Key Takeaways

- Digital transformation, AI-driven efficiencies, and ambitious M&A moves are enabling Siegfried to rapidly close margin gaps and scale global market share.

- Expansion into gene therapies and ESG leadership position Siegfried for outsized growth in high-demand pharma segments and premium contract wins.

- Heavy reliance on a few large customers and exposure to downward pricing pressures threaten Siegfried's long-term margins, revenue stability, and competitive positioning.

Catalysts

About Siegfried Holding- Engages in contract development and manufacturing of active pharmaceutical ingredient (API) and finished dosage forms worldwide.

- While analyst consensus broadly sees Siegfried's EVOLVE+ strategy and operational excellence as drivers for incremental growth, this view underestimates how the company's ongoing digitalization, network-wide rollout of AI-driven process optimization, and proven ability to compress production cycles will catalyze significant multi-year margin expansion-positioning Siegfried to close the EBITDA margin gap with best-in-class global CDMOs well ahead of expectations, providing a step-change in net margin and core EBITDA.

- Although analyst consensus acknowledges the Grafton acquisition as an incremental contributor, it materially understates the transformative impact of Siegfried's aggressive, M&A-fueled US and global footprint expansion at a time when valuations in the sector have reset; this dynamic gives Siegfried a unique window to turbocharge global market share and rapidly compound revenue in the world's fastest-growing pharma outsourcing markets.

- Siegfried's strategic move into high-growth segments such as gene therapy and viral vectors, combined with robust early-phase partnerships and its DINAMIQS subsidiary, positions the company to capture outsized market share as personalized medicines surge and cell and gene therapies transition to commercialization, driving substantial long-term recurring revenue and creating a structural advantage in pipeline diversity.

- The rapid aging of populations in the US, Europe, and Asia, together with the accelerated pace of drug innovation by small and midsize biotech firms, ensures a multi-year increase in complex pharmaceutical demand that only sophisticated CDMOs with validated track records, broad technology offerings, and geographic breadth can serve at scale-fueling Siegfried's volume growth, pricing power, and revenue visibility far beyond what is currently priced into the stock.

- Siegfried's substantial investments and leadership in ESG-including a 50% carbon emissions reduction and broad management diversity-strongly position the company to benefit as major pharma customers increasingly make ESG performance a core vendor selection criterion, enabling Siegfried to win premium contracts, achieve higher average project values, and further expand net margins as ESG-driven procurement becomes standard across the life sciences industry.

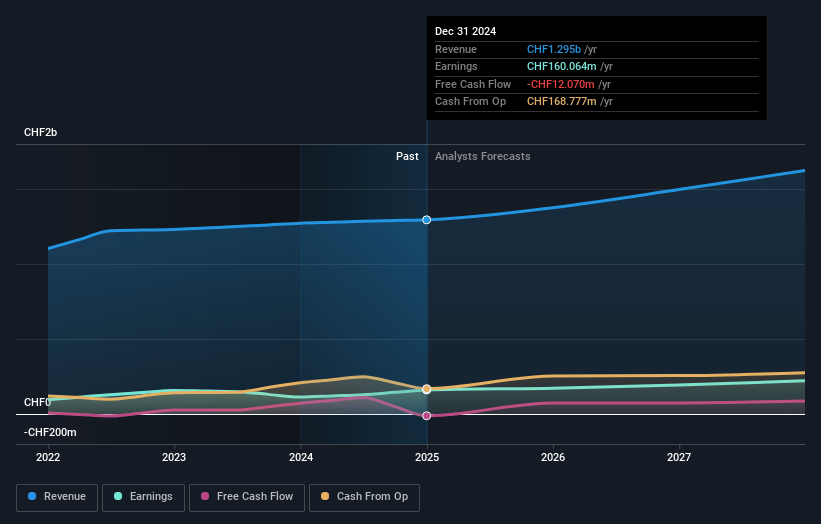

Siegfried Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Siegfried Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Siegfried Holding's revenue will grow by 10.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.4% today to 14.3% in 3 years time.

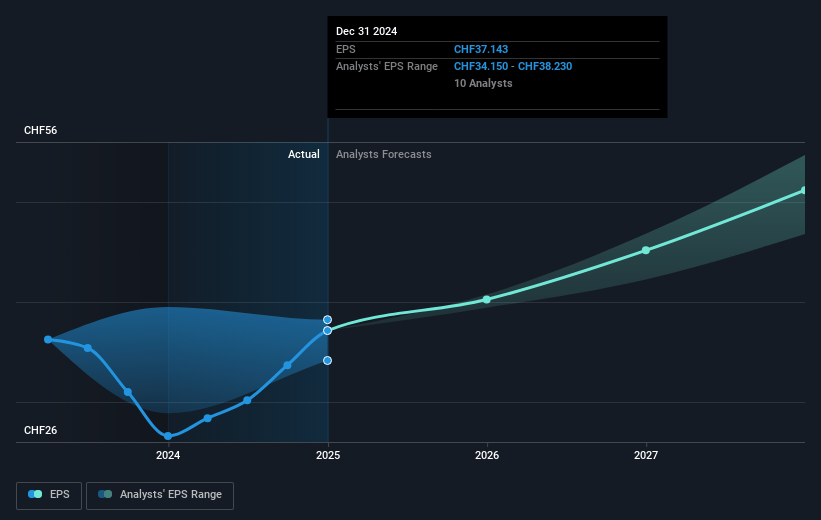

- The bullish analysts expect earnings to reach CHF 247.1 million (and earnings per share of CHF 5.53) by about July 2028, up from CHF 160.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.2x on those 2028 earnings, up from 24.8x today. This future PE is lower than the current PE for the GB Life Sciences industry at 32.2x.

- Analysts expect the number of shares outstanding to grow by 2.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.56%, as per the Simply Wall St company report.

Siegfried Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global trend toward increased economic protectionism and evolving trade barriers could make it more difficult and expensive for Siegfried to access international markets and supply chains, which may compress long-term margins and threaten sustained revenue growth.

- Persistent demographic shifts and aging populations, while boosting overall drug demand, are increasingly counterbalanced by cost-containment policies and worldwide downward pressure on drug prices, potentially capping topline growth opportunities for Siegfried and reducing their pricing power over time.

- Siegfried's high customer concentration-such as Novartis comprising between 10 percent and 20 percent of revenues and the next largest customer at 9 percent-leaves the company exposed to renegotiation, volume loss, or strategic changes at a few large pharma partners, which could lead to abrupt declines in revenue and earnings.

- The company's significant involvement in generic API manufacturing heightens its exposure to margin erosion due to accelerating global price competition, regulatory scrutiny, and the migration of production to lower-cost markets, threatening Siegfried's long-term net margins and return on capital.

- Intensifying competition in the CDMO sector-including expansion by Asian players and industry consolidation-may diminish Siegfried's pricing power and erode market share, resulting in sustained pressure on operating margins and slower revenue growth in the years ahead.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Siegfried Holding is CHF141.89, which represents two standard deviations above the consensus price target of CHF112.42. This valuation is based on what can be assumed as the expectations of Siegfried Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF142.0, and the most bearish reporting a price target of just CHF94.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF1.7 billion, earnings will come to CHF247.1 million, and it would be trading on a PE ratio of 30.2x, assuming you use a discount rate of 4.6%.

- Given the current share price of CHF90.8, the bullish analyst price target of CHF141.89 is 36.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.