Last Update 09 Dec 25

Fair value Increased 0.89%BAER: Execution And Margin Discipline Will Shape Moderately Positive Future Outlook

Analysts have trimmed their price target on Julius Bär Gruppe slightly to CHF 67.50 from CHF 69.00, reflecting modestly stronger revenue growth expectations, offset by a marginally lower profit margin outlook and a nearly unchanged valuation multiple.

Analyst Commentary

Recent revisions to price targets suggest that sentiment on Julius Bär Gruppe remains broadly constructive, but with a more measured outlook on execution risks and margin durability.

Bullish Takeaways

- Bullish analysts continue to see upside from current levels, as indicated by the maintained positive rating alongside only a modest trim to the price target.

- The cumulative move in target prices over recent months, from CHF 65 to CHF 67.50, still reflects improved confidence in the group’s medium term growth and earnings trajectory.

- Positive expectations center on the bank’s ability to convert stable client inflows and fee based income into sustainable revenue growth, supporting a premium relative valuation to peers.

- Execution on strategic initiatives, including cost discipline and operational efficiency, is viewed as a key lever that could unlock further upside to both margins and the target multiple.

Bearish Takeaways

- Bearish analysts highlight that the recent reduction in the price target signals less conviction around near term profit margin expansion, even as revenue expectations firm up.

- There is caution that higher operating costs and potential investment needs could cap earnings leverage, limiting the scope for further re rating of the shares.

- Some market participants see the valuation as closer to fair value after the prior series of upward revisions, leaving less room for error on execution and capital allocation.

- Uncertainties around the macro backdrop and client activity levels raise concerns that revenue growth could prove more cyclical than currently embedded in estimates.

What's in the News

- Received in principle approval from Abu Dhabi's FSRA to open Julius Baer (Abu Dhabi) Ltd. in ADGM by December 2025, targeting ultra high net worth clients and expanding its two decade presence in the UAE (company announcement).

- Issued earnings guidance indicating IFRS net profit for full year 2025 is expected to be below 2024, due to non recurring tax provision releases, the sale of Julius Baer Brazil, and net credit losses, while highlighting strong underlying profitability and capital generation (company guidance).

- Obtained regulatory approvals to open a new Julius Baer Europe branch in Lisbon in Q4 2025, with the local team relocating to the new Avenida da Liberdade office from January 2026 to enhance service for high and ultra high net worth clients in Portugal (company announcement).

Valuation Changes

- Fair Value has risen slightly to CHF 63.02 from CHF 62.47, indicating a modest uplift in intrinsic value estimates.

- Discount Rate is unchanged at 8.91 percent, implying a stable risk and return profile in the valuation model.

- Revenue Growth assumptions have increased slightly to 7.67 percent from 7.30 percent, reflecting a small improvement in top line expectations.

- Net Profit Margin has edged down marginally to 25.65 percent from 25.81 percent, pointing to a slightly more conservative profitability outlook.

- Future P/E has increased fractionally to 14.12x from 14.06x, suggesting a near unchanged but mildly higher valuation multiple applied to forward earnings.

Key Takeaways

- Rising global wealth and operational efficiency are driving sustained profit growth, supporting future revenue and fee-based income expansion.

- Strategic digital transformation and prudent risk management boost client retention, while resumed share buybacks may enhance shareholder value.

- Ongoing credit risks, weak capital flexibility, limited cost savings, and slow expansion make Julius Bär Gruppe vulnerable to stagnation amid rising competition and digital disruption.

Catalysts

About Julius Bär Gruppe- Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

- Strong growth in net new money and significant year-on-year increases in underlying net profit signal that Julius Bär is capturing rising global wealth and intergenerational transfers, which should directly support future revenue and fee-based income expansion.

- Progress in cost efficiency, as evidenced by the lower cost-income ratio and ahead-of-plan CHF 130 million cost savings target, suggests sustained improvement in operational margins and profitability going forward.

- The robust balance sheet and ongoing investment in risk management position the company to capitalize on increased demand for reputable and compliant private banks amid global regulatory scrutiny, aiding client retention and supporting net new money inflows.

- Strategic execution focused on delivering exceptional wealth management services and ongoing digital transformation is expected to enhance client experience, driving sustained advisory revenues and more stable earnings.

- Intentions to resume share buybacks in the future, once timing permits, indicate that capital returns to shareholders could further boost earnings per share over time.

Julius Bär Gruppe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Julius Bär Gruppe's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.2% today to 26.7% in 3 years time.

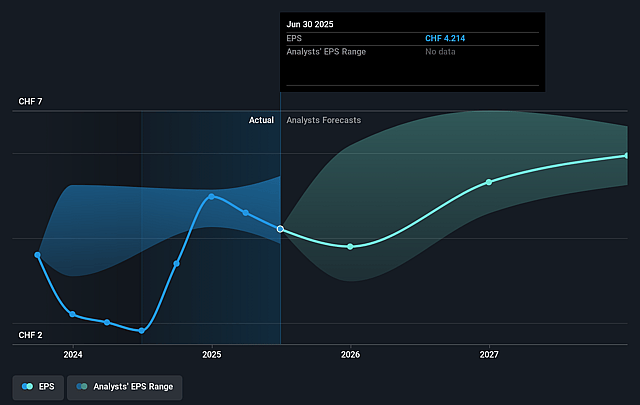

- Analysts expect earnings to reach CHF 1.2 billion (and earnings per share of CHF 6.35) by about September 2028, up from CHF 865.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, up from 13.4x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

Julius Bär Gruppe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant 35% year-on-year decrease in IFRS net profit, mainly related to loan loss allowances and the sale of the Brazilian onshore business, highlights ongoing credit quality and geographic concentration risks that may continue to negatively impact earnings if not addressed through sustained diversification and risk controls.

- The company's hesitation or inability to commit to a share buyback in the near term, even as investors expected it, may signal constrained capital flexibility or uncertainty about future cash flows, potentially reducing shareholder returns and dampening near

- to medium-term share price appreciation.

- The continuing credit review by the new Chief Risk Officer indicates unresolved risk exposures in the loan book, raising the prospect of further loan loss allowances or write-downs; this undermines confidence in asset quality and could significantly weigh on both net margins and future profitability.

- Achieving CHF 130 million in cost savings by the end of 2025 is essential to improving the cost-income ratio, but sustained cost pressures due to regulatory requirements, compliance, and potential operational inefficiencies may limit success on this front, restricting operating leverage and margin improvement.

- The one-off impact from exiting the Brazilian onshore market, along with a lack of mention of significant expansion into high-growth regions or digital innovation, exposes Julius Bär Gruppe to the risk of stagnation, as it may lag competitors in capturing emerging market growth and adapting to digital disruption-this could hinder long-term net new money inflows and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF60.813 for Julius Bär Gruppe based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF70.0, and the most bearish reporting a price target of just CHF52.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF4.5 billion, earnings will come to CHF1.2 billion, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of CHF56.78, the analyst price target of CHF60.81 is 6.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Julius Bär Gruppe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.