1. Catalysts

- Evenamide (Schizophrenia Add-On Therapy): The key growth catalyst for Newron is Evenamide, a novel glutamate-modulating drug in Phase III development for treatment-resistant schizophrenia (TRS). This compound could become the first-ever add-on therapy for patients with TRS, addressing a large unmet need. The TRS population is significant (roughly 20–30% of all schizophrenia patients), so a successful Evenamide launch could meaningfully boost Newron’s sales. Notably, regulators have approved Newron’s pivotal Phase III program (ENIGMA-TRS) with two large trials underway, reflecting confidence in Evenamide’s Phase II results. If Evenamide achieves positive Phase III outcomes by ~2026 and secures approval by ~2027–28, it could open a new revenue stream on a scale far beyond Newron’s historical revenues.

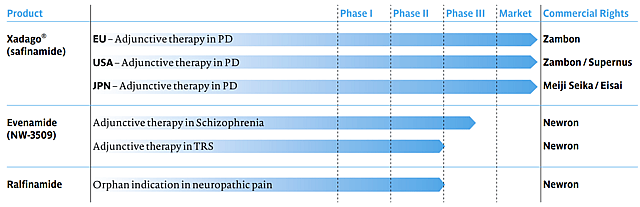

- Safinamide (Xadago for Parkinson’s Disease): Newron’s existing product, Safinamide (brand Xadago), is an approved add-on therapy for Parkinson’s disease that provides a base of royalty revenue. However, while Xadago contributes steady sales, its impact is limited by a mature, competitive market. The Parkinson’s add-on segment already has generic MAO-B inhibitors (e.g. rasagiline/Azilect) – Azilect peaked at $519 million in 2014 but plunged below $50 million after generics arrived – indicating headwinds for premium pricing. Xadago competes in this generic-heavy environment, so its growth is relatively modest. New catalysts here could include expansion to new markets (it launched in the US in 2017 and Japan in 2019) or new indications (a trial for levodopa-induced dyskinesia was contemplated), but these are incremental. In summary, Safinamide provides a stable revenue floor but is not expected to drive explosive growth given the industry backdrop.

- Industry Tailwinds: Newron is benefitting from a broader revival of interest in neuropsychiatric drugs. After decades of little innovation in schizophrenia therapy, major players are investing heavily – for example, Bristol Myers Squibb acquired Karuna Therapeutics for ~$14 billion and in late 2024 KarXT (Cobenfy) became the first new class of schizophrenia drug approved in ~35 years. This renewed big-pharma focus on CNS disorders suggests a supportive environment for promising entrants like Evenamide. The high unmet need in TRS and positive early data have already enabled Newron to strike regional licensing deals (e.g. for Asia), which drove a surge in 2024 revenue from €9 million to €51 million. Further partnerships (for the US/EU market) or milestone payments are potential near-term catalysts. Overall, the market tailwinds – strong demand for novel schizophrenia treatments and interest from larger pharma – position Newron to significantly scale its sales if its pipeline delivers.

2. Assumptions

- 5-Year Revenue Outlook: In a base-case scenario (5 years from now, ~2030), we project Newron’s revenue to expand dramatically compared to today. This assumes Evenamide is approved and launched by 2028, becoming a commercial product for several years by 2030. Given the sizable TRS patient pool (out of ~3.8 million schizophrenia cases in major markets), even a moderate penetration at premium pricing could yield hundreds of millions of euros in annual sales. For context, Newron’s 2024 revenue was €51.4 million – largely from one-time license fees – so a successful Evenamide launch could multiply that figure many times over. In addition, Safinamide’s royalties (currently on the order of single-digit millions) may continue, though likely flat or declining as patents expire in the late 2020s. Analysts are already forecasting robust top-line growth (on the order of ~35–40% annually) for Newron, reflecting expectations that Evenamide will drive revenues markedly higher by 2030. Under these assumptions, we anticipate Newron’s revenue in five years could reach the high tens or even low hundreds of millions (EUR), assuming successful product rollout and market uptake.

