Key Takeaways

- Rising demand and tighter supply in Asia could drive a faster-than-expected earnings surge, with cost controls enabling sustained margin and profit improvement.

- Strategic moves into sustainable packaging and personal care position CMPC to capture market share, pricing power, and structural long-term growth.

- Heavy reliance on traditional pulp, regional exposure, competition, and regulatory pressures threaten profitability and financial stability amid ambitious capital spending.

Catalysts

About Empresas CMPC- Engages in the production and sale of pulp and wood products in Chile and internationally.

- Analysts broadly agree that a cyclical recovery in pulp prices driven by restocking and demand in Asia will improve revenues, but this actually understates the potential; with CMPC having sold out 100% of August China volumes in the first week and the high-demand season commencing, pulp price and volume upside could be sharper and come earlier than the market expects, leading to a rapid uplift in EBITDA and net income from Q4 onward.

- Analyst consensus sees cost optimization initiatives stabilizing or modestly improving margins; however, forward-looking cost reductions from newly implemented organizational changes, robust fixed cost control, and efficient maintenance scheduling signal a step change in structural margins, positioning CMPC for record-high margin expansion as production normalizes and input costs decrease, translating into outsized earnings growth.

- The company's aggressive expansion into value-added and sustainable packaging solutions places it at the forefront of the accelerating global shift away from plastics-meaning not only higher volumes but also premium pricing power as regulations and consumer demand shift, driving outsized long-term revenue and margin gains.

- With urbanization and a rising middle-class in Latin America, CMPC's reinforced geographic and product diversification-especially through the Falcon acquisition and integration-sets the stage for market share capture and sustained double-digit growth in personal care, enhancing topline performance and earnings quality even in challenging cycles.

- Industry-leading investments in forestry technology and sustainable, certified operations create barriers to entry just as regulatory scrutiny and traceability demands rise globally; CMPC is set to benefit from superior yields, stable or declining raw material costs, and increased market share, resulting in structurally higher returns on invested capital and free cash flow over the long term.

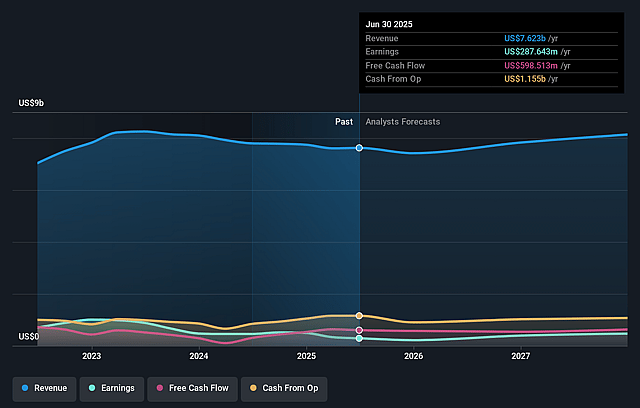

Empresas CMPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Empresas CMPC compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Empresas CMPC's revenue will grow by 4.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 9.8% in 3 years time.

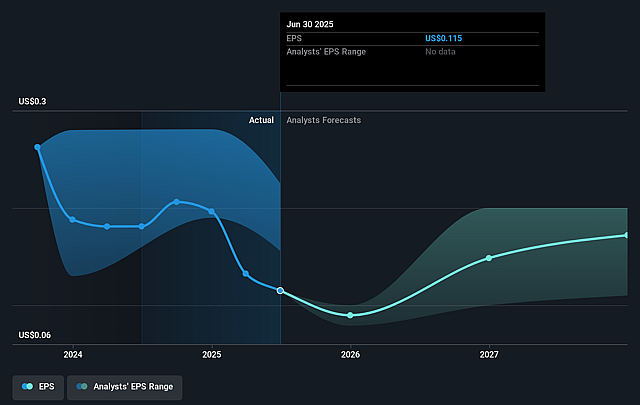

- The bullish analysts expect earnings to reach $846.5 million (and earnings per share of $0.23) by about September 2028, up from $287.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, down from 13.5x today. This future PE is lower than the current PE for the CL Forestry industry at 13.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.25%, as per the Simply Wall St company report.

Empresas CMPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing acceleration of digitalization and continued decline in global demand for graphic paper products threaten the company's traditional pulp business, which could create downward pressure on revenues over time.

- CMPC remains heavily exposed to South American operations, leaving it vulnerable to currency volatility and regional political risk, as evidenced by negative currency impacts in Softys and increased costs across its businesses, which may continue to compress net earnings.

- The company is facing increased competition and oversupply in key markets, particularly from low-cost producers in regions like Asia and Brazil, resulting in price pressures and reduced margins, as seen in the year-over-year EBITDA decline across all segments.

- High leverage and rising operating expenditures, coupled with ambitious capital projects such as Natureza, raise the risk of financial strain if market conditions deteriorate or if pulp prices remain weak, potentially undermining free cash flow and net income.

- Heightened environmental and sustainability regulations, combined with industry-wide scrutiny of carbon emissions, deforestation, and water use, could substantially increase compliance and operating costs, eroding profitability and potentially limiting access to key export markets in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Empresas CMPC is CLP2709.7, which represents two standard deviations above the consensus price target of CLP1909.76. This valuation is based on what can be assumed as the expectations of Empresas CMPC's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP2803.76, and the most bearish reporting a price target of just CLP1598.82.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.7 billion, earnings will come to $846.5 million, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 16.2%.

- Given the current share price of CLP1499.9, the bullish analyst price target of CLP2709.7 is 44.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Empresas CMPC?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.