Last Update 28 Aug 25

Fair value Increased 3.38%With both the discount rate and future P/E ratio remaining stable, there is no change in analyst valuation, leaving Flughafen Zürich’s consensus price target effectively unchanged at CHF240.79.

Valuation Changes

Summary of Valuation Changes for Flughafen Zürich

- The Consensus Analyst Price Target remained effectively unchanged, at CHF240.79.

- The Discount Rate for Flughafen Zürich remained effectively unchanged, at 5.29%.

- The Future P/E for Flughafen Zürich remained effectively unchanged, at 23.64x.

Key Takeaways

- Major infrastructure and international expansions, along with high-margin non-aviation growth, are set to drive earnings diversification and long-term profit resilience.

- Digitalization, sustainability efforts, and regulatory mechanisms support efficiency, earnings stability, and reduced reliance on any one market or revenue stream.

- Regulatory constraints, heavy capital spending, operational disruptions, demographic trends, and currency fluctuations threaten sustainable revenue growth, margin expansion, and future profitability.

Catalysts

About Flughafen Zürich- Owns and operates the Zurich Airport in Switzerland.

- Sustained growth in global air travel demand, exemplified by Zurich Airport reaching record passenger volumes and strong international traffic recovery (notably in Asia and the Americas), points to continued top-line growth as global mobility and business connectivity trends drive higher revenues.

- Major capacity and infrastructure investments at Zurich (Dock A replacement, landside commercial expansion, new terminal projects), alongside international ventures (notably Noida Airport launching in late 2025 with a projected rapid passenger ramp-up), are set to boost operational capacity, fee-earning assets, and long-term earnings diversification.

- Expansion of high-margin non-aviation businesses-including retail (e.g. new luxury brands, eventual reopening and 7,000 sqm expansion landside), real estate (acquisition of Radisson Blu, growth of The Circle office/food hub), and international airport management-positions Flughafen Zürich for resilient and growing net margins as non-cyclical revenue streams increase in share.

- Advancements in digitalization, sustainability (fleet modernization, accreditation, energy-efficient operations) and seamless travel experiences not only increase cost efficiency but are likely to enhance passenger spending and attract regulatory incentives, supporting margin improvement and moderating capex pressures on earnings.

- Regulatory mechanisms (rollover for over/underearnings, expected moderate tariff reduction) improve earnings stability and competitiveness, while a strong project pipeline overseas (Noida, Brazil, Chile) ensures long-term revenue and EBITDA growth, reducing reliance on a single geography or business line.

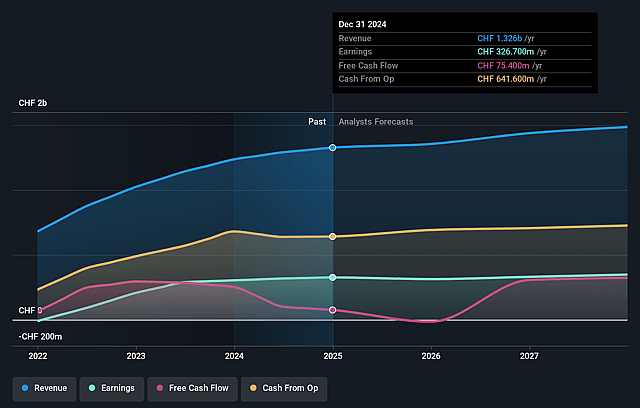

Flughafen Zürich Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flughafen Zürich's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.2% today to 23.0% in 3 years time.

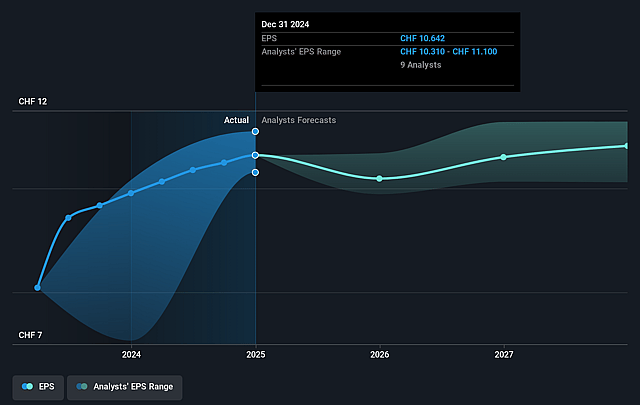

- Analysts expect earnings to reach CHF 345.0 million (and earnings per share of CHF 11.4) by about September 2028, up from CHF 336.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, up from 22.2x today. This future PE is greater than the current PE for the GB Infrastructure industry at 22.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.88%, as per the Simply Wall St company report.

Flughafen Zürich Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming moderate reduction in Zurich Airport's regulated charges, driven by currently high returns relative to allowed levels, is likely to dampen future regulated revenue growth and may cap net margin expansion during the next tariff period.

- Substantial capital expenditures required for major infrastructure projects (e.g., Dock A replacement, Landside Passenger Zone, Noida Airport) will increase debt and depreciation, potentially suppressing free cash flow and net earnings, especially if revenue growth does not keep pace or projects face delays and cost overruns.

- A prolonged period of construction at Zurich, notably on the Landside Passenger Zone, is already causing commercial revenue declines due to restricted retail offering and could continue to pressure top-line non-aviation revenues and EBITDA until completion in 2027.

- Demographic and secular trends such as the rise of virtual meetings, slower business travel recovery, and potential demographic headwinds in Europe may constrain long-term passenger growth, which could limit future aviation and non-aviation revenue streams.

- Currency risk from international expansion, particularly with the Indian rupee's depreciation against the Swiss franc, may reduce the long-term profitability and return on investment from ventures like Noida, translating into potential earnings headwinds when converting foreign operations' results back to the group's reporting currency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF248.929 for Flughafen Zürich based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF280.0, and the most bearish reporting a price target of just CHF200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF1.5 billion, earnings will come to CHF345.0 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of CHF243.0, the analyst price target of CHF248.93 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.