Last Update 23 Sep 25

Fair value Increased 5.53%The consensus Analyst Price Target for Basilea Pharmaceutica has increased to CHF90.42, reflecting a higher future P/E multiple despite slightly lower forecast revenue growth.

What's in the News

- Basilea raised full-year 2025 revenue guidance to CHF 225 million (up 8%) but lowered expected operating result to CHF 50 million from CHF 62 million.

- Initiated FORWARD-IM, a phase 3 registrational study for broad-spectrum antifungal fosmanogepix, targeting invasive mold infections in adults; study managed by PSI CRO AG, partially funded by BARDA, and with Pfizer retaining first negotiation rights.

- BARDA committed an additional USD 39 million (total USD 68 million to date) toward development of fosmanogepix and BAL2062, under an OTA potentially providing up to USD 268 million in non-dilutive funding over 12 years, covering roughly 60% of project costs.

Valuation Changes

Summary of Valuation Changes for Basilea Pharmaceutica

- The Consensus Analyst Price Target has risen from CHF85.68 to CHF90.42.

- The Future P/E for Basilea Pharmaceutica has significantly risen from 14.82x to 16.39x.

- The Consensus Revenue Growth forecasts for Basilea Pharmaceutica has fallen slightly from 10.1% per annum to 9.7% per annum.

Key Takeaways

- Expanding global sales of key anti-infective drugs and successful commercialization partnerships are driving top-line growth and increased royalty income.

- Strategic pipeline development, acquisitions, and a partnership-driven model support profit growth, regulatory momentum, and future market expansion.

- Loss of key product exclusivity, reliance on few pipeline assets, funding uncertainty, and growing competition all threaten revenue growth, margins, and long-term stability.

Catalysts

About Basilea Pharmaceutica- A Swiss commercial-stage biotech company focused on developing and commercializing treatments for severe bacterial and fungal infections.

- The strong, sustained double-digit sales growth of Cresemba, especially fueled by surging demand in emerging markets like China and Japan, points to broadening global healthcare access and increasing prevalence of hospital-acquired and drug-resistant fungal infections-secular forces likely to drive ongoing top-line growth and expand international revenue streams.

- The successful U.S. launch of Zevtera, supported by a top-tier commercial partner with a robust national hospital sales infrastructure and exclusivity into 2034, capitalizes on increasing antibiotic resistance and rising demand for innovative hospital anti-infectives-positioning Basilea to significantly scale royalty income and market share in the largest global branded antibiotic market.

- Advancing late-stage, broad-spectrum antifungal and antibiotic pipeline assets (e.g., fosmanogepix, ceftibuten-ledaborbactam)-each targeting severe, multidrug-resistant infections-aligns with mounting global investment and regulatory support for new anti-infectives, indicating potentially accelerated approvals, expanded addressable patient populations, and future multi-year revenue expansion.

- Acquisition and in-licensing activity (e.g., ceftibuten-ledaborbactam) that deepens the anti-infective portfolio and leverages government non-dilutive funding (e.g., BARDA awards) both reduces R&D burden and minimizes dilution risk, while also increasing the probability of new product launches, thus supporting growth in both operating and net profits.

- The flexible, partnership-based commercialization model enables Basilea to rapidly scale new assets, capture global stewardship initiatives targeting drug-resistant "superbug" threats, and maintain disciplined cost structure-supporting margin expansion and stronger long-term free cash flow and earnings.

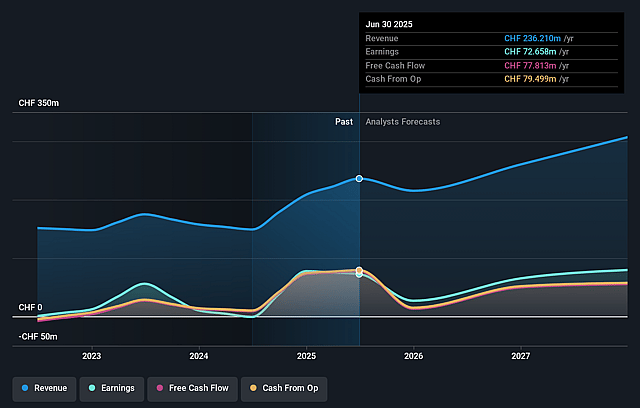

Basilea Pharmaceutica Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Basilea Pharmaceutica's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.8% today to 24.7% in 3 years time.

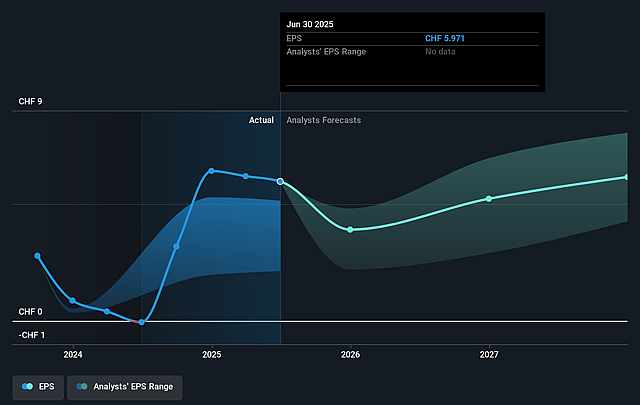

- Analysts expect earnings to reach CHF 78.0 million (and earnings per share of CHF 6.16) by about September 2028, up from CHF 72.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CHF105.5 million in earnings, and the most bearish expecting CHF53.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from 7.8x today. This future PE is greater than the current PE for the GB Biotechs industry at 7.8x.

- Analysts expect the number of shares outstanding to grow by 1.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.95%, as per the Simply Wall St company report.

Basilea Pharmaceutica Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming loss of Cresemba's market exclusivity in the US and Europe at the end of 2027 raises the risk of a rapid decline in revenues from its leading product, potentially impacting both near-term and medium-term revenue and net margins.

- Heavy reliance on a limited number of late-stage assets (notably Cresemba, Zevtera, and future prospects like fosmanogepix and ceftibuten-ledaborbactam) increases earnings volatility; regulatory setbacks, competition, or slower-than-expected commercialization could disrupt projected growth and pressure future earnings.

- Persistent uncertainty about securing additional non-dilutive funding for pipeline development (e.g., for ceftibuten-ledaborbactam) could drive increased R&D expenses or require additional debt/equity funding, potentially compressing net margins and shareholder returns.

- Intensifying competition in the anti-infectives and antibiotics space from generics, biosimilars, and new branded products-including market entrants with broader spectrum or earlier launches-may pressure Basilea's pricing power and erode long-term topline potential.

- Rising global cost-containment measures, aggressive pricing negotiations, and reimbursement hurdles across major markets-combined with currency fluctuations-may limit Basilea's ability to maintain margins and sustain revenue growth, especially as new products enter more price-sensitive geographies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF85.683 for Basilea Pharmaceutica based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF120.0, and the most bearish reporting a price target of just CHF55.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF315.5 million, earnings will come to CHF78.0 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 4.0%.

- Given the current share price of CHF46.35, the analyst price target of CHF85.68 is 45.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.