Key Takeaways

- Digital channel expansion and integrated ecosystem position Falabella for sustained growth in revenue, market share, and customer engagement across retail and financial services.

- Advanced cost controls, omnichannel investments, and improved inventory management support margin expansion and robust, multi-year earnings growth potential.

- Heavy reliance on transient tourism, intensifying digital competition, macroeconomic headwinds, and supply chain pressures threaten Falabella's long-term growth, profitability, and operational stability.

Catalysts

About Falabella- Engages in the retail sale of clothing, accessories, home products, electronics, and beauty and other products in Chile, Peru, Colombia, Brazil, Mexico, Uruguay, and Argentina.

- Analysts broadly agree that Falabella's operational and e-commerce momentum will drive revenue growth, but the pace may be significantly understated: the company is scaling both its proprietary multi-category 3P marketplace and rapidly improving fulfillment, already delivering 70% of orders in under 48 hours, supporting the potential for mid-20s percentage compound annual revenue growth in digital channels over the next several years.

- Analyst consensus expects cost containment to improve margins, but this underappreciates the operating leverage possible as sales growth outpaces inflation and expense growth, with further SG&A dilution and advanced inventory management initiatives likely to drive net margin expansion faster than anticipated.

- Falabella's integrated ecosystem-including retail, financial services, digital payments, and logistics-benefits disproportionately from rising urbanization and financial inclusion in Latin America, positioning the company for sustained, long-term expansion in both market share and average revenue per user as millions of new consumers access modern retail and banking.

- The rapid expansion of digital banking services and digital savings products across multiple markets, combined with double-digit loan book growth and best-in-class credit risk metrics, strongly suggests structural, not cyclical, improvement in ROE and fee income, setting up a multi-year runway for robust earnings growth in the financial arm.

- Falabella's commitment to omnichannel and supply chain investments, including the transformation of Maestro stores and exponential SKU growth through 3P sellers, is enabling industry-leading customer satisfaction and loyalty, which-when layered onto secular e-commerce adoption-will compound LTV and drive both superior sales retention and premium margin accretion over time.

Falabella Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Falabella compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Falabella's revenue will grow by 8.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.9% today to 6.9% in 3 years time.

- The bullish analysts expect earnings to reach CLP 1089.3 billion (and earnings per share of CLP 361.66) by about August 2028, up from CLP 614.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, down from 20.2x today. This future PE is greater than the current PE for the CL Multiline Retail industry at 11.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.89%, as per the Simply Wall St company report.

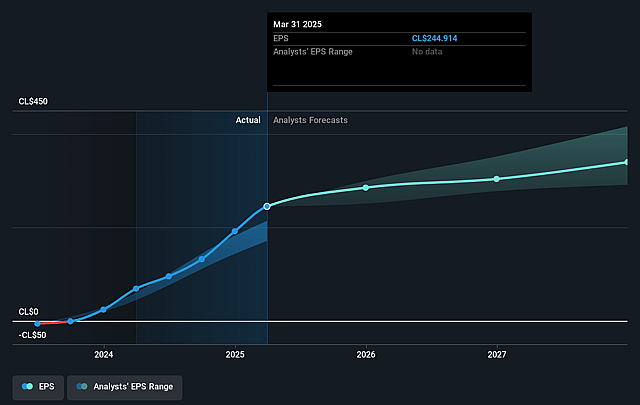

Falabella Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Falabella's strong recent growth in brick-and-mortar retail, particularly in Chile and Peru, is heavily influenced by a temporary influx of foreign shoppers, especially Argentines; management explicitly cautions this tourist-driven boost will fade, which could lead to slower future revenue and earnings growth as visitor levels revert to historical norms.

- Despite improvements in e-commerce, Falabella faces intensifying competition from global e-commerce giants such as Amazon and MercadoLibre, whose scale and innovation threaten to erode market share and pricing power, potentially pressuring both revenues and net margins in the long run.

- Management underscores ongoing macroeconomic volatility and inflationary pressures across Latin America, which can suppress consumer discretionary spending and weaken Falabella's sales volumes, particularly if regional economies or currencies deteriorate further, thereby impacting revenue and reported earnings in US dollar terms.

- Structural challenges in Falabella's digital transformation and integration efforts could result in elevated technology expenses without adequate returns, especially against more agile digital-native competitors, which risks compressing net margins and slowing earnings growth over time.

- Persistent supply chain disruptions, rising logistics costs, and global inventory imbalances, especially given Falabella's reliance on imported goods and regional currency instability, could undermine gross margins and lead to earnings volatility, particularly if these pressures outpace operational efficiencies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Falabella is CLP5250.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Falabella's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP5250.0, and the most bearish reporting a price target of just CLP3380.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CLP15698.0 billion, earnings will come to CLP1089.3 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 12.9%.

- Given the current share price of CLP4959.0, the bullish analyst price target of CLP5250.0 is 5.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.