Last Update 29 Nov 25

688082: Recent Private Placement Will Unlock Significant Upside For Shareholders

ACM Research (Shanghai)'s analyst price target has been revised downward slightly to $191.33, as analysts take a more cautious view on future earnings multiples and discount rates.

What's in the News

- ACM Research (Shanghai), Inc. will hold a Special/Extraordinary Shareholders Meeting on November 14, 2025, at 10:30 China Standard Time. The meeting will take place at Building B2, Lane 999, Dangui Road, China (Shanghai) Pilot Free Trade Zone (Key Developments).

- On September 24, 2025, the company completed a private placement by issuing 38,601,326 ordinary shares at CNY 116.11 per share, raising CNY 4,481,999,961.86. Net proceeds amounted to CNY 4,400,000,000 after expenses. The offering was allocated to 17 qualified investors and the shares are subject to a six-month lock-up period before trading on the STAR Market (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at CN¥191.33, reflecting stability in expectations for the company's fair value.

- Discount Rate has decreased slightly from 10.89% to 10.79%, indicating a marginally lower cost of capital assumption.

- Revenue Growth projection remains constant at 28.99%.

- Net Profit Margin estimate is unchanged at 24.06%.

- Future P/E ratio has fallen modestly from 34.39x to 33.70x, suggesting a slightly more conservative outlook on future earnings multiples.

Key Takeaways

- Market optimism may overstate ACM's ability to sustain rapid growth and margin expansion amid sector risks and competitive pressures.

- High valuation and earnings expectations rely on successful innovation, domestic demand, and operational execution despite potential headwinds from competition and geopolitical uncertainties.

- Strong technology leadership, global expansion, and deepening customer relationships position the company for sustained growth and resilience despite industry and geopolitical challenges.

Catalysts

About ACM Research (Shanghai)- Engages in the research, development, production, and sale of semiconductor equipment in China and internationally.

- Expectations that accelerating technological self-sufficiency initiatives in China will structurally boost long-term order flow for domestic equipment suppliers are likely baked into the stock, with investors anticipating ACM will maintain a dominant share in a persistently strong $40B+ China WFE (Wafer Fab Equipment) market-this could be supporting above-trend revenue growth assumptions.

- The market may be pricing in an optimistic scenario for ACM's ability to rapidly expand its addressable markets and margin profile due to the ongoing proliferation of AI, 3D integration, and panel-level packaging, especially as management cites a robust pipeline of differentiated, next-generation cleaning, plating, and advanced packaging tools; if sector adoption or competitive barriers slow, long-term revenue/margin upside could be overestimated.

- Investors may be extrapolating recent gross margin performance (48.7%, above long-run guide) and increased manufacturing scale (Lingang and Oregon expansions) as indicative of persistent earnings leverage, overlooking the likely variability tied to product mix, rising R&D intensity, and potential cost inflation from localizing supply chains.

- Confidence in ongoing share gains (with raised market share targets for cleaning and plating tools) and the company's ability to successfully monetize innovation through sustained pricing power may be fueling expectations for future net margin expansion-potentially ignoring the risk of increased domestic competition and future price compression in China.

- Anticipation of insulated revenue growth due to localization mandates and a "de-risked" supply chain may be leading to higher valuation multiples, although execution risks remain around global expansion, geopolitical headwinds, and the possibility that China WFE demand has temporarily peaked-making future earnings projections vulnerable to downside surprises.

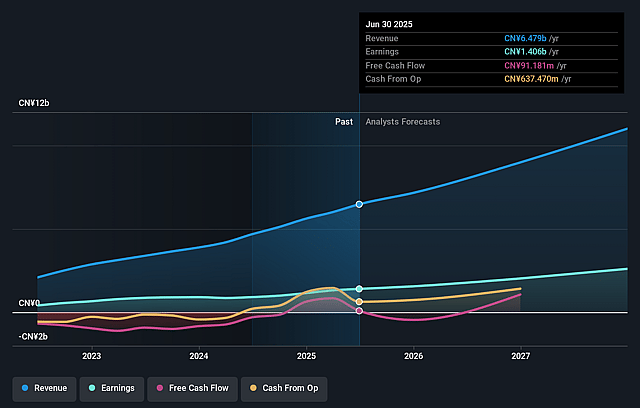

ACM Research (Shanghai) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ACM Research (Shanghai)'s revenue will grow by 23.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.7% today to 23.8% in 3 years time.

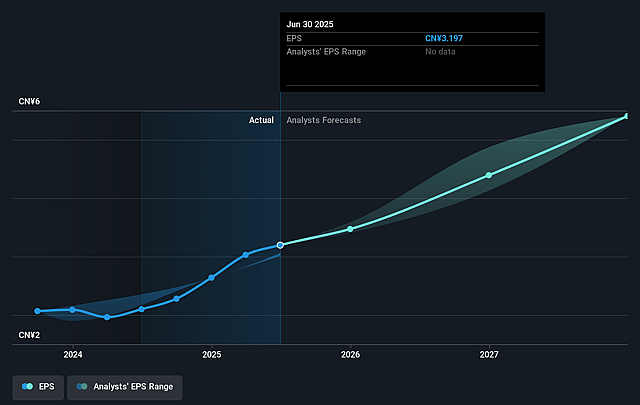

- Analysts expect earnings to reach CN¥2.9 billion (and earnings per share of CN¥5.4) by about September 2028, up from CN¥1.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, down from 47.3x today. This future PE is lower than the current PE for the CN Semiconductor industry at 72.1x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.68%, as per the Simply Wall St company report.

ACM Research (Shanghai) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ACM Research (Shanghai) demonstrated strong ongoing product innovation and differentiation, including new proprietary cleaning and plating technologies (e.g., nitrogen bubbling for wet bench, high-temperature SPM, and horizontal panel-level plating); these advancements position ACM as a technology leader and could help drive sustained revenue and gross margin growth by capturing more share in advanced semiconductor manufacturing.

- The company is executing on a robust expansion strategy, notably building new high-capacity R&D and production centers in both China (Lingang) and the US (Oregon), which will enable greater scale, improve customer proximity, and support global market penetration, potentially strengthening future topline revenue and improving net margins through improved operational efficiency.

- ACM has established and is deepening relationships with both leading Chinese and international semiconductor manufacturers, gaining repeat orders and customer evaluations for new platforms; this customer traction suggests revenue resilience and the possibility of global earnings expansion despite geopolitical headwinds.

- Management raised its long-term revenue outlook dramatically, reflecting confidence in both their own growing market share (increasing targets for cleaning and plating to 60%) and a larger addressable Chinese WFE market (to $40 billion), indicating structural demand tailwinds that could lead to multi-year revenue and net income growth above expectations.

- The company's continued investments in R&D (increasing R&D spend to 14–16% of sales), robust IP portfolio, and rapid product development roadmap (with incremental revenue from advanced packaging, PECVD, Track, and panel-level tools expected in 2026 and beyond) position ACM to capitalize on secular trends such as AI, advanced packaging, and 3D device growth, supporting long-term financial outperformance in revenue, gross margin, and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CN¥126.5 for ACM Research (Shanghai) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥140.0, and the most bearish reporting a price target of just CN¥102.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥12.1 billion, earnings will come to CN¥2.9 billion, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 10.7%.

- Given the current share price of CN¥150.68, the analyst price target of CN¥126.5 is 19.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.