Key Takeaways

- The easing of U.S. operational constraints and India's plant expansion may boost efficiency and drive future revenue growth.

- Enhanced brand value through sustainability initiatives strengthens SIG's market competitiveness and could support revenue and margin growth.

- Unresolved operational challenges and slow demand recovery, combined with economic and currency issues, could strain growth and investor confidence in SIG Group.

Catalysts

About SIG Group- Provides aseptic carton packaging systems and solutions for beverage and liquid food products.

- SIG Group's bag-in-box and spouted pouch operations are anticipated to return to growth in the second half of the year, which should positively impact revenue and contribute to future earnings growth.

- The easing of capacity constraints and production bottlenecks in SIG's U.S. facilities is expected to improve operating efficiencies, potentially increasing net margins and earnings.

- The completion of the aseptic sleeves plant in India, along with the approval of an extrusion line, supports SIG's strategy for local expansion and is expected to drive future revenue growth.

- The Forest+ initiative and sustainable forestry management projects could enhance SIG's brand value and competitiveness in the market, potentially supporting revenue and margin growth due to increased customer preference for sustainable packaging solutions.

- Improvements in free cash flow and a reduction in net leverage indicate strengthened financial health, which could lead to better earnings and potentially support stock dividends or buybacks, contributing to a higher EPS in the future.

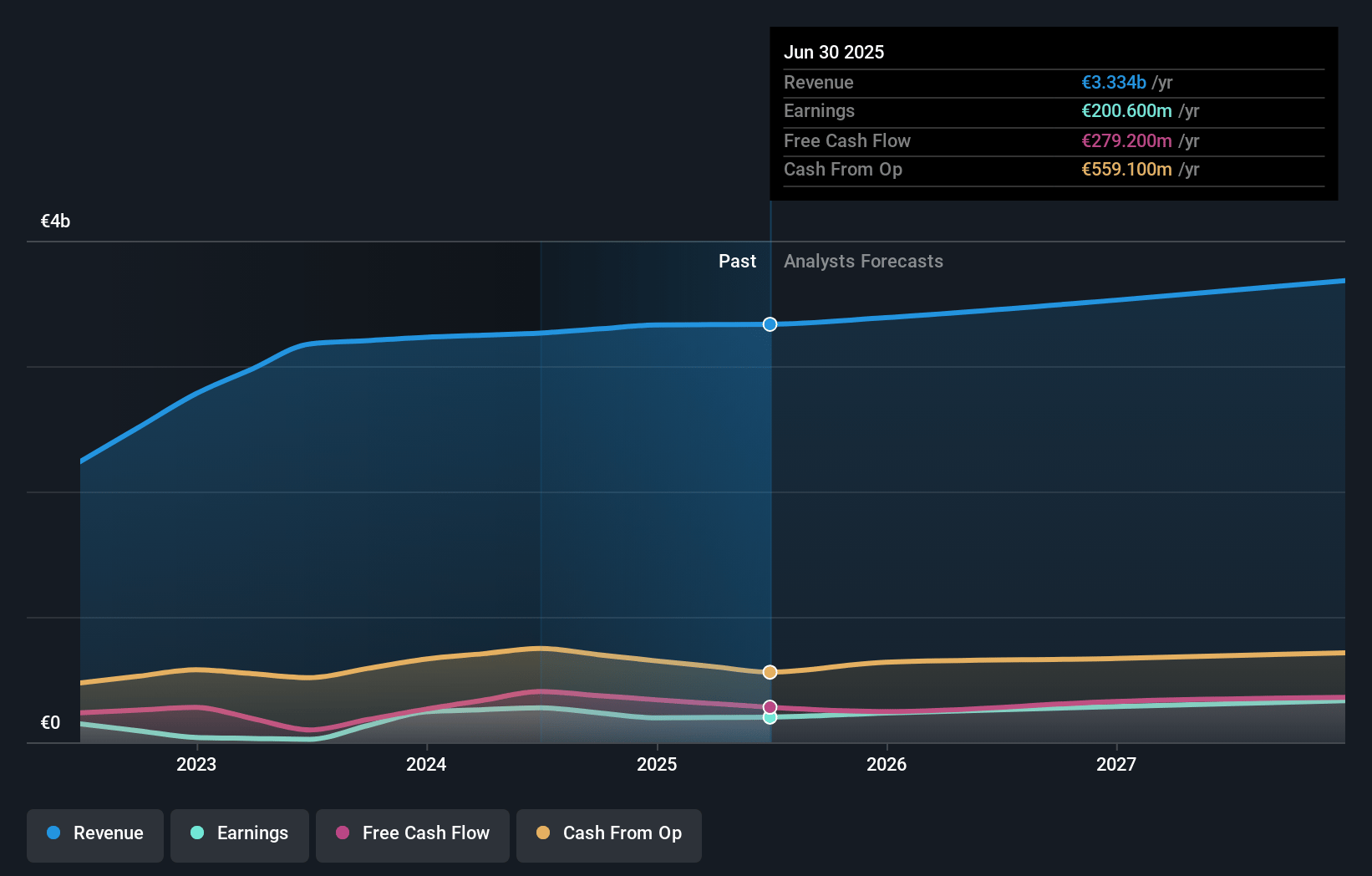

SIG Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SIG Group's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 9.4% in 3 years time.

