Key Takeaways

- Rising digital competition and evolving customer preferences threaten BCI's revenue growth, with fintechs and new entrants eroding traditional banking profitability.

- Heightened regulatory and compliance demands increase operational complexity and costs, squeezing margins and undermining long-term financial performance.

- Expansion of digital platforms, strong international operations, robust risk management, and strategic partnerships are driving resilient growth, diversified revenue, and stable earnings for BCI.

Catalysts

About Banco de Crédito e Inversiones- Provides various banking products and services in Chile, United States, and Peru.

- Mounting digital disruption from fintechs and non-bank financial institutions across Latin America is set to erode BCI's traditional banking revenue streams, creating persistent margin compression and making it increasingly difficult to sustain current earnings levels over the coming years.

- Intensifying regulatory demands related to anti-money laundering, ESG requirements, and data privacy will elevate compliance costs and operational complexity for BCI, placing additional downward pressure on net margins and overall profitability as the cost base expands faster than revenue.

- The pace of digital transformation at BCI, although emphasized, risks falling behind the capabilities of regional and global competitors, threatening customer retention and acquisition, which may stall sustainable fee income and loan growth over the medium term.

- Ongoing demographic changes, specifically younger generations' preference for agile digital-native financial services, threaten to accelerate customer attrition and reduce BCI's market share in key segments, jeopardizing long-term revenue stability.

- Prolonged low or declining interest rates driven by regional monetary policy easing, combined with a fiercely competitive deposit environment, are likely to cause sustained net interest margin pressure and limit the bank's ability to grow earnings at the pace implied by the current valuation.

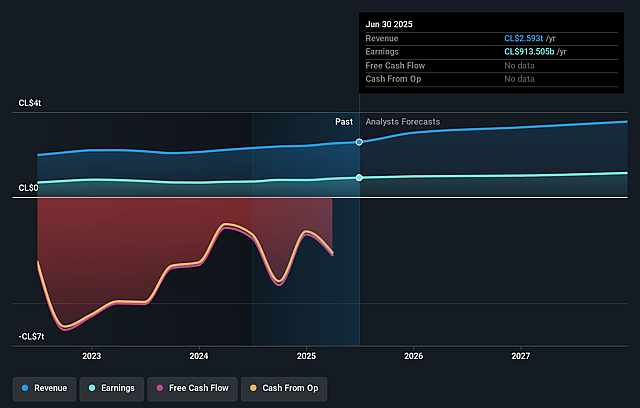

Banco de Crédito e Inversiones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Banco de Crédito e Inversiones compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Banco de Crédito e Inversiones's revenue will grow by 10.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 35.2% today to 32.9% in 3 years time.

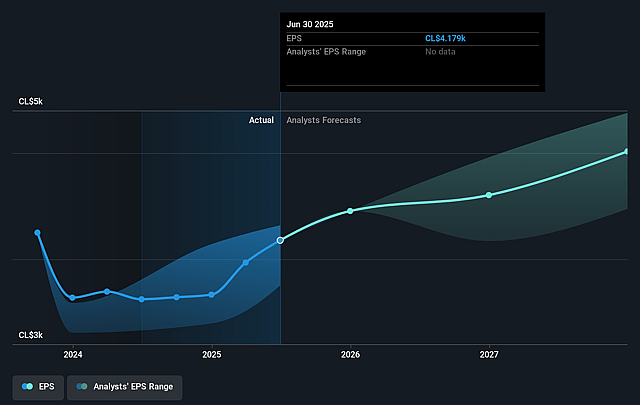

- The bearish analysts expect earnings to reach CLP 1151.2 billion (and earnings per share of CLP 4637.21) by about July 2028, up from CLP 913.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 8.9x today. This future PE is lower than the current PE for the CL Banks industry at 8.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.09%, as per the Simply Wall St company report.

Banco de Crédito e Inversiones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid expansion and successful monetization of MACHBANK, BCI's fully digital banking platform, has resulted in 43% year-over-year growth in checking balances and 46% growth in overall balances, positioning BCI to capture the long-term secular trend of digital financial inclusion, which may drive significant revenue and net interest income growth.

- City National Bank of Florida, BCI's U.S. subsidiary, consistently outpaces U.S. banking industry deposit growth (7% versus 2% in the first quarter) and maintains strong asset quality, conservative loan underwriting, and an expanding net interest margin, adding resilient earnings and supporting diversified revenue streams outside Chile.

- Proactive risk management, disciplined provisioning, and improving nonperforming loan ratios-especially in consumer and commercial portfolios-have led to a 21.5% decline in provision expenses and robust coverage ratios of 143.49%, strengthening BCI's earnings stability and limiting downside risk to net income.

- BCI's capital and liquidity positions are robust, with CET1 ratios well above regulatory minimums and sustained liquidity buffers, providing the flexibility for growth and resilience against adverse macroeconomic or regulatory shocks, which underpins long-term profitability and earnings growth.

- Strategic focus on partnerships with leading brands and continuous expansion of the BCI retail ecosystem, including advances in digitalization and loyalty programs, is driving strong fee income performance (27% year-over-year growth) and positions the bank to maintain or expand net margins against secular industry headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Banco de Crédito e Inversiones is CLP29890.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco de Crédito e Inversiones's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP45000.0, and the most bearish reporting a price target of just CLP29890.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CLP3494.3 billion, earnings will come to CLP1151.2 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 11.1%.

- Given the current share price of CLP37000.0, the bearish analyst price target of CLP29890.0 is 23.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.