Key Takeaways

- Large physical presence and slow digital adaptation risk stagnating growth as consumer habits shift and fixed costs remain high.

- Exposure to macroeconomic volatility and rising consumer sustainability preferences could erode retail and financial performance over time.

- Strong digital commerce growth, effective cost controls, and tech-driven efficiency are boosting Falabella's profitability, diversification, balance sheet strength, and prospects for profitable reinvestment.

Catalysts

About Falabella- Engages in the retail sale of clothing, accessories, home products, electronics, and beauty and other products in Chile, Peru, Colombia, Brazil, Mexico, Uruguay, and Argentina.

- Falabella's large physical retail and real estate footprint exposes it to declining in-store sales as digital-native competitors continue to capture share, causing revenue stagnation in core formats and lower return on assets as fixed costs remain high despite potential foot traffic erosion.

- Heavy ongoing investments in logistics, marketplace platforms, and AI may fail to deliver competitive advantages against more agile, global e-commerce players, leading to operating margin compression if technology adoption lags market leaders and efficiency gains underwhelm expectations.

- Persistently volatile macroeconomic conditions in Latin America combined with accelerating inflation threaten to undermine consumer spending power, resulting in slower growth in both retail revenue and demand for financial services, which can ultimately weigh on consolidated top-line and earnings growth.

- Falabella's financial services business faces significant long-term credit and currency risk across Chile, Peru, and Colombia; any future economic slowdown or depreciation would increase non-performing loans and loan losses, jeopardizing both ROE targets and net margin sustainability.

- Intensifying consumer preference for sustainability, resale, and minimalist lifestyles is likely to hurt demand for fast fashion and large-format department stores, directly pressuring revenue growth opportunities and limiting the potential for margin expansion associated with Falabella's retail model.

Falabella Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Falabella compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Falabella's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.8% today to 5.1% in 3 years time.

- The bearish analysts expect earnings to reach CLP 731.4 billion (and earnings per share of CLP 293.57) by about September 2028, down from CLP 863.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 16.7x today. This future PE is greater than the current PE for the CL Multiline Retail industry at 11.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.76%, as per the Simply Wall St company report.

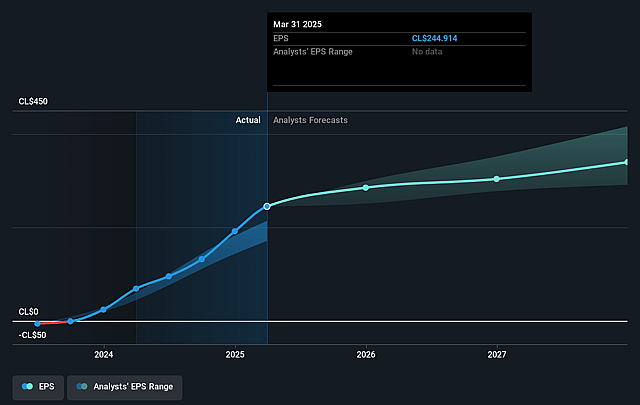

Falabella Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid expansion and strong adoption of the e-commerce platform, with GMV growing close to 20% and seller sales up 36% year-over-year, suggest Falabella is well positioned to benefit from the secular growth in digital commerce; this trend supports sustained increases in digital revenues and gross profit margins.

- The group has demonstrated significant and consistent margin improvement across all business units, with consolidated EBITDA margin rising to 14.9% and operating leverage aided by disciplined cost and SG&A controls, helping to enhance overall earnings and profitability over time.

- Falabella's digital banking and financial services units are showing robust profitability and portfolio growth, with ROE reaching 20% in Chile, 15% in Peru, and 8% in Colombia, contributing to more diversified and resilient earnings streams and boosting long-term return on equity for shareholders.

- Ongoing investment and integration of AI and technology throughout retail, logistics, banking, and customer engagement are driving higher productivity, personalization, and operational efficiency, which are likely to structurally improve margins and support net income growth.

- Strengthened balance sheet, falling net financial debt, improved net debt-to-EBITDA, and active engagement with rating agencies position Falabella closer to regaining investment grade status, which would lower cost of capital and enable reinvestment for further revenue and profit expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Falabella is CLP3486.25, which represents two standard deviations below the consensus price target of CLP4957.78. This valuation is based on what can be assumed as the expectations of Falabella's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP6000.0, and the most bearish reporting a price target of just CLP3460.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CLP14330.8 billion, earnings will come to CLP731.4 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 12.8%.

- Given the current share price of CLP5741.0, the bearish analyst price target of CLP3486.25 is 64.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Falabella?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.