Key Takeaways

- Strong international growth, digital leadership, and strategic M&A position Bci for faster asset expansion and earnings outperformance than analyst expectations.

- Advanced risk management, digital investments, and targeted financial inclusion enable sustainable cost reductions, higher margins, and durable market leadership in Chile and Peru.

- Intensifying fintech competition, macroeconomic volatility, rate pressures, and integration risks threaten BCI's earnings stability and long-term profitability in its core markets.

Catalysts

About Banco de Crédito e Inversiones- Provides various banking products and services in Chile, United States, and Peru.

- Analyst consensus expects Bci's international presence via City National Bank of Florida, Bci Miami, and Bci Peru to diversify risk and drive moderate revenue growth, but this view underestimates the compounding impact of deposit growth, outperformance versus peers, and strategic M&A optionality in the U.S., which together position Bci for much faster-than-expected asset and earnings expansion through higher net interest margins and scalable fee generation.

- While the consensus highlights MACHBANK's break-even prospects and digital growth, analysts broadly agree that monetization will be gradual; however, MACHBANK's 46% year-over-year growth in balances, rapid portfolio diversification, and targeted financial inclusion strategy suggest it could emerge as Chile's leading digital financial ecosystem ahead of schedule, driving exponential customer acquisition, step-function growth in low-cost deposit funding, and sharply higher fee income and net margins by 2026.

- Bci's leadership in new data analytics and risk management is enabling sustainable reductions in provision costs and loan losses-recent improvements in nonperforming loan ratios and recoveries could prove structural, not cyclical, setting the stage for multi-year improvements in cost of risk and consistently higher returns on equity.

- The growing middle class in Chile and Peru, alongside government efforts to expand financial inclusion, places Bci's specialized retail and SME loan products at the center of a secular uptick in credit demand, ensuring above-system loan growth and durable expansion of both fee and interest income well beyond analyst forecasts.

- Investments in digital infrastructure and automation are already materially lowering Bci's underlying cost base and efficiency ratio, creating significant operating leverage that, as digital adoption accelerates, can drive margin expansion and earnings outperformance relative to peers capped by legacy branch costs.

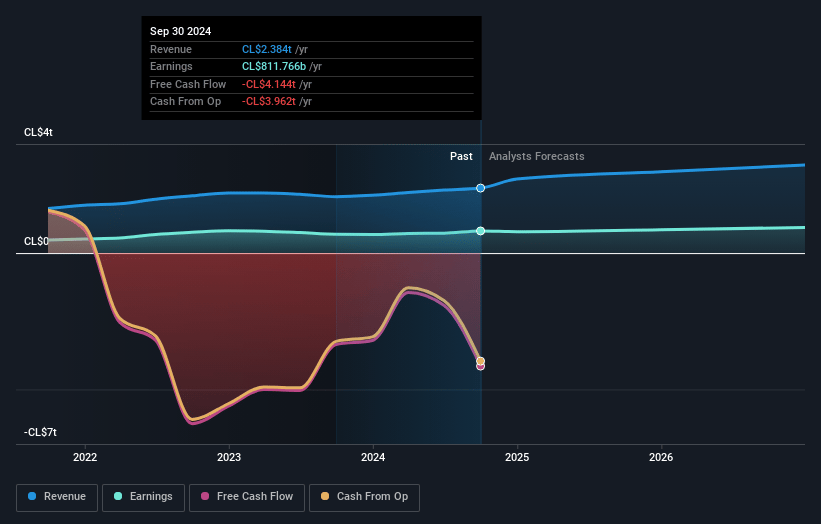

Banco de Crédito e Inversiones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banco de Crédito e Inversiones compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banco de Crédito e Inversiones's revenue will grow by 15.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 35.2% today to 31.0% in 3 years time.