- 5-Year Earnings Outlook: Over the next five years, we expect Newron’s profitability to hinge on R&D investment versus product rollout. In the near term, earnings may remain volatile – Newron only just achieved its first-ever net profit in 2024 (€15.8 million) after years of losses, primarily due to one-off licensing revenue. As the company funds Phase III trials (through 2025–2026), it could return to net losses in those years absent new upfront payments, reflecting high R&D costs. However, by 2030 (assuming Evenamide’s approval and commercialization), Newron should transition to a sustainable profit model. We assume that with Evenamide on the market, R&D spending will moderate (post-approval) and high-margin product revenues will dominate. Net profit margins for a specialty biotech could plausibly reach ~20–30% once the business matures, given Evenamide would be a proprietary drug with limited direct competition initially. Thus, by 2030 Newron’s earnings could be on the order of tens of millions of euros in net income, a dramatic turnaround from its pre-2024 losses. In summary, we assume strong earnings growth in the latter part of the 5-year horizon, contingent on Evenamide’s success – a shift from negative earnings during the development phase to solid profitability by the time of commercialization.

3. Risks

- Clinical and Regulatory Uncertainty: The foremost risk is that Newron’s key catalyst, Evenamide, may not succeed in Phase III. CNS drug development is challenging – even with encouraging Phase II data, there is no guarantee the larger pivotal trials will meet efficacy endpoints or confirm long-term safety. Any unforeseen adverse effects or insufficient efficacy in the ongoing ENIGMA-TRS studies (which won’t read out initial results until late 2026) could derail approval. Regulatory risk is also present: authorities like the FDA will scrutinize Evenamide’s safety given it’s a novel mechanism (glutamate modulation) being added on top of antipsychotics. In the past, regulators have imposed clinical holds or requested additional studies for Evenamide (due to preclinical safety signals), reflecting a cautious stance. If trial outcomes disappoint or regulators raise concerns, Newron’s anticipated growth driver would evaporate, leaving the company with little to propel sales. In short, the stock’s bull case hinges on a successful approval process – a single-product dependency that heightens risk.

- Financial and Funding Risks: Newron is a small-cap biotech and remains financially fragile. The company had only ~€9.8 million in cash at 2024 year-end (before a new license payment in early 2025) and has ongoing cash burn from R&D. In fact, auditors raised a “going concern” warning in early 2024, expressing doubt about Newron’s ability to fund itself long-term. This highlights the risk that catalysts might not play out if Newron runs out of capital to complete its trials. The company will likely need additional funding or partnerships to bridge the gap until Evenamide’s potential approval – which could mean dilutive equity raises or debt. Failure to secure financing would jeopardize development timelines. Even if Evenamide succeeds clinically, launching a drug globally is expensive; without a larger partner, Newron might struggle to commercialize it alone. Thus, there is a material risk that financial constraints could impede Newron’s plans (for example, trial delays or inability to launch, if funds dry up).

- Competitive and Market Risks: Newron faces competition from both new and established therapies. In TRS (schizophrenia), the current standard treatment is clozapine, a generic antipsychotic reserved for refractory cases. Evenamide is meant to be added to patients’ existing regimens (including clozapine), but if it offers only incremental benefit, clinicians might remain reliant on clozapine or other combinations. Moreover, the landscape is evolving: a wave of new schizophrenia drugs is emerging, which could compete for the same patients. Notably, KarXT (Cobenfy by Karuna/BMS) just obtained approval in late 2024, introducing the first novel mechanism in decades. While KarXT targets broader schizophrenia (not specifically TRS), its success indicates that physician and payer attention will be divided among new options. Other pharmaceutical companies are also developing innovative treatments (e.g. muscarinic agonists, dopamine partial agonists, TAAR1 agonists); any breakthrough that addresses refractory patients could diminish Evenamide’s market potential. Additionally, large pharma competitors have vastly greater resources for marketing – if Newron partners with or is acquired by a big firm that would help, but if not, it may struggle to penetrate the market against incumbents. In Parkinson’s, competition is primarily generic, which, while limiting upside for Xadago, also means pricing pressure if Safinamide faces generic entrants later this decade. Overall, competition poses a risk that Newron’s future products won’t achieve the market share or pricing power assumed in our projections.

- Execution and Other Risks: There are operational risks such as potential delays in trial enrollment or data readouts (for instance, recruiting hundreds of TRS patients worldwide is complex). Any delay could push back approval and revenue timing. Regulatory changes or higher standards for neuro drugs could also change the expected outcomes – for example, if authorities require additional studies on long-term safety, that would increase costs and time. There is also a risk that Evenamide’s commercial uptake, even if approved, could be slower than expected if physicians are cautious to adopt an add-on therapy or if reimbursement is challenging (payers might demand clear cost-effectiveness, especially since many schizophrenia drugs are generic). Lastly, Newron’s strategy relies on partnerships (it has licensed Evenamide in some Asian markets already); if a global partner is not secured, the company’s small size could hinder its ability to capitalize on Evenamide fully. All these factors mean the outcomes above are not guaranteed – significant risks could prevent the catalysts from delivering the anticipated results.

