Last Update01 May 25Fair value Increased 0.081%

Key Takeaways

- Novartis' innovative drug launches and radioligand therapy pipeline position it for significant growth and revenue diversification.

- Strong market penetration and sales of drugs like Kisqali, coupled with U.S. investment, support long-term net margin and EPS growth.

- Tariff exposure, European pricing pressures, increased competition, and geopolitical factors could negatively impact Novartis’s revenue, margins, and profit growth.

Catalysts

About Novartis- Engages in the research, development, manufacture, distribution, marketing, and sale of pharmaceutical medicines in Switzerland and internationally.

- Novartis is poised to experience significant growth from its innovative drug approvals and upcoming launches, including Pluvicto, Vanrafia, and Fabhalta, which are anticipated to drive revenue growth.

- The company is achieving impressive sales and market penetration, notably with Kisqali's growth in both U.S. and international markets, suggesting potential for continued revenue growth and enhanced net margins.

- Kesimpta and Leqvio have demonstrated robust sales growth with opportunities to expand in both U.S. and ex-U.S. markets, potentially boosting net margins and earnings.

- The expanding radioligand therapy pipeline, including targets like FAP, HER2, and DLL3, positions Novartis for longer-term growth and diversification of revenue streams.

- Continued focus and investment in its U.S. manufacturing and R&D footprint, along with an ongoing share buyback program, underpin expectations for sustainable earnings per share growth.

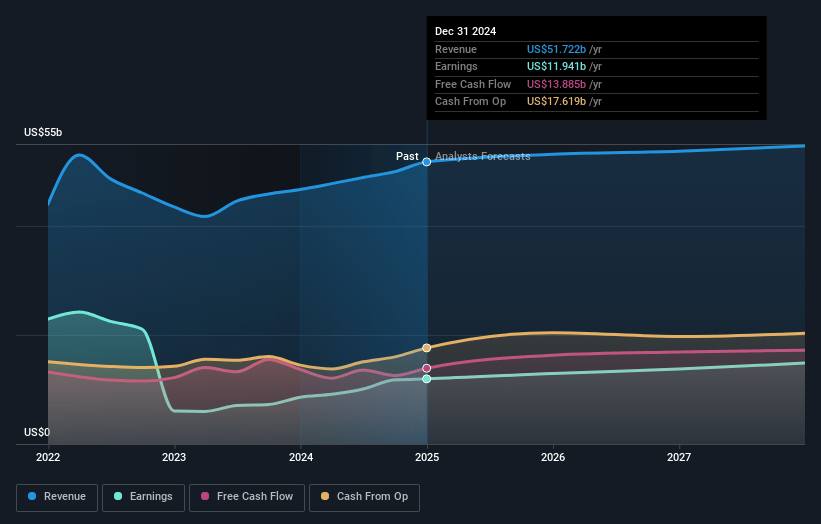

Novartis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Novartis's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.2% today to 27.5% in 3 years time.

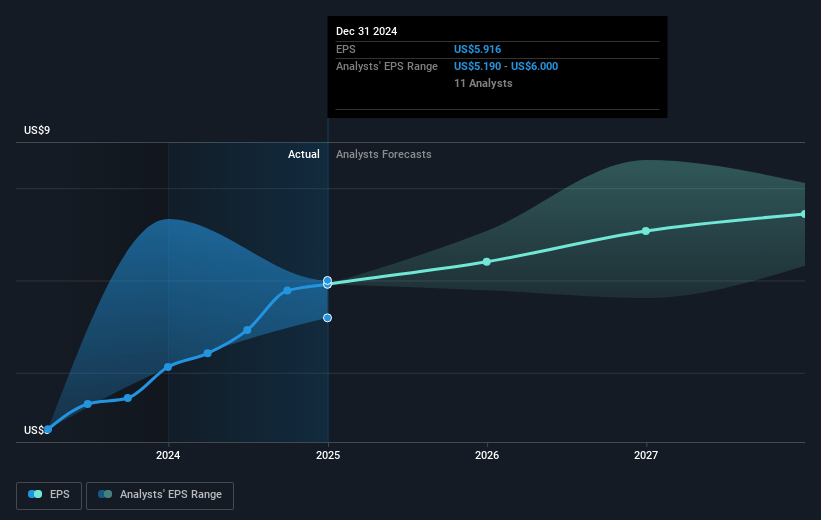

- Analysts expect earnings to reach $15.5 billion (and earnings per share of $8.04) by about May 2028, up from $12.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $12.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, down from 17.3x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 25.8x.

- Analysts expect the number of shares outstanding to decline by 3.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.82%, as per the Simply Wall St company report.

Novartis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariff exposure could impact Novartis's supply chain and profitability, as the company intends to produce all of its key U.S. products domestically, which may increase costs and impact net margins.

- European pricing pressures, including the declining prices that do not adequately reward innovation, could lead to reduced revenues and profit growth, especially if 30% of new medicines are either delayed or not launched in Europe.

- Increasing competition and potential generic entries for key products like Entresto and Tasigna in the U.S. could significantly impact revenue growth and margins in the coming years.

- Pipeline and R&D investments carry inherent risks, such as clinical trial failures or delays, which could impact projected revenue growth and require more investment, affecting overall earnings and cash flow.

- Uncertain geopolitical factors, including potential changes in U.S. healthcare pricing control policies, such as most favored nation legislation, could negatively impact revenue and profit margins if prices are driven down significantly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF98.363 for Novartis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF115.24, and the most bearish reporting a price target of just CHF77.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $56.4 billion, earnings will come to $15.5 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 3.8%.

- Given the current share price of CHF93.79, the analyst price target of CHF98.36 is 4.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.