Key Takeaways

- Long-term planning reliability and infrastructure expansions could enhance revenue and asset value, boosting Flughafen Zürich's growth and stability.

- Sustainability initiatives and a new dividend policy may improve operational efficiency and attract greater investment interest.

- Delays and regulatory challenges at multiple airports may impact revenue and profitability, while operational cost increases and environmental events present further financial risks.

Catalysts

About Flughafen Zürich- Owns and operates the Zurich Airport in Switzerland.

- The introduction of the rollover mechanism for airport charges and regulatory adjustments provides greater long-term planning reliability, potentially enhancing future revenue growth and negotiation outcomes.

- The inauguration of Noida Airport is expected to be a significant growth driver for Flughafen Zürich's international business, contributing positively to future earnings once operational.

- The expansion of real estate assets and modernized infrastructure across airports enriches the commercial and real estate business segments, likely increasing revenue stability and enhancing asset value.

- The adoption of sustainability initiatives and technological advances, such as autonomous vehicles and renewable energy sources, could improve operational efficiency and margin expansion over time.

- The new dividend policy with increased payout ratios could appeal to investors, potentially impacting stock valuation and attracting greater investment interest.

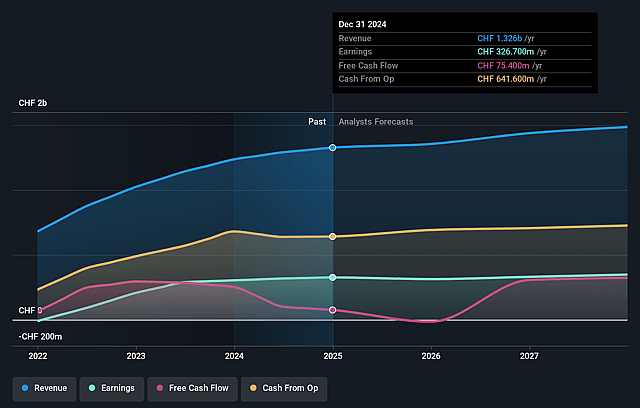

Flughafen Zürich Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flughafen Zürich's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.6% today to 23.4% in 3 years time.

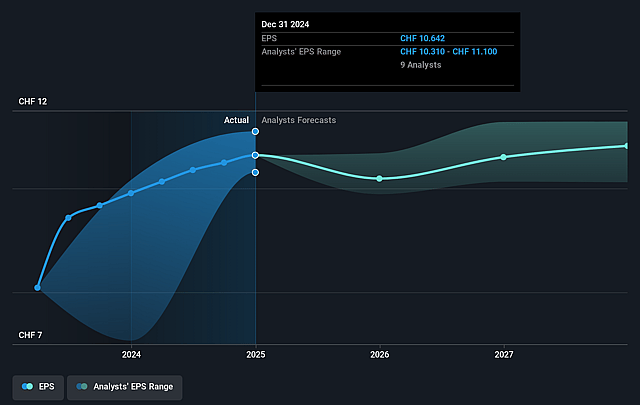

- Analysts expect earnings to reach CHF 348.1 million (and earnings per share of CHF 10.82) by about August 2028, up from CHF 326.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF311 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.1x on those 2028 earnings, up from 23.2x today. This future PE is greater than the current PE for the GB Infrastructure industry at 23.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.87%, as per the Simply Wall St company report.

Flughafen Zürich Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The opening of Noida Airport has experienced delays, which may further affect its contribution to revenue and earnings. Regulatory approvals and operational ramp-ups pose a risk to initial projections, thus impacting expected financial returns.

- Construction and expansion projects at Zurich Airport are expected to cause temporary mid-single-digit million Swiss franc losses in commercial revenue per year until completed in 2027, affecting overall revenue and profitability during these years.

- Rising operational costs, including personnel expenses due to inflation and increased headcounts, may impact net margins despite higher revenue from increased traffic, potentially affecting the bottom line.

- International operations in regions like Latin America may face challenges due to environmental events (as seen with Porto Alegre Airport's temporary closure), which could disrupt passenger traffic and affect international revenue streams.

- Regulatory challenges, such as ongoing negotiations for airport charges and uncertainty around the regulated WACC at Zurich Airport, could impact revenues and profitability depending on outcomes, posing a risk to financial forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF235.357 for Flughafen Zürich based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF270.0, and the most bearish reporting a price target of just CHF200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF1.5 billion, earnings will come to CHF348.1 million, and it would be trading on a PE ratio of 24.1x, assuming you use a discount rate of 5.9%.

- Given the current share price of CHF247.2, the analyst price target of CHF235.36 is 5.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.