Last Update 29 Nov 25

Fair value Decreased 3.89%CMPC: Future Profit Margins Will Drive Upside Despite Higher Discount Rate

Analysts have lowered their price target for Empresas CMPC from CLP 1,819 to CLP 1,748, citing reduced expectations for revenue growth and profit margins.

What's in the News

- A board meeting is scheduled for November 6, 2025, to consider and approve the publishing and transmission of Interim Consolidated Financial Statements to regulatory and market authorities (Key Developments).

- Empresas CMPC S.A. recently conducted an Analyst/Investor Day event (Key Developments).

Valuation Changes

- Fair Value: Decreased from CLP 1,819 to CLP 1,748. This indicates a moderate reduction in estimated intrinsic value.

- Discount Rate: Increased slightly from 16.40% to 16.41%.

- Revenue Growth: Lowered from 4.05% to 3.41%, reflecting diminished growth expectations.

- Net Profit Margin: Declined from 5.05% to 3.96%. This represents a notable reduction in forecast profitability.

- Future P/E: Rose from 18.07x to 22.59x, suggesting higher anticipated valuations relative to earnings.

Key Takeaways

- Expansion into sustainable packaging and global markets enhances long-term growth prospects while supporting resilience against regional instability.

- Emphasis on operational efficiency, cost optimization, and ESG initiatives strengthens competitiveness and attractiveness to investors.

- Margin compression, rising costs, and exposure to volatile pulp prices and currencies pose significant risks to sustained revenue, earnings, and financial stability.

Catalysts

About Empresas CMPC- Engages in the production and sale of pulp and wood products in Chile and internationally.

- Global demand for sustainable, renewable packaging is expected to strengthen, supporting Empresas CMPC's biopackaging and pulp segments-particularly as regulatory pressure and consumer preference shift away from single-use plastics. This should boost long-term top-line revenue, especially as downstream customers commit to more sustainable supply chains.

- The company's ongoing investments in pulp capacity expansion (e.g., BioCMPC and the proposed Natureza project) are positioned to scale up production efficiency and meet anticipated demand from a growing global middle class, especially in Asia and Latin America, supporting future revenue growth and EBITDA margin expansion.

- CMPC's focus on cost optimization, operational efficiency (highlighted by decreasing cash costs year-over-year in hardwood), and digital transformation/automation initiatives should drive sustainable improvements in net margins even in a challenged pricing environment.

- Strengthened ESG positioning, including responsible forestry asset management and vertical integration, makes Empresas CMPC increasingly attractive to ESG-focused investors. This could lower future financing costs and improve valuation multiples over time, positively impacting net earnings and capital structure.

- The company's geographic diversification and market expansion (e.g., through Falcon acquisition in Brazil and focus on Latin America and Asia) help reduce exposure to regional economic volatility and currency depreciation, providing a more resilient earnings and cash flow profile as new demand centers mature.

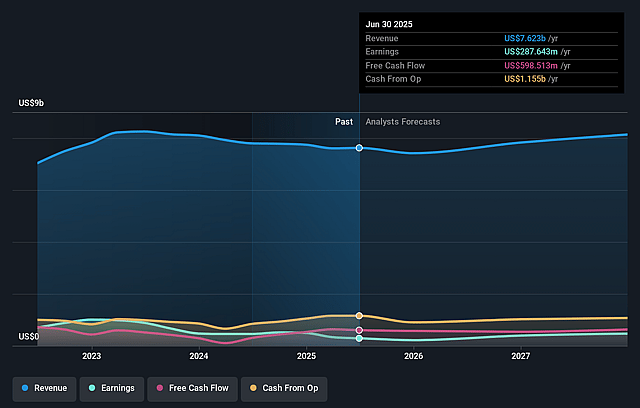

Empresas CMPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Empresas CMPC's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 5.2% in 3 years time.

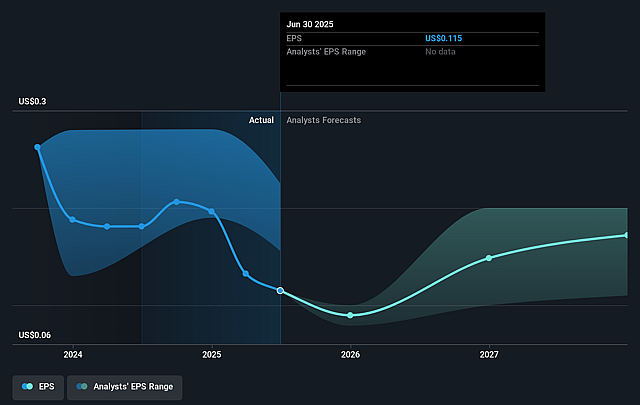

- Analysts expect earnings to reach $424.9 million (and earnings per share of $0.17) by about September 2028, up from $287.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $745 million in earnings, and the most bearish expecting $312 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from 13.9x today. This future PE is greater than the current PE for the CL Forestry industry at 13.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.25%, as per the Simply Wall St company report.

Empresas CMPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged downward pressure on average sales prices for both hardwood and softwood pulp, as well as ongoing currency depreciation in Latin America, have significantly reduced year-over-year revenues and EBITDA margins-posing risk to sustained top-line and earnings growth.

- Sharp declines in Softys and Biopackaging EBITDA (down 38% and 25% year-over-year, respectively), driven by increased market competition, higher integration and operating costs, and volume decreases, signal persistent margin compression and revenue stagnation in key business segments.

- Elevated capital expenditures for acquisitions (such as Falcon) and large-scale projects (like Natureza), combined with rising operating costs and expenses, resulted in negative free cash flow and a high net debt-to-EBITDA ratio (3.65x), increasing financial risk and pressuring net income and equity value if market conditions worsen.

- Heavy reliance on expectations of pulp price recoveries in China, Brazil, and Mexico exposes the company to global supply/demand uncertainty, regional overcapacity, and cyclical volatility-raising the risk of continued price weaknesses that could erode revenue and net margins.

- Ongoing industry headwinds from excess pulp capacity in major markets, greater exposure to foreign exchange volatility, and secular trends such as accelerating digitalization (reducing paper demand) and rising regulatory compliance costs may further impact operating margins and constrain long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP1912.679 for Empresas CMPC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP2791.47, and the most bearish reporting a price target of just CLP1605.27.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.2 billion, earnings will come to $424.9 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 16.2%.

- Given the current share price of CLP1540.0, the analyst price target of CLP1912.68 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Empresas CMPC?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.