non-performing loans, which could weigh on net income and margins if economic conditions deteriorate or underwriting weakens.

- Rising Operational and Compliance Costs: Operating expenses are accelerating (up 11.8% year-over-year) due to tech investments, administrative costs, and taxes, and the digital expansion subjects Grupo Cibest to heightened regulatory, cyber, and data privacy risks, potentially reducing operational efficiency and compressing net profit margins.

- Structural Competitive Threats: The rapid advance of fintechs, neobanks, and big tech in Latin America, coupled with the need to continually upgrade digital capabilities and legacy IT, poses a long-term threat to customer acquisition, fee income, and core banking revenues, pressuring market share and earnings sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of COP69092.779 for Grupo Cibest based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of COP177522.4, and the most bearish reporting a price target of just COP30604.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be COP34925.0 billion, earnings will come to COP7122.8 billion, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 17.9%.

- Given the current share price of COP59200.0, the analyst price target of COP69092.78 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Grupo Cibest?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.