Last Update03 Sep 25Fair value Increased 2.63%

The upward revision in dormakaba Holding’s price target reflects a significantly higher expected Future P/E despite a declining net profit margin, resulting in an increased consensus fair value from CHF737.43 to CHF756.83.

Valuation Changes

Summary of Valuation Changes for dormakaba Holding

- The Consensus Analyst Price Target has risen slightly from CHF737.43 to CHF756.83.

- The Future P/E for dormakaba Holding has significantly risen from 20.48x to 22.75x.

- The Net Profit Margin for dormakaba Holding has fallen from 5.25% to 4.87%.

Key Takeaways

- Expansion into digital and cloud-enabled security solutions, alongside targeted growth in key verticals, strengthens long-term revenue potential and recurring earnings.

- Efficiency-driven measures and focused M&A activity are improving margins, cash flow, and market share while promoting sustainable competitive advantages.

- Lagging innovation, portfolio gaps, operational inefficiencies, and reliance on cyclical markets hinder growth and margin expansion, jeopardizing competitiveness in a shifting digital landscape.

Catalysts

About dormakaba Holding- Provides access and security solutions worldwide.

- dormakaba's push into digital access control, cloud-based security solutions, and IoT integration (e.g., new product launches such as Skyra for mobile/cloud-enabled infrastructure and partnerships like Safetrust) positions it to capitalize on the accelerating shift toward digital building solutions, supporting higher recurring revenues and long-term top-line growth.

- The company's targeted expansion in high-growth verticals (airports, data centers, healthcare) as urbanization and critical infrastructure spending rise-combined with its increased North American focus and go-to-market overhaul-should unlock new sources of demand and accelerate organic revenue growth.

- Ongoing complexity reduction, product portfolio rationalization, and ramp-up of global shared service centers (especially in best-cost countries such as Bulgaria and Mexico) are driving substantial cost savings, margin expansion, and improved cash flow, with further efficiency gains expected to lift net margins over the next few years.

- Dormakaba's increasing investment in software and modular, platform-based product strategies-exemplified by appointing a software-centric CIO and consolidating firmware/IT systems-aligns with industry trends toward integrated, interoperable solutions, boosting customer retention, lifetime value, and supporting recurring earnings growth.

- The company's M&A and local-for-local strategies (including recent bolt-on acquisitions, divestitures of lower-margin units, and JV in China) will increase scale in strategic markets and technologies, enabling market share gains, diversification, and sustained improvement in EBITDA and earnings stability.

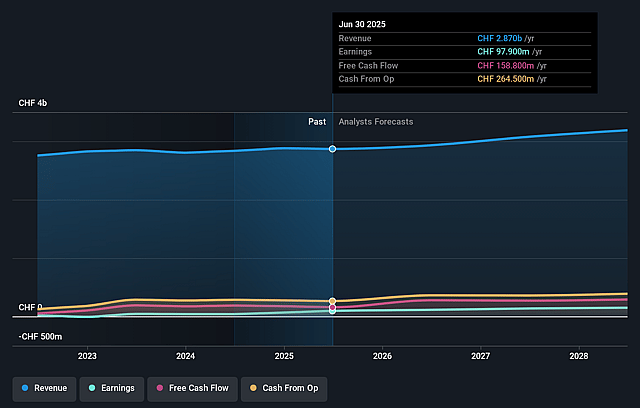

dormakaba Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming dormakaba Holding's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 4.9% in 3 years time.

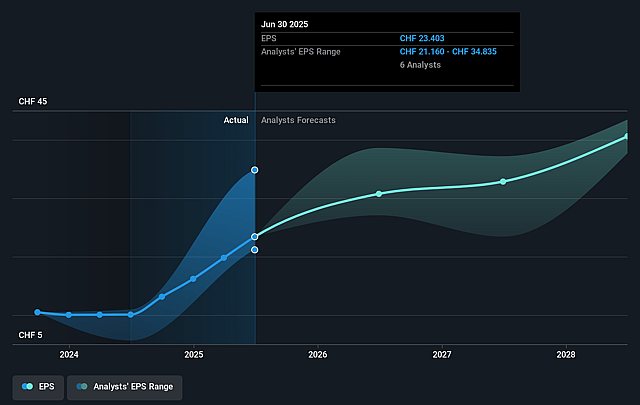

- Analysts expect earnings to reach CHF 161.2 million (and earnings per share of CHF 37.97) by about September 2028, up from CHF 97.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 29.5x today. This future PE is lower than the current PE for the GB Building industry at 32.6x.

- Analysts expect the number of shares outstanding to decline by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.65%, as per the Simply Wall St company report.

dormakaba Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's historic underinvestment and product portfolio gaps in key U.S. segments (especially in hardware and automatics) may persist, risking slower market share gains and muted revenue growth in the world's largest market, particularly as the shift from bundled/