Last Update20 Aug 25Fair value Increased 8.53%

Despite a reduction in consensus revenue growth forecasts from 5.4% to 4.9% and an increase in future P/E from 19.02x to 19.98x, analysts have still revised Falabella's fair value upward, with the consensus price target rising from CLP4560 to CLP4949.

Valuation Changes

Summary of Valuation Changes for Falabella

- The Consensus Analyst Price Target has risen from CLP4560 to CLP4949.

- The Consensus Revenue Growth forecasts for Falabella has fallen from 5.4% per annum to 4.9% per annum.

- The Future P/E for Falabella has risen from 19.02x to 19.98x.

Key Takeaways

- Digital transformation and fintech investments are strengthening customer relationships, boosting repeat sales, and driving sustained revenue and margin growth.

- Supply chain digitization and disciplined cost control are expanding margins and supporting profitable, scalable growth across core Latin American markets.

- Macroeconomic volatility, rising competition, persistent debt, and increasing ESG requirements threaten growth prospects and margins amid slowing consumer demand in core Latin American markets.

Catalysts

About Falabella- Engages in the retail sale of clothing, accessories, home products, electronics, and beauty and other products in Chile, Peru, Colombia, Brazil, Mexico, Uruguay, and Argentina.

- The ongoing expansion and increasing adoption of e-commerce and digital payment solutions is accelerating GMV growth (online GMV up 19%, 3P seller sales up 36%), improving conversion rates, supporting higher cross-channel sales, and ultimately expanding Falabella's total addressable market-directly driving revenue and operating margin expansion.

- Falabella's investment in AI-driven personalization, digital transformation, and data-powered customer engagement (including AI chatbots, automated marketing, and personalized recommendations) is enhancing customer loyalty and increasing repeat purchases, supporting higher customer retention and rising lifetime value, which should have a sustained positive impact on revenues and margins.

- Strategic reinforcement of the fintech ecosystem via expansion of Banco Falabella, greater credit card usage, and new insurance partnerships is deepening customer relationships, broadening high-margin financial services income, and fueling credit-driven sales growth-supporting net margins and consolidated earnings improvements.

- Disciplined cost control, ongoing supply chain digitization, and mature omnichannel operations are creating sustained SG&A leverage even as sales volumes rise; this allows for margin expansion while supporting operational scalability and profitability.

- Robust execution on market share gains and omnichannel leadership in key Latin American markets, in a context of a rising middle class and urbanization, positions Falabella to capture outsize long-term discretionary spending growth, directly benefiting top-line revenue and potential long-term earnings.

Falabella Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Falabella's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.8% today to 6.0% in 3 years time.

- Analysts expect earnings to reach CLP 881.9 billion (and earnings per share of CLP 359.6) by about August 2028, up from CLP 863.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CLP1044.0 billion in earnings, and the most bearish expecting CLP731.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, up from 15.8x today. This future PE is greater than the current PE for the CL Multiline Retail industry at 12.1x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.74%, as per the Simply Wall St company report.

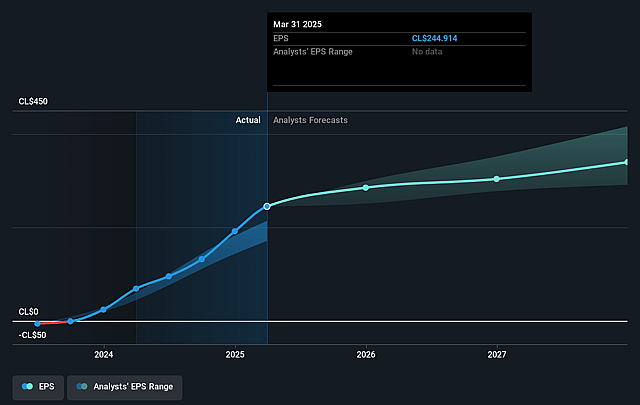

Falabella Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Falabella's significant exposure to ongoing macroeconomic and currency volatility in key South American markets (particularly Brazil, Mexico, and to some extent Peru and Chile) poses a structural risk, especially as management described Brazil as "challenging" and Mexico as facing "a more restrictive economic environment." These market headwinds could limit real revenue growth and compress net margins through higher cost pressures and weaker consumer demand.

- Intensifying competition from global e-commerce platforms and direct-to-consumer brands could erode Falabella's market share, especially as the company's own e-commerce growth is partly based on increasing seller participation and digital engagement rather than proprietary product differentiation. This trend may pressure topline growth and lead to further margin erosion in retail over the long term.

- Sustained debt burdens and the need to recover investment-grade ratings remain a notable risk-management continues to highlight leverage and active engagement with rating agencies. Despite recent improvement to a 1.9x non-banking net debt/EBITDA level, the legacy of significant debt and any macro shocks could constrain future investment and put downward pressure on net earnings through higher interest cost.

- The company faces higher cost structures and potential margin pressures from increasing sustainability and ESG compliance expectations. Management acknowledges the need for disciplined investment amidst a "challenging environment," but tightening regulations and consumer preferences for ESG-compliant operations may require ongoing capital outlays, raising SG&A and dampening long-term profitability.

- Slower economic growth and changing demographic trends in Latin America-such as the forecasted slowdown in Peru (due to non-repeatable pension fund withdrawals) and weak construction activity in Brazil and Mexico-could structurally limit consumer spending growth in core categories. This presents a risk to sustaining the current pace of revenue and net income growth, especially as base comparisons become more difficult.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP4948.889 for Falabella based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP6000.0, and the most bearish reporting a price target of just CLP3380.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CLP14713.5 billion, earnings will come to CLP881.9 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of CLP5440.0, the analyst price target of CLP4948.89 is 9.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.