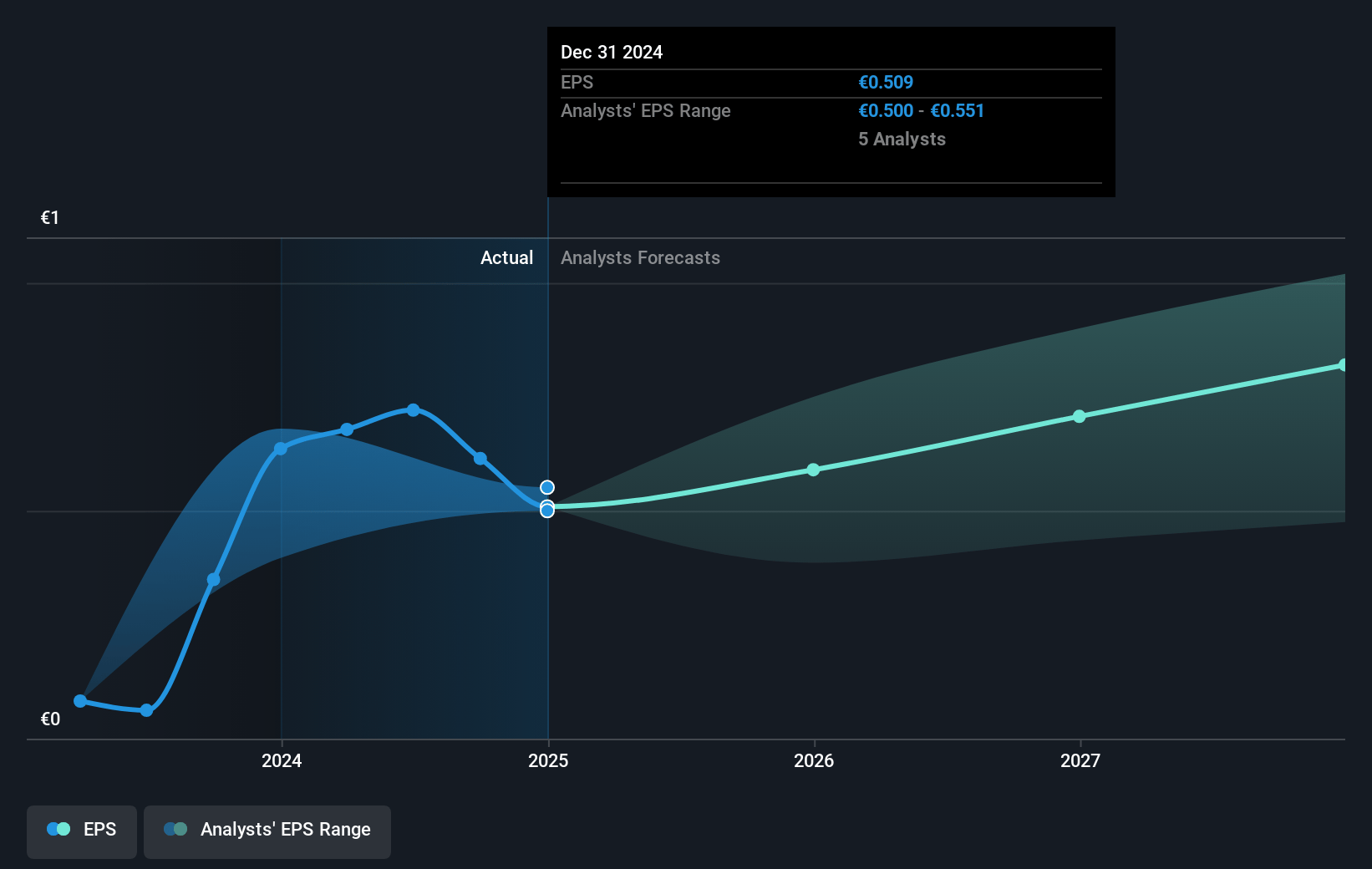

- Analysts expect earnings to reach €349.1 million (and earnings per share of €0.89) by about January 2028, up from €275.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €291 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, up from 29.3x today. This future PE is greater than the current PE for the CH Packaging industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.99%, as per the Simply Wall St company report.

SIG Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The demand recovery in the foodservice sector is not yet back to pre-pandemic levels, which could impact revenue growth from these operations if the recovery remains slow.

- Operational challenges in North American bag-in-box facilities are not fully resolved until the end of the year, potentially continuing to strain operating efficiencies and net margins until fully addressed.

- The growth in sales for the Asia Pacific region, particularly China, has been impacted by a subdued economic environment, which may constrain revenue growth in these markets if the economic slowdown persists.

- Currency fluctuations have negatively impacted margins, reducing the adjusted EBITDA margin by 50 basis points for the first nine months, indicating potential risks to net income if such currency volatility continues.

- The exiting Chairman of the Board could suggest uncertainties in strategic continuity or investor confidence, possibly affecting investor sentiment and share price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF22.79 for SIG Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF27.32, and the most bearish reporting a price target of just CHF17.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €3.7 billion, earnings will come to €349.1 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 4.0%.

- Given the current share price of CHF19.92, the analyst's price target of CHF22.79 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives