Key Takeaways

- New advanced and sustainable product launches, along with proprietary platforms, are driving higher-margin growth and diversification across expanding healthcare markets.

- Strengthened manufacturing and efficiency programs increase margin resilience, operational leverage, and position medmix to capture demand in developed and emerging regions.

- Declining revenues, execution risks, geopolitical pressures, and rising competition threaten medmix's margins, growth prospects, and ability to sustain profit improvements.

Catalysts

About medmix- Designs, produces, and sells high-precision devices and services in Switzerland and internationally.

- Recent and forthcoming launches of advanced products in the Dental and Surgery units (e.g., CliX applicator ecosystem and vented syringe system), tailored to meet rising global demand for minimally invasive, precise, and infection-preventing delivery systems, are set to drive higher-margin revenue growth as the healthcare sector expands with the aging population and shifting medical technology needs.

- Ongoing innovation in eco-friendly and recyclable delivery systems (greenLine, ecopaCC), recognized by major global customers and supported by third-party sustainability rankings, positions medmix to benefit from accelerating regulatory and customer push for sustainable solutions-laying a foundation for both volume growth and enhanced pricing power.

- Geographic expansion in key growth markets, particularly through increased U.S.-based manufacturing and insourcing (Atlanta, Elgin), is strengthening local supply chains and customer relationships and enables medmix to offset tariff exposure and capitalize on increased healthcare spending in emerging markets, supporting both top-line growth and margin resilience.

- Execution of a CHF 30 million efficiency and cost-out program, with savings beginning to flow through to earnings, is driving improved operational leverage and expanded EBITDA margins, providing resilience during periods of flat or declining revenues and setting the stage for stronger net earnings as end markets recover.

- Expansion of proprietary device platforms (e.g., PiccoJect and D-Flex in drug delivery) and strategic partnerships with OEMs is increasing medmix's exposure to high-growth medical segments and diversifying revenue streams, supporting sustained revenue and net margin expansion as the healthcare industry adopts more automated, precise, and single-use solutions.

medmix Future Earnings and Revenue Growth

Assumptions

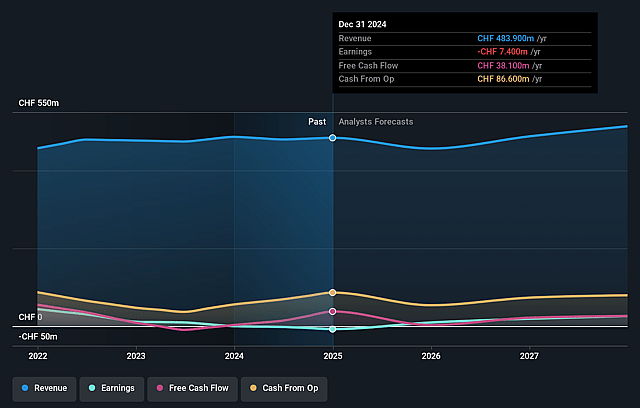

How have these above catalysts been quantified?- Analysts are assuming medmix's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.5% today to 5.1% in 3 years time.

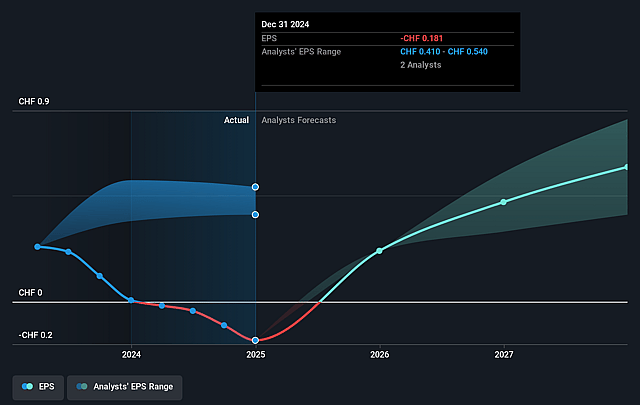

- Analysts expect earnings to reach CHF 26.2 million (and earnings per share of CHF 0.63) by about September 2028, up from CHF -7.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CHF35.5 million in earnings, and the most bearish expecting CHF16.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.7x on those 2028 earnings, up from -57.8x today. This future PE is greater than the current PE for the CH Medical Equipment industry at 34.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

medmix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing revenue declines and negative organic volume growth-particularly in key segments like Beauty and Drug Delivery and despite operational cost savings-signal potential stagnation or saturation in certain end-markets, risking slower future top-line growth and pressuring net earnings.

- Heavy reliance on achieving planned cost-out programs and efficiency gains to protect margins; if these operational initiatives do not fully compensate for ongoing revenue shortfalls, there is risk to sustaining net margin improvement and mid-term profit guidance.

- Increased exposure to geopolitical risk through U.S. tariffs and FX fluctuations; although mitigation actions and price increases are planned, delays, incomplete pass-through of costs, or worsening trade scenarios could erode both revenue and gross margins.

- Persistent challenges in ramping new product launches (notably in Drug Delivery and Beauty) and delays in securing large-scale projects highlight execution risk; failure to successfully commercialize innovation or recover segment growth could negatively impact future revenue and earnings growth trajectories.

- Heightened competition, particularly from lower-cost players in emerging markets or from shifts toward alternative/reusable delivery solutions, may undermine medmix's pricing power and market share over time, compressing gross margins and threatening longer-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF19.0 for medmix based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF513.8 million, earnings will come to CHF26.2 million, and it would be trading on a PE ratio of 34.7x, assuming you use a discount rate of 6.1%.

- Given the current share price of CHF10.48, the analyst price target of CHF19.0 is 44.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on medmix?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.