Key Takeaways

- Increased automation, AI adoption, and digital hiring platforms threaten Adecco's traditional staffing business, compressing margins and challenging its long-term competitiveness.

- Demographic shifts, regulatory changes, and lagging digital transformation further erode Adecco's addressable market, increase costs, and risk operational inefficiency.

- Investments in AI, digital solutions, and high-growth markets alongside flexible cost management and sector diversification are enhancing profitability and positioning Adecco for sustained growth.

Catalysts

About Adecco Group- Provides human resource services to businesses and organizations in Europe, North America, the Asia Pacific, South America, and North Africa.

- Rapid acceleration of automation and AI adoption threatens to structurally erode Adecco's core business in temporary and lower-skilled staffing, with clients increasingly substituting contingent labor with digital or automated solutions. This shift is likely to drive persistent declines in placement volumes, directly undercutting long-term revenue growth and risking ongoing market share loss.

- Demographic headwinds in Adecco's key markets-including aging populations and shrinking working-age cohorts-will intensively reduce the available candidate pool, impeding Adecco's ability to fulfill client demand. Over time, this constraint will limit the company's addressable market, resulting in weaker top-line revenue and pressuring future earnings capacity.

- The proliferation of direct digital hiring platforms and gig economy models is bypassing traditional staffing intermediaries at scale, causing a structural decline in service fees and accelerating the commoditization of Adecco's core offerings. This trend is set to further compress net margins and challenge the competitive sustainability of the traditional Adecco business model.

- Ongoing challenges in Adecco's efforts to digitally transform operations-especially when compared to more agile, tech-native competitors-risk leaving the company lagging in innovation and operational efficiency. Continued delays or setbacks in deploying effective tech-enabled solutions may drive operational inefficiencies, as well as increasing SG&A costs relative to peers, further depressing net margins and eroding long-term competitive advantage.

- Intensifying regulatory complexity and labor law reforms across Europe-including tighter restrictions on temporary contracts and rising compliance costs-are set to further inflate Adecco's operational cost base while dampening client demand for staffing solutions. This is likely to lead to continued gross margin pressure and high earnings volatility, particularly as the group remains heavily exposed to European market cycles.

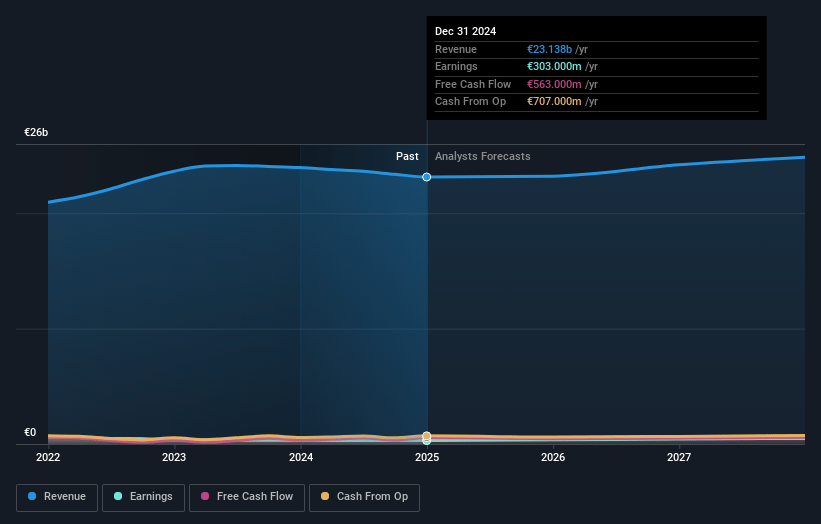

Adecco Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Adecco Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Adecco Group's revenue will grow by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.3% today to 1.9% in 3 years time.

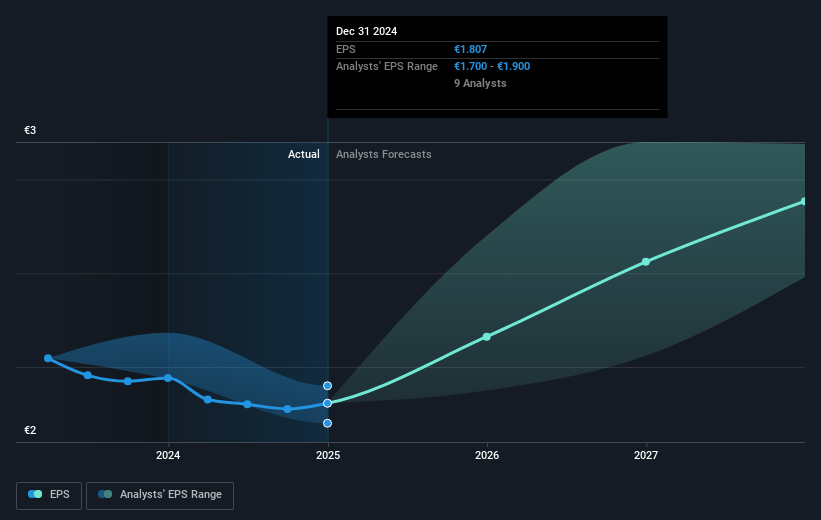

- The bearish analysts expect earnings to reach €444.9 million (and earnings per share of €2.69) by about July 2028, up from €290.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, down from 15.7x today. This future PE is lower than the current PE for the GB Professional Services industry at 21.7x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.46%, as per the Simply Wall St company report.

Adecco Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Adecco is actively investing in AI and digital solutions, such as prescreening agents and the Agentic AI deployment with Salesforce, which are expected to improve operational efficiency, reduce costs, and enhance customer experience, supporting higher earnings and profitability.

- The company continues to gain market share across most major territories, with broad-based improvements in flexible placement volumes and positive momentum seen in North America and emerging markets, positioning revenues for potential future growth as markets stabilize.

- Adecco's operations in APAC and Latin America are structurally growing, with double-digit revenue increases and improved margins, indicating that geographical and sector diversification could buffer against weaknesses in European markets and enhance group-level revenue and margins.

- The company maintains a robust and highly flexible cost structure, demonstrated by its ability to rapidly resize capacity and manage SG&A expenses tightly, which supports the commitment to maintain a 3% EBITA margin floor on an annual basis and sustains profitability even in difficult environments.

- Adecco's expansion in higher-margin segments like professional staffing, tech, and defense, along with pipeline wins in new sectors and the turnaround progress in challenging units like Akkodis Germany and Adecco U.S., positions the company for improved net margins and earnings in the medium and long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Adecco Group is CHF18.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Adecco Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF40.9, and the most bearish reporting a price target of just CHF18.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €23.8 billion, earnings will come to €444.9 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 5.5%.

- Given the current share price of CHF25.36, the bearish analyst price target of CHF18.5 is 37.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.