Key Takeaways

- E-commerce momentum, integrated digital ecosystems, and advanced AI initiatives are positioning Falabella for lasting margin gains and greater cross-business synergies.

- Exclusive brands and expanded financial services are boosting customer value and strengthening competitive advantage amid growing digital adoption in Latin America.

- Rising digital competition, reliance on physical stores, limited investment capacity, and regional macroeconomic risks threaten Falabella's profitability and long-term growth trajectory.

Catalysts

About Falabella- Engages in the retail sale of clothing, accessories, home products, electronics, and beauty and other products in Chile, Peru, Colombia, Brazil, Mexico, Uruguay, and Argentina.

- Analysts broadly agree that Falabella's e-commerce and omnichannel investments are driving strong revenue growth, but the current acceleration in sellers' GMV-up 36% year-over-year-with 3P exceeding 8% of GMV, indicates marketplace scale and network effects could deliver far higher sales and take-rate-driven margin expansion than the market anticipates, especially as e-commerce penetration surges across Latin America.

- While consensus expects margin gains from operational improvements, Falabella's group-wide EBITDA margin has already surpassed previous guidance, and ongoing advances in AI-driven logistics, personalized marketing, and efficiency initiatives position the company to structurally lift net margins beyond recent historical benchmarks for years, not just quarters.

- Falabella's integrated ecosystem, spanning retail, malls, payments, banking, and insurance, is enhancing cross-business synergies through advanced loyalty programs and bundled offerings, likely unlocking higher customer lifetime value and steady double-digit earnings growth as the expanding middle class increases demand for full-service platforms.

- The company is poised for significant upside from its strategic bet on exclusive brands and private labels, now reinforced by influencer-led collaborations and curated in-store experiences, a shift expected to boost gross margins and defend pricing power in a region where brand differentiation is increasingly important.

- With rapid urbanization and the rise of digital payments, Falabella's strengthened financial services and digital wallet offerings are set to grow even faster, deepening financial inclusion, expanding underwriting reach, and enabling superior cross-sell-an underappreciated catalyst for both top-line growth and recurring net income streams.

Falabella Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Falabella compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Falabella's revenue will grow by 7.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 6.8% today to 6.7% in 3 years time.

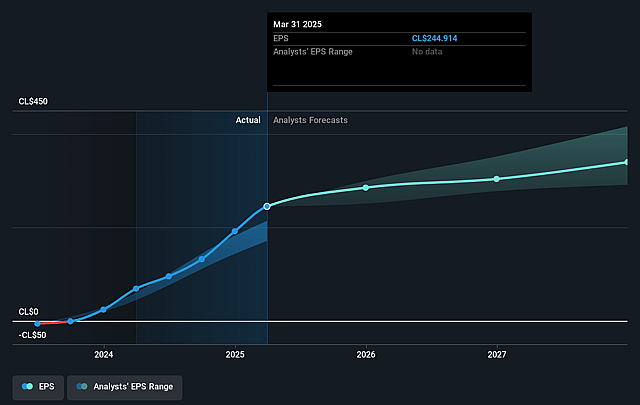

- The bullish analysts expect earnings to reach CLP 1044.2 billion (and earnings per share of CLP 450.23) by about September 2028, up from CLP 863.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 16.4x today. This future PE is greater than the current PE for the CL Multiline Retail industry at 11.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.76%, as per the Simply Wall St company report.

Falabella Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Falabella continues to face rising competition from major global e-commerce platforms like Amazon and Mercado Libre, who are expanding aggressively in Latin America. This intensifying digital rivalry could erode Falabella's market share and slow its revenue growth in core and emerging markets.

- As consumer habits steadily shift toward fully digital shopping experiences, the relevance of physical department stores and malls-a major component of Falabella's ecosystem-declines, which may lead to stagnating same-store sales and lower asset utilization, reducing long-term revenue and profitability.

- Despite recent improvements, Falabella's high leverage and history of elevated debt levels limit its ability to invest aggressively in innovation and digital capabilities, which in turn puts future earnings growth and dividend payments under pressure, especially if borrowing costs rise.

- Falabella's operations are heavily exposed to macroeconomic volatility in Chile, Peru, and Colombia, making its profits and revenues sensitive to regional inflation, currency swings, and slowdowns, as seen in cautious commentary regarding difficult environments in Brazil and Mexico.

- The ongoing oversupply and declining foot traffic in brick-and-mortar retail across Latin America elevates the risk of future store closures and asset write-downs, pressuring both top-line sales and net margins as traditional retail channels become structurally less profitable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Falabella is CLP6000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Falabella's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP6000.0, and the most bearish reporting a price target of just CLP3460.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CLP15692.8 billion, earnings will come to CLP1044.2 billion, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 12.8%.

- Given the current share price of CLP5650.0, the bullish analyst price target of CLP6000.0 is 5.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.