Key Takeaways

- Structural shifts toward digitalization and alternative materials threaten demand for core products, risking long-term revenue decline and reduced market relevance.

- High leverage, negative cash flow, and regional risks increase financial vulnerability amid rising compliance costs and uncertain project returns.

- Ongoing efficiency programs, strategic capacity expansion, expected pulp price rebound, product mix improvements, and disciplined deleveraging all position the company for stronger profitability and lower financial risk.

Catalysts

About Empresas CMPC- Engages in the production and sale of pulp and wood products in Chile and internationally.

- The accelerating shift toward digital media, e-invoicing, and paperless communications will steadily erode demand for Empresas CMPC's core pulp and paper products, resulting in declining revenues and increased idle capacity for its largest business units over the coming decade.

- Intensifying global competition to supply eco-friendly packaging will likely drive up regulatory compliance costs and capital spending on new technologies, but with little pricing power in commoditized segments, this will compress net margins and strain long-term earnings.

- CMPC's high leverage and planned mega-projects like Natureza require ongoing substantial capital investment, even as free cash flow generation has turned negative and debt levels have increased; should cyclical pulp prices remain weak or climate volatility disrupt timber supply, the company could face prolonged balance sheet stress and higher interest expenses.

- The firm's heavy exposure to Latin American markets leaves it highly vulnerable to potential currency depreciation, political instability, and unpredictable policy shifts, which can erode both earnings and cash flow while increasing the risk profile for investors.

- Industry-wide advances in synthetic and recycled materials threaten to displace wood pulp as a primary input for packaging and hygiene products, potentially leading to a structural decline in long-term demand and a permanent reduction in CMPC's addressable market and profit outlook.

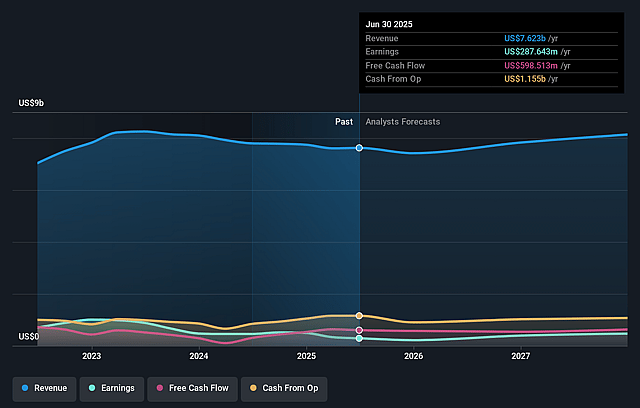

Empresas CMPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Empresas CMPC compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Empresas CMPC's revenue will grow by 1.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.8% today to 4.4% in 3 years time.

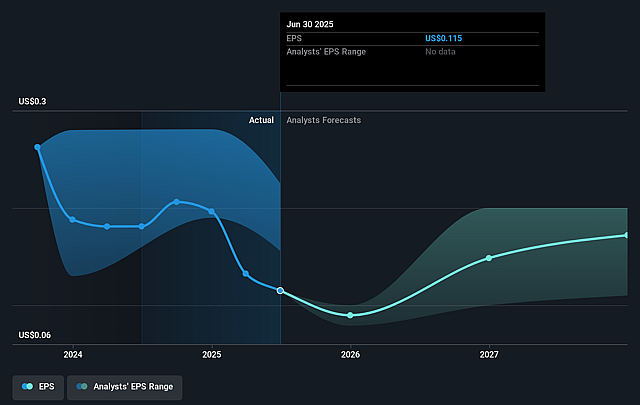

- The bearish analysts expect earnings to reach $352.2 million (and earnings per share of $0.12) by about September 2028, up from $287.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 13.9x today. This future PE is greater than the current PE for the CL Forestry industry at 13.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.25%, as per the Simply Wall St company report.

Empresas CMPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The management highlighted a positive long-term trend of cost reduction and operational efficiency, particularly in the Pulp business, with ongoing programs yielding continuous improvement, which may support EBITDA margins and long-term earnings.

- Company leadership remains strongly committed to strategic expansion projects like Natureza, which are expected to significantly bolster production capacity and future revenue generation, even with current market underappreciation.

- Multiple executives expressed high conviction that current low pulp prices are at or near cyclical bottoms, citing strong early-month order flows in China, anticipated demand recovery in the second half of the year, and upcoming restocking cycles, suggesting a likely rebound in prices and top-line growth.

- The Softys segment is leveraging integration of recent acquisitions (such as Falcon) and intensified focus on higher-margin personal care categories, promising volume growth and improved profitability in consumer products, which could stabilize or grow net income over time.

- The company is actively deleveraging through working capital reduction, CapEx discipline, asset sales, and rigorous financial planning around major projects, strengthening the balance sheet and mitigating financing risks, which would support earnings quality and reduce credit concerns in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Empresas CMPC is CLP1605.27, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Empresas CMPC's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP2791.47, and the most bearish reporting a price target of just CLP1605.27.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.0 billion, earnings will come to $352.2 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 16.2%.

- Given the current share price of CLP1540.0, the bearish analyst price target of CLP1605.27 is 4.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.