Key Takeaways

- The leadership team's execution strength and digital service synergies position Interroll for significantly faster growth in market share, recurring revenue, and margin expansion than expected.

- Localized manufacturing and innovative automation platforms will enable Interroll to outpace competitors in emerging markets, tapping premium demand and supporting robust, sustainable earnings growth.

- Growing competition, technological shifts, and unfavorable currency trends threaten revenue growth, margins, and long-term relevance unless innovation and strategic adaptation accelerate.

Catalysts

About Interroll Holding- Provides material-handling solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

- Analyst consensus expects the new CEO and leadership team to incrementally improve growth and margins, but his proven track record in both execution and strategy across global markets, combined with an energized, experienced board and seamless CEO transition, points to a far more aggressive acceleration in market share gains, operational excellence, and profit margin expansion than currently forecasted.

- Analysts broadly expect service business expansion to support margins, but the underappreciated synergy between digitalized service offerings, better data from installed base, and rapid rollout globally could drive recurring high-margin revenue much faster, leading to a steeper upward trajectory in earnings quality and predictability.

- As e-commerce and labor shortages intensify globally, Interroll's advanced modular automation platforms (incorporating real-time software, controls, and energy-saving features) are uniquely positioned to address scalability and efficiency needs, setting up an inflection point for product and system demand and supporting robust long-term revenue growth and premium gross margins.

- With the company's highly localized production network and continuous investment in lean, automated manufacturing systems, Interroll stands to outpace competitors by delivering tailored, resilient supply chain solutions in fast-growing markets like India, Southeast Asia, and South America, unlocking outsized sales growth and improving net margins through reduced logistics and material costs.

- Interroll's commitment to market-driven innovation-enabling hardware-software upgrades for the installed base and offering proven, energy-efficient solutions-will capture outsized shares of new and retrofit projects as customers seek to meet rising sustainability mandates, driving both top-line growth and further margin expansion.

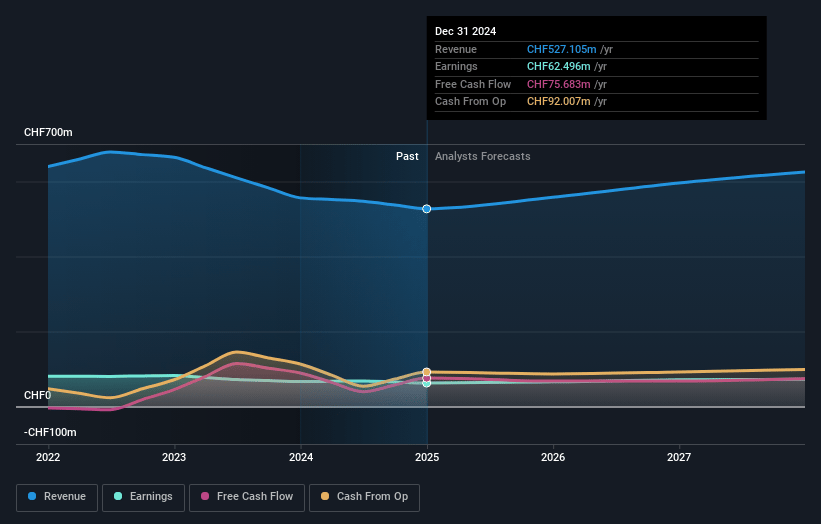

Interroll Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Interroll Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Interroll Holding's revenue will grow by 7.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.9% today to 12.4% in 3 years time.

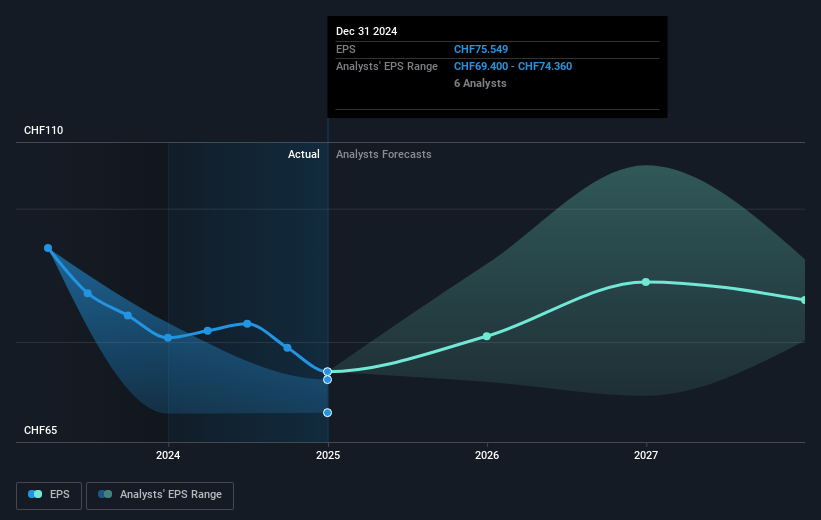

- The bullish analysts expect earnings to reach CHF 82.2 million (and earnings per share of CHF 96.43) by about July 2028, up from CHF 62.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 0.0x on those 2028 earnings, down from 30.3x today. This future PE is lower than the current PE for the GB Machinery industry at 18.9x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.94%, as per the Simply Wall St company report.

Interroll Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from low-cost Asian manufacturers, especially Chinese firms aggressively targeting both their domestic market and international regions such as Southeast Asia and Latin America, could drive price erosion, putting pressure on both revenues and net profit margins over time.

- The company's results showed a multi-year stagnation of order intake and several years of book-to-bill ratios below one, signaling a declining sales backlog; if this subdued demand, particularly in large project business, persists or the expected cyclical rebound does not materialize, this could restrain revenue growth and earnings recovery.

- Secular industry shifts toward robotics, higher-value automation, and fully autonomous systems could reduce the addressable market for traditional conveyor-based solutions, risking technological obsolescence and impacting long-term revenue and operating leverage if Interroll does not successfully accelerate innovation in software and IoT.

- Supply chain localization and global economic fragmentation may lessen cross-border logistics complexity and delay major material handling investments, especially as de-globalization and reshoring reduce the need for some of Interroll's core solutions; this could depress demand and slow future revenue growth.

- Ongoing appreciation of the Swiss franc erodes the top-line reporting in Swiss currency, as demonstrated by a cumulative CHF 90 million hit to reported sales over several years, which, if persistent, risks masking underlying growth and may negatively impact investor sentiment and future reported revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Interroll Holding is CHF2608.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Interroll Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF2608.0, and the most bearish reporting a price target of just CHF2000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF662.5 million, earnings will come to CHF82.2 million, and it would be trading on a PE ratio of 0.0x, assuming you use a discount rate of 4.9%.

- Given the current share price of CHF2285.0, the bullish analyst price target of CHF2608.0 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.