Catalysts

About Idorsia

Idorsia is a science driven biopharmaceutical company developing and commercializing innovative therapies targeting major unmet medical needs in cardiovascular disease, insomnia, rare disorders, and infectious disease.

What are the underlying business or industry changes driving this perspective?

- Rapid commercial acceleration of QUVIVIQ, driven by more than doubling net sales year on year and expanding public reimbursement across major European markets, positions Idorsia to scale a global insomnia franchise and materially increase revenue while leveraging a largely fixed commercial cost base to enhance operating margins.

- Global expansion of QUVIVIQ into large underpenetrated insomnia markets such as China, Latin America, and the Middle East, combined with potential class descheduling in the U.S., is expected to support higher volume and a better payer mix, which in turn may support sustained top line growth and structurally improved net margins.

- TRYVIO, as the first new drug class for uncontrolled and resistant hypertension in over three decades with reported differentiation in patients with chronic kidney disease, may benefit from guideline updates and growing clinical awareness, providing a second commercial pillar with potential pricing power and earnings contribution.

- A capital light, partnership centric model that out licenses late stage assets such as selatogrel, cenerimod, lucerastat, and the C. diff vaccine to global players enables Idorsia to participate in large markets through milestones and royalties, which can expand earnings potential without proportionate R&D or SG&A increases.

- Focused investment in a pipeline described as de risked and high value, including pediatric daridorexant, Fabry disease with lucerastat, and multiple first in class chemokine receptor antagonists, provides multiple potential opportunities for future launches that can diversify revenue and support operating leverage as shared platforms and infrastructure scale.

Assumptions

This narrative explores a more optimistic perspective on Idorsia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

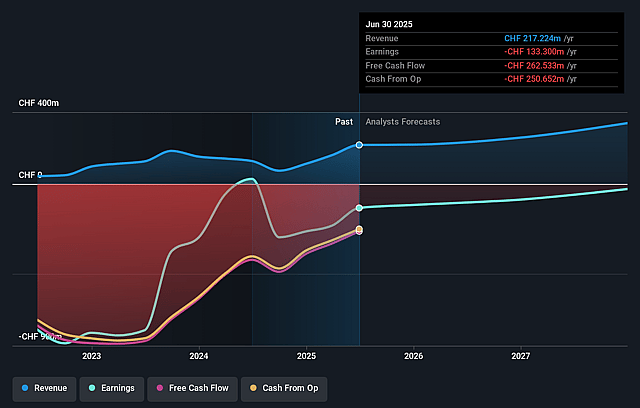

- The bullish analysts are assuming Idorsia's revenue will grow by 19.9% annually over the next 3 years.

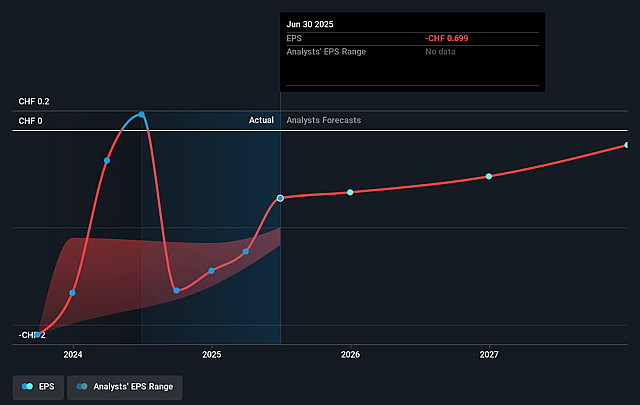

- The bullish analysts are not forecasting that Idorsia will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Idorsia's profit margin will increase from -50.7% to the average GB Biotechs industry of 20.0% in 3 years.

- If Idorsia's profit margin were to converge on the industry average, you could expect earnings to reach CHF 80.1 million (and earnings per share of CHF 0.28) by about December 2028, up from CHF -117.9 million today.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.5x on those 2028 earnings, up from -8.7x today. This future PE is greater than the current PE for the GB Biotechs industry at 8.8x.

- The bullish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.08%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- QUVIVIQ remains the primary growth driver and its current momentum is heavily concentrated in EUCAN while U.S. prescriptions are flat with a downsized field force. Any slower than expected uptake in new geographies or failure to secure broader reimbursement and primary care adoption could cap top line expansion and delay the shift from commercial profitability in 2026 to overall profitability in 2027, pressuring revenue and earnings growth.

- The strategy and medium term guidance rely on the eventual descheduling of the DORA class in the U.S., yet the FDA and DEA process has uncertain time lines and may take longer than the 6 to 9 month analogs or result in only partial relief. This would limit pricing flexibility, volume growth and promotional intensity in the world’s largest insomnia market and therefore constrain revenue and net margin improvement.

- Idorsia’s financial position remains fragile, with liquidity of CHF 72 million at mid 2025, dependence on undrawn facilities and milestone receipts, and continued non GAAP operating losses. Any delay, reduction or failure in future milestone payments, partnerships or product launches could force further dilution or cost cutting that slows R&D, harms the pipeline and weighs on long term earnings power.

- The investment case assumes successful partnering and commercialization of TRYVIO in resistant and uncontrolled hypertension and broader pipeline assets such as lucerastat, chemokine receptor antagonists and the C. diff vaccine. If guideline updates, payer support, partner negotiations or regulatory paths fall short of expectations, these assets could contribute far less than anticipated, limiting diversification of revenue and keeping operating margins structurally weak.

- Long development cycles and scientific risk across multiple early and mid stage programs, including pediatric daridorexant, lucerastat’s ongoing regulatory discussions and first in class chemokine receptor antagonists, mean clinical setbacks, safety signals or suboptimal proof of concept data could erode the future launch portfolio. This could leave the company over reliant on a single product and increase the likelihood that revenue growth and earnings fail to reach the levels implied by a bullish valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Idorsia is CHF6.0, which represents up to two standard deviations above the consensus price target of CHF5.0. This valuation is based on what can be assumed as the expectations of Idorsia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF6.0, and the most bearish reporting a price target of just CHF4.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be CHF400.5 million, earnings will come to CHF80.1 million, and it would be trading on a PE ratio of 25.5x, assuming you use a discount rate of 6.1%.

- Given the current share price of CHF4.11, the analyst price target of CHF6.0 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Idorsia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.