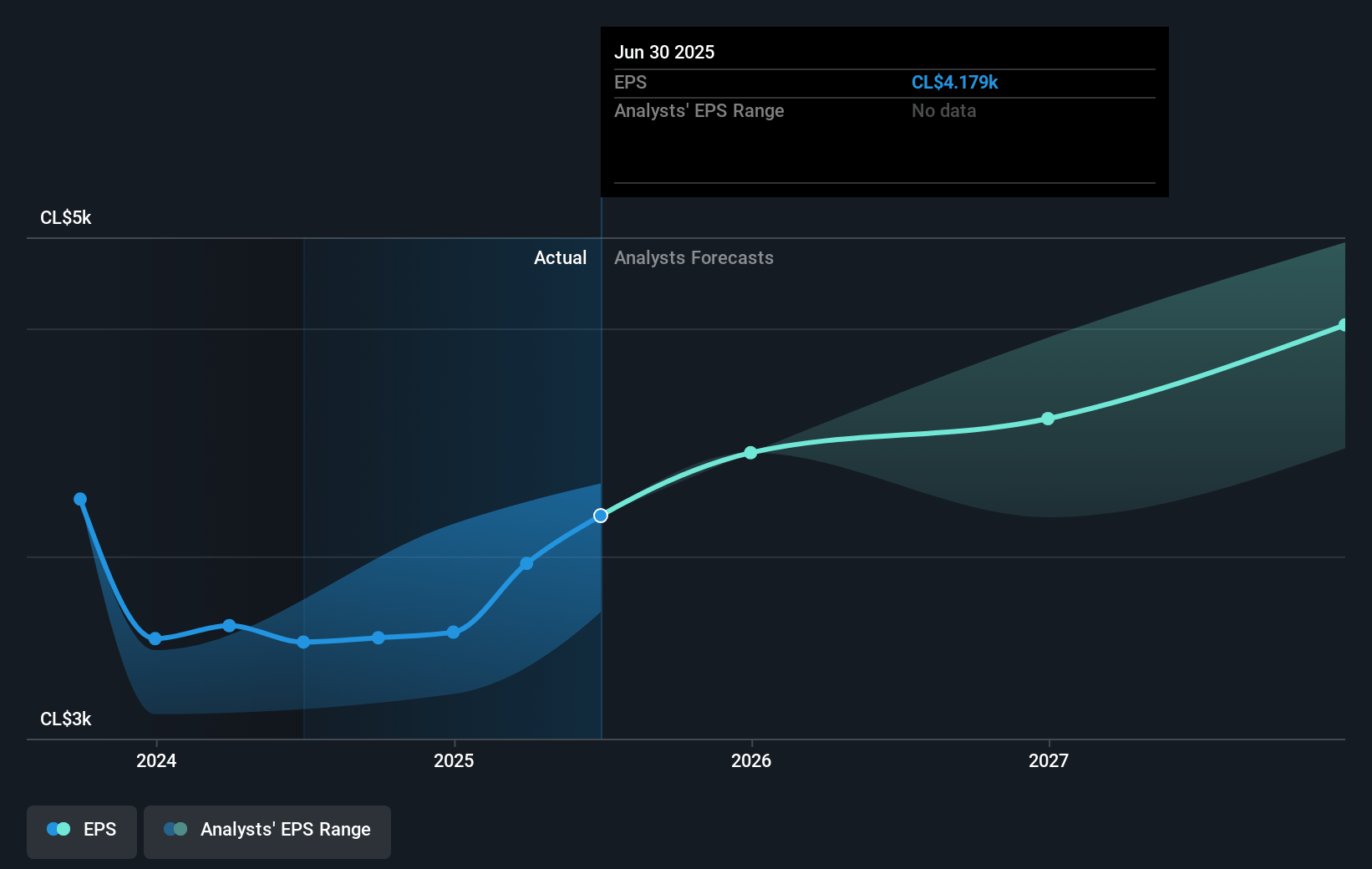

- The bullish analysts expect earnings to reach CLP 1222.1 billion (and earnings per share of CLP 5573.89) by about July 2028, up from CLP 913.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 8.9x today. This future PE is greater than the current PE for the CL Banks industry at 8.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.09%, as per the Simply Wall St company report.

Banco de Crédito e Inversiones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Digital disruption and growing fintech competition, particularly from established players like Tempo, Mercado Pago, BancoEstado and others, could erode BCI's market share and lead to lower growth and declining fee-based revenue over time, putting long-term pressure on revenue and earnings.

- Macroeconomic volatility in Chile and Latin America-including elevated unemployment, high inflation, and external shocks from U.S. tariffs-may drive higher credit risk, increase nonperforming loans, and negatively impact the bank's asset quality and loan loss provisions, ultimately reducing net income.

- Prolonged low interest rate environments in the region and anticipated Central Bank rate cuts could compress net interest margins and constrain future earnings growth even as loan growth moderates in BCI's core Chilean market.

- The bank's heavy concentration in mature Chilean markets and relatively modest organic local loan growth heighten the risk of stagnating net interest income, making BCI more vulnerable to shifts in local demand and increased competition.

- Future M&A activities, or challenges in integrating cross-border operations such as City National Bank in Florida, introduce execution risk and have the potential to raise operating expenses and integration costs, which could suppress earnings and erode net margins in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banco de Crédito e Inversiones is CLP45000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco de Crédito e Inversiones's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP45000.0, and the most bearish reporting a price target of just CLP29890.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CLP3943.5 billion, earnings will come to CLP1222.1 billion, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 11.1%.

- Given the current share price of CLP37000.0, the bullish analyst price target of CLP45000.0 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.