Key Takeaways

- Export controls and supply chain shifts are restricting ACM Research's access to critical technologies and reducing its opportunities in high-margin overseas markets.

- Heavy spending and product concentration, combined with greater competition and regulatory barriers, are straining margins and heightening risks to future profitability.

- Strategic technology innovation, domestic market positioning, global capacity expansion, and product diversification together drive ACM Research (Shanghai)'s resilience and long-term revenue growth prospects.

Catalysts

About ACM Research (Shanghai)- Engages in the research, development, production, and sale of semiconductor equipment in China and internationally.

- The prospect of tighter export controls and escalating geopolitical tensions between the US and China is expected to further limit ACM Research's access to key components and advanced technologies from global suppliers. As January 1 has already cut off access to certain US parts, the company's efforts to source alternatives may not fully offset the loss of critical technologies, posing long-term revenue downside and potentially hampering earnings from global customers.

- With international chip manufacturers and customers accelerating efforts to diversify their supply chains away from China, ACM Research is likely to face declining demand outside its domestic market. This long-term trend reduces the company's growth opportunities in higher-margin overseas markets and puts sustained pressure on future topline and net margin performance.

- Intensifying competition from both domestic Chinese equipment makers and global incumbents could lead to price wars and the erosion of ACM's market share, especially as its product portfolio remains highly concentrated in the wafer cleaning segment. This dynamic is likely to compress net margins and increase earnings volatility as larger players invest heavily to capture the same supply chain localization tailwinds.

- The company's aggressive capital spending and R&D investments, directed at broadening its product portfolio and scaling up production capacity in China and Oregon, are placing heavy strain on cash flow and operating margins. If anticipated demand for new tools like PECVD, panel-level packaging, and Track does not materialize quickly due to customer adoption delays or technological hurdles, the mismatch between expenses and revenue could suppress profitability and prolong negative free cash flow periods.

- Ongoing regulatory scrutiny of cross-border deals and capital availability for Chinese tech firms adds further risk to ACM's ability to raise international funding. If international collaboration opportunities dry up and global customer adoption falters due to trade and technology restrictions, the company's long-term international revenue ambitions and net income growth potential will likely remain out of reach.

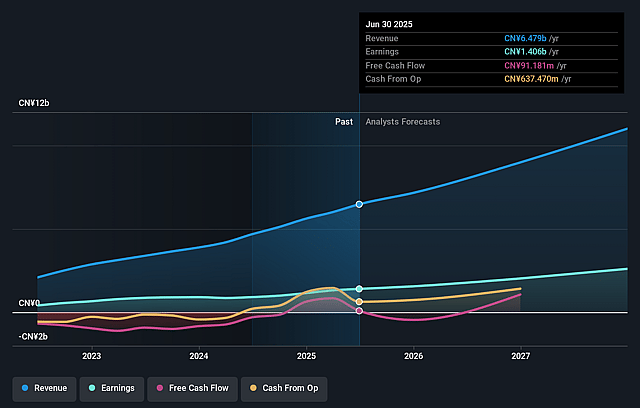

ACM Research (Shanghai) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ACM Research (Shanghai) compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ACM Research (Shanghai)'s revenue will grow by 25.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 21.7% today to 24.6% in 3 years time.

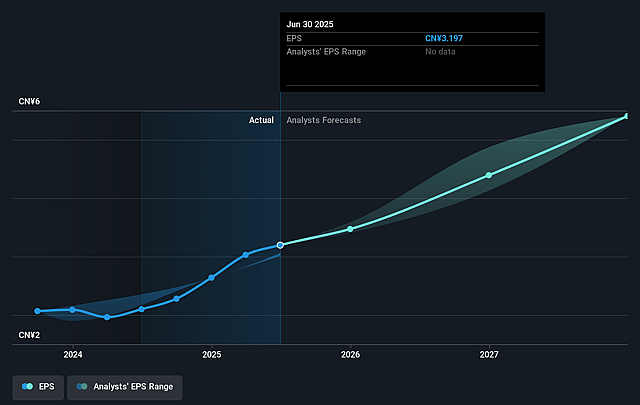

- The bearish analysts expect earnings to reach CN¥3.2 billion (and earnings per share of CN¥6.41) by about September 2028, up from CN¥1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.9x on those 2028 earnings, down from 44.6x today. This future PE is lower than the current PE for the CN Semiconductor industry at 69.0x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.57%, as per the Simply Wall St company report.

ACM Research (Shanghai) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated adoption of AI, advanced memory (3D NAND, DRAM), 3D logic, panel-level packaging, and other digitally driven secular trends is fueling sustained demand for wafer processing and cleaning tools, providing ACM Research (Shanghai) a structural runway for revenue and shipment growth.

- ACM's continued technology innovation-exemplified by proprietary breakthroughs like the nitrogen bubble cleaning system, high-temp SPM, and horizontal panel plating-strengthens its market differentiation, enabling the company to win market share, increase average selling prices, and enhance margins over time.

- The ongoing build-out and localization of China's $40 billion WFE (Wafer Fab Equipment) market, along with government policy goals for domestic self-sufficiency, positions ACM as a national champion with rising market share targets in cleaning and plating, suggesting robust long-term topline growth despite industry cycles or export control headwinds.

- The company's major investments in global R&D and manufacturing capacity (such as the Lingang and Oregon facilities) and ongoing traction with customers outside China, including key US, Korean, and Taiwanese accounts, improve international revenue resilience and reduce vulnerability to domestic market volatility or regulatory changes.

- Expansion of ACM's product portfolio into adjacent growth markets such as furnace, PECVD, Track, and advanced panel-level packaging tools widens its addressable market, reduces concentration risk from cleaning tools alone, and supports sustained revenue growth with the potential for higher long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ACM Research (Shanghai) is CN¥102.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ACM Research (Shanghai)'s future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥163.5, and the most bearish reporting a price target of just CN¥102.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥12.8 billion, earnings will come to CN¥3.2 billion, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 10.6%.

- Given the current share price of CN¥141.98, the bearish analyst price target of CN¥102.0 is 39.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.