Key Takeaways

- ACM Research is poised for accelerated growth and market leadership in China and globally, driven by domestic semiconductor expansion and aggressive innovation in key manufacturing technologies.

- Expanding production and R&D footprint supports higher profitability and operating leverage, with strong potential for establishing industry standards in next-generation chip manufacturing.

- Geopolitical tensions, over-reliance on China, rising R&D costs, industry consolidation, and technology shifts all pose significant risks to ACM Research (Shanghai)'s growth and stability.

Catalysts

About ACM Research (Shanghai)- Engages in the research, development, production, and sale of semiconductor equipment in China and internationally.

- Analysts broadly agree that ACM Research will benefit from China's push toward domestic semiconductor capacity and increased capital spending, but there is potential for even faster-than-expected market share gains in China, given the rapid ramp of new fabs and ACM's recent moves to raise its long-term China revenue target by an additional $1 billion, which could accelerate top-line growth beyond current estimates.

- Analyst consensus factors in incremental innovation around ACM's differentiated cleaning and plating tools, but given the pace of customer adoption (such as repeat orders for the new Ultra C wb Wet Bench and breakthroughs in horizontal panel-level plating), there is potential for a step-function increase in average selling prices and gross margins as the company establishes de facto standards for next-generation AI and memory device manufacturing.

- ACM is positioned to capture a disproportionate share of upside from the global rush to localize chip supply chains, as it is one of the rare equipment suppliers simultaneously expanding capacity and R&D in China, the US, and Korea, potentially unlocking sustained revenue and earnings growth through de-risked global market access.

- With major production and R&D facility buildouts nearing completion in Lingang and Oregon, ACM's manufacturing scale is set to nearly triple; this provides a long runway to support the expected surge in semiconductor capital intensity linked to accelerated digitalization, AI, and EV demand, which should drive strong operating leverage and higher profitability.

- ACM's outsized and sustained investment in proprietary R&D (now 14 to 16 percent of sales versus global peers at 10 to 12 percent) signals an aggressive push to dominate new process segments including advanced packaging, panel-level technology, and high-temperature furnace tools, setting up the company to become a multi-segment leader with diversified, recurring revenue streams and increasing net margins.

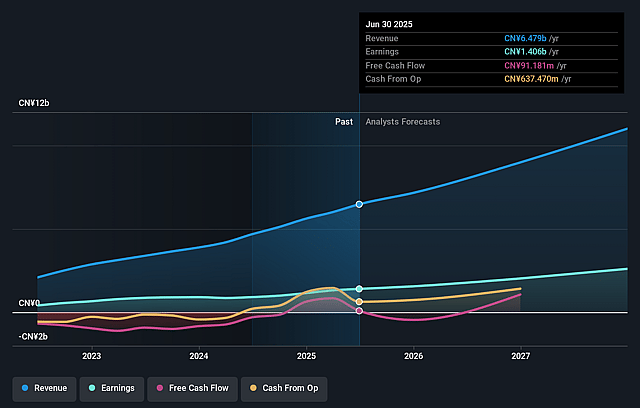

ACM Research (Shanghai) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ACM Research (Shanghai) compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ACM Research (Shanghai)'s revenue will grow by 25.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.7% today to 24.6% in 3 years time.

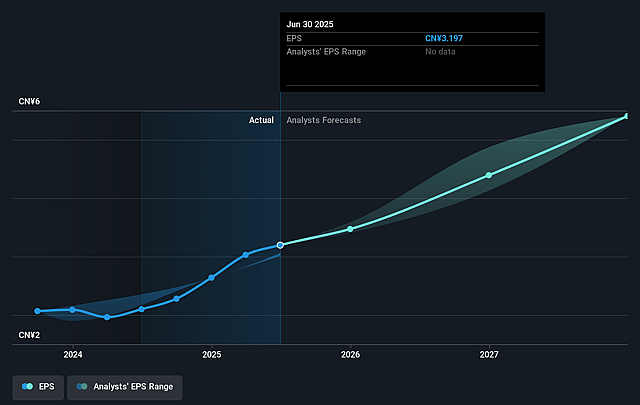

- The bullish analysts expect earnings to reach CN¥3.2 billion (and earnings per share of CN¥6.41) by about September 2028, up from CN¥1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, down from 44.6x today. This future PE is lower than the current PE for the CN Semiconductor industry at 69.0x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.57%, as per the Simply Wall St company report.

ACM Research (Shanghai) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising U.S.-China geopolitical tensions and expanding export controls threaten ACM Research (Shanghai)'s access to critical components and international markets, which could directly restrict revenue growth from outside China and disrupt global sales pipelines.

- The company's strong reliance on the Chinese domestic semiconductor market and a concentrated customer base exposes it to cyclical downturns or abrupt policy shifts by the Chinese government, potentially causing significant revenue volatility and unstable earnings performance over time.

- Heavy and growing R&D expenditure, now increasing to around 14 to 16 percent of sales, risks compressing net margins if technological investments do not translate into timely sales or if competitive pressures require even higher investment to keep pace.

- Industry consolidation among larger global semiconductor equipment vendors and the increasing capital intensity of advanced node manufacturing make it more difficult for ACM to compete on scale and pricing, which could squeeze gross margins and limit long-term market share, especially outside China.

- Emerging shifts in semiconductor device architectures and materials, such as the move to 3D structures or panel-level packaging, may render some of ACM's current product platforms obsolete or less differentiated, creating a risk of declining demand and underutilization of new capacity, ultimately impacting future revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ACM Research (Shanghai) is CN¥163.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ACM Research (Shanghai)'s future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥163.5, and the most bearish reporting a price target of just CN¥102.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥12.8 billion, earnings will come to CN¥3.2 billion, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 10.6%.

- Given the current share price of CN¥141.98, the bullish analyst price target of CN¥163.5 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.