4. Valuation

- 3-Year Outlook (2025–2028): In the next 3 years, Newron’s valuation will likely be driven by clinical milestones rather than fundamental earnings, as Evenamide will still be in trials. By 2028, the pivotal Phase III results for Evenamide should be known (expected by end of 2026 for interim 12-week endpoints). If results are positive, Newron’s business will transition from pure R&D into regulatory filing and pre-commercial mode. In this scenario, by 2028 Newron could be preparing for product launch (or negotiating a lucrative partnership/licensing deal for Evenamide in major markets). The market would likely price in future revenue at this point, potentially rerating the stock higher well ahead of actual sales. We might see Newron’s valuation start to reflect anticipated cash flows from Evenamide – for example, via higher price-to-sales multiples on forecasted sales. Conversely, if Phase III trials fail or show only marginal benefit, by 2028 Newron would have little to show for years of development, and its valuation could collapse (likely trading near cash value or reliant on the small Parkinson’s royalty stream). Thus, over the 3-year horizon, Newron is a binary outcome story: substantial upside if Evenamide proves out, but significant downside if not.

- 5-Year Outlook (2030): By 2030, Newron’s business model will be much clearer. In a successful case, Evenamide would be commercialized in the US and Europe (launch around 2028), and Newron could be generating substantial revenue and profit from this franchise. We estimate revenues in 2030 could reach a few hundred million euros (as discussed) with net profit margins in the 20%+ range. This would position Newron as a profitable mid-size specialty pharma company. At that stage, one can apply more traditional valuation metrics. If we assume, hypothetically, €300 million in revenue and a 25% net margin, that’s ~€75 million in net income. A valuation multiple of 15–20× earnings (typical for a growing pharma) would imply a market capitalization of €1.1–1.5 billion. For context, Newron’s current market cap is only ~CHF 160 million (around €150 m) at a share price of ~CHF7–8. This illustrates the magnitude of potential upside if all goes well. In fact, sell-side analysts’ 12-month price targets already average CHF 16.76 (with a high of CHF 26.25), implying that the stock could roughly double or triple from current levels as Evenamide progresses. These targets are risk-adjusted for trial outcomes; a full success would warrant even higher valuation. It’s worth noting that one independent analysis estimates Newron is trading at over an 80% discount to its intrinsic value – essentially reflecting that the market is heavily discounting the probability of success. By 2030, if success is achieved, we’d expect that discount to vanish as real earnings materialize, and Newron’s valuation to converge toward fair value based on its cash flows.

- Fair Value and Multiples: Considering the above, our fair value analysis leans on the successful-case outlook. Under a set of reasonable assumptions (Evenamide approval, a few hundred million in sales by early 2030s, healthy margins), Newron appears significantly undervalued at present. The market is giving a low probability of success – hence the stock’s deep discount to many models’ fair value. If we assign, say, a 50% probability of Evenamide success, one could argue the stock’s current price (~CHF7) still doesn’t fully reflect the risk-weighted NPV of future cash flows. With success, we’ve illustrated a path to a billion+ euro valuation; with failure, value might be <€50 m. Weighing those, a fair value today might be somewhere in between, depending on one’s confidence in the drug. Analysts’ current targets around CHF 16–17 likely factor in a moderate success probability, and they suggest substantial upside from today’s price. For long-term investors, the valuation multiple could evolve: near-term, the stock may trade at high multiples of current earnings (or sales) because earnings are low and future growth is the focus. If Evenamide is approved, the market might shift to valuing Newron on a price-to-sales basis initially (biotechs often trade at several times forward sales for a hot new drug). As profits come in by 2030, a P/E approach becomes more relevant. By 2035, if Newron is a mature company (or part of one), it might trade closer to the pharma industry P/E norm (perhaps 10–20×, depending on growth). In summary, Newron’s stock has a high-risk, high-reward profile: the fair value could be multiples of the current price in a success case, but the realization of that value hinges on clinical and commercial execution in the coming years. The prudent approach is to monitor the catalyst milestones (trial readouts, partnership news) closely, as these will be the inflection points that drive valuation toward our projected fair value range.

How well do narratives help inform your perspective?

Disclaimer

The user HedgeY holds no position in SWX:NWRN. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.