Last Update 11 Dec 25

Fair value Increased 0.14%SCHN: Asian Agreement And Margins Will Shape Balanced Medium Term Outlook

Analysts have nudged their blended price target for Schindler Holding slightly higher to about CHF 298.5 from roughly CHF 298.1. This reflects modestly lower assumed revenue growth, offset by a slightly stronger profit margin outlook and a marginally higher future valuation multiple.

Analyst Commentary

Recent research points to a finely balanced view on Schindler Holding, with incremental changes in price targets reflecting both confidence in the companys execution and lingering caution around its growth trajectory and valuation.

Bullish Takeaways

- Bullish analysts highlight the slight upward revisions in some price targets as evidence that earnings resilience and margin execution are tracking ahead of earlier expectations.

- The modest increase in valuation assumptions suggests confidence that Schindler can sustain a premium versus certain peers, supported by a stable service revenue base and disciplined capital allocation.

- Incremental target price rises are seen as a signal that medium term growth, particularly from modernization and service, can offset near term cyclical softness in new equipment orders.

- Some forecasts assume that stronger profitability, rather than aggressive top line expansion, will be the key driver of shareholder returns, which reduces execution risk relative to more growth dependent industrial names.

Bearish Takeaways

- Bearish analysts maintain cautious stances, with target cuts underscoring concerns that the current order environment and construction market headwinds could cap near term revenue growth.

- Hold and Neutral ratings indicate limited perceived upside from current levels, as the shares already discount a meaningful degree of margin improvement and operational efficiency.

- Some valuation frameworks assume slower growth in key end markets, raising the risk that even modest multiple expansion could prove difficult if macro conditions deteriorate.

- The balance of recent target changes suggests that while downside risk appears contained, the path to materially higher returns will likely require clearer evidence of sustained organic growth and margin outperformance.

What's in the News

- Schindler Holding AG plans an upcoming Analyst and Investor Day, which is expected to provide updated strategic priorities, financial targets, and guidance on margin improvement and capital allocation (Key Developments).

- Schindler signed a Master Services and Supplies Agreement with Accor to supply, modernize, and maintain elevators, escalators, and moving walkways across nine key Asian markets. This agreement strengthens its service and modernization pipeline (Key Developments).

- The long-term collaboration with Accor, focused on innovative technology and tailored services, is intended to enhance guest experience and streamline operations in one of Accor’s fastest growing regions. This supports Schindler’s recurring revenue base (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly to about CHF 298.5 from roughly CHF 298.1, reflecting a modest upward adjustment in the blended target.

- Discount Rate has edged down marginally to around 5.05 percent from about 5.05 percent previously, implying a slightly lower required return in the valuation model.

- Revenue Growth Assumptions have fallen meaningfully to roughly 3.3 percent from about 4.3 percent, signaling more conservative expectations for top line expansion.

- Net Profit Margin has increased slightly to just over 10.2 percent from about 10.0 percent, indicating a modestly more optimistic view on profitability.

- Future P/E Multiple has risen marginally to around 35.6x from about 35.3x, suggesting a slightly higher expected valuation for Schindler’s earnings.

Key Takeaways

- Strong growth in Modernization and Service, especially in China and Asia-Pacific, supports higher-margin, recurring revenues amid global sustainability and urbanization trends.

- Operational streamlining and digital innovation enhance profitability and position the company for stable earnings despite short-term installation market challenges.

- Exposure to low-growth, price-competitive regions and external cost pressures threaten sustainable margin improvement, limiting long-term revenue expansion and earnings quality.

Catalysts

About Schindler Holding- Engages in the production, installation, maintenance, and modernization of elevators, escalators, and moving walks worldwide.

- The rapid acceleration in Schindler's Modernization business-showing double-digit growth globally and particularly robust order momentum in China (supported by government programs to upgrade aging elevators)-positions the company to capitalize on global modernization and sustainability trends, driving recurring, higher-margin revenue growth.

- Expansion and strength in Service (mid-single-digit growth and portfolio expansion, especially in fast-growing regions like Asia-Pacific and China) supports revenue stability and margin improvement, leveraging rising demand for accessible mobility and ongoing urbanization.

- Operational efficiency initiatives, including significant structural streamlining (particularly in China), procurement savings, and SG&A reduction, are beginning to deliver visible improvements in operating margins, setting the stage for sustained net margin expansion even as topline growth moderates.

- Growing backlog, especially in Modernization and Service, combined with building order momentum outside of China, underpins future revenue increase and earnings visibility despite near-term new installation weakness in China.

- Strategic development of new product offerings (e.g., U.S. mid-rise elevators) and investment in digital services are expected to bolster differentiated revenue streams and enhance long-term profitability, supporting higher long-term returns as industry demand for smart, sustainable solutions rises.

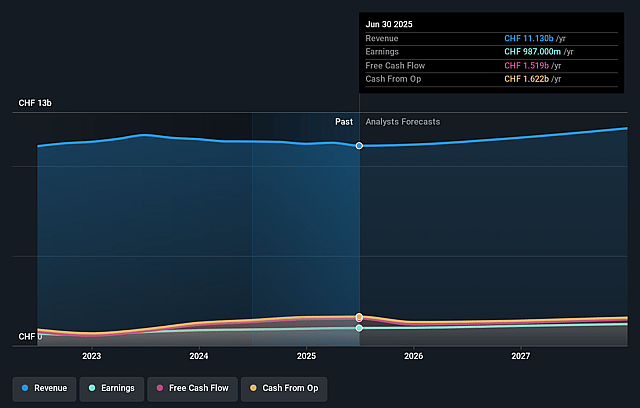

Schindler Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Schindler Holding's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 9.9% in 3 years time.

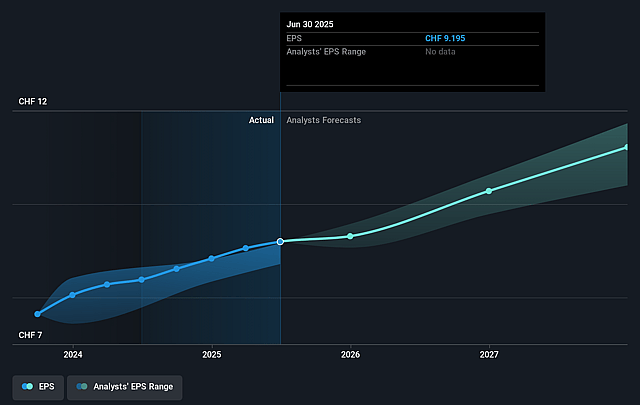

- Analysts expect earnings to reach CHF 1.2 billion (and earnings per share of CHF 11.58) by about September 2028, up from CHF 987.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, down from 31.0x today. This future PE is greater than the current PE for the GB Machinery industry at 21.8x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.89%, as per the Simply Wall St company report.

Schindler Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged contraction in China's New Installation (NI) market, with multi-year double-digit declines in residential floor space starts, is leading to a smaller installed base; this reduces future Service and Modernization growth potential, directly limiting long-term revenue expansion.

- Company restructuring and ongoing efficiency initiatives, especially in China, reflect the risk of sustained margin pressure from low-margin orders, negative scale effects, and challenging market dynamics, which could compress group net margins and EBIT growth in future years.

- Persistent Swiss franc strength is generating significant currency headwinds, consistently eroding order intake and revenue reported in Swiss francs, creating long-term pressure on top-line growth and earnings for the group.

- Heightened global tariffs, particularly those impacting input materials like copper and specific markets post-August, introduce structural cost risks and customer project viability challenges that may not be fully mitigated by pricing or supply chain adaptation, weighing on future group profitability.

- Modernization and New Installation segments in China currently deliver margins below group average, and sectoral overexposure to low-growth, price-competitive regions (e.g., Western Europe, China) could prolong a reliance on lower-profit business lines, impeding sustainable net margin improvement and potentially undermining long-term earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF294.0 for Schindler Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF333.0, and the most bearish reporting a price target of just CHF233.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF12.5 billion, earnings will come to CHF1.2 billion, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 4.9%.

- Given the current share price of CHF284.5, the analyst price target of CHF294.0 is 3.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Schindler Holding?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.