Narratives are currently in beta

Key Takeaways

- Geberit's focus on new products and market expansion is expected to drive future revenue growth and enhance market share.

- Specialization in manufacturing and strategic operational adjustments aim to boost profitability by improving efficiency and saving costs.

- Geberit's revenue faces pressure from currency challenges, sector declines, increased costs, and strategic divestments, impacting margins and earnings.

Catalysts

About Geberit- Develops, produces, and distributes sanitary products and systems for the residential and commercial construction industry.

- Geberit is focusing on expanding its market position by launching new products like FlowFit, Mapress Therm, and the shower toilet Alba, which could drive future revenue growth.

- The company is implementing a specialization strategy for its ceramics manufacturing network to improve efficiency and product quality, which may enhance net margins through cost reductions and productivity improvements.

- Geberit's plans to establish a new distribution center in Northern Germany aim to improve logistics and mitigate risks, potentially leading to higher earnings as it enhances supply chain resilience and operational capacity.

- Increased operational expenses for sales initiatives, IT, and digitalization, alongside market expansion in emerging regions like India, Saudi Arabia, Vietnam, and Egypt, are intended to support long-term revenue growth and market share.

- The decision to close the Basel ceramic plant and consolidate production to other facilities is expected to yield annual savings of EUR 10 million starting in 2027, boosting profitability and net margins.

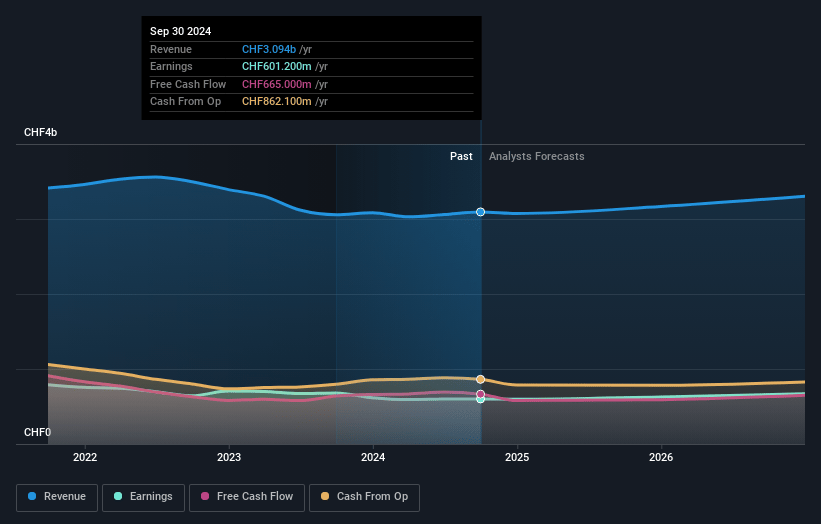

Geberit Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Geberit's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.4% today to 20.6% in 3 years time.

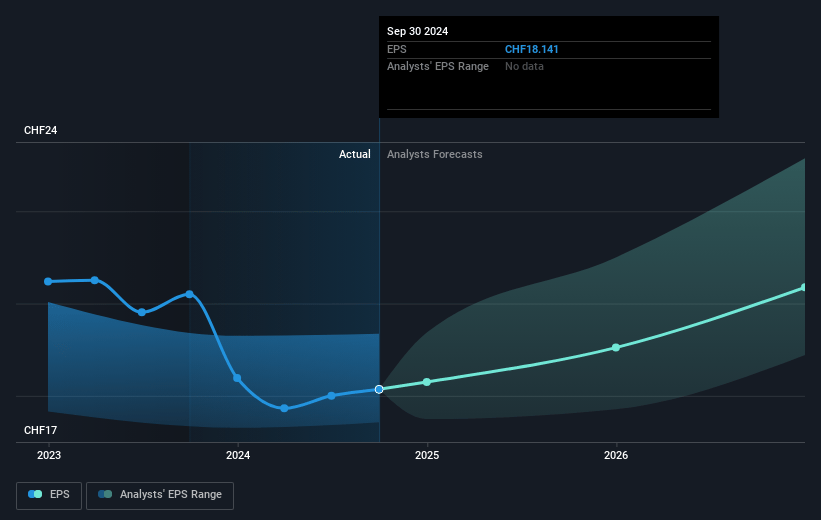

- Analysts expect earnings to reach CHF 703.4 million (and earnings per share of CHF 21.21) by about January 2028, up from CHF 601.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF619 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, down from 27.8x today. This future PE is greater than the current PE for the GB Building industry at 26.6x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.14%, as per the Simply Wall St company report.

Geberit Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geberit faces risks from unfavorable currency developments, which reduced net sales by CHF 40 million in one quarter and CHF 76 million for the full year. This impacts revenue and potentially net earnings due to translation losses.

- The company projects a slightly lower EBITDA margin for the full year, attributed to wage inflation of 4% and planned expenditure increases, which could compress net margins if not offset by productivity gains.

- The new construction market in key regions like Germany and the Nordic countries is expected to decline further in 2025, which could negatively impact sales revenue, given Geberit's exposure to this sector.

- The divestment of the Nordic shower business is resulting in reduced sales in Northern Europe, indicating potential challenges in maintaining revenue growth in that region.

- The closure of the Basel ceramic plant, with associated costs estimated at EUR 40 million, presents a risk of financial strain from write-offs and one-time expenses, which could affect net earnings until expected savings materialize in 2027.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF495.75 for Geberit based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF614.0, and the most bearish reporting a price target of just CHF390.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF3.4 billion, earnings will come to CHF703.4 million, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 5.1%.

- Given the current share price of CHF505.8, the analyst's price target of CHF495.75 is 2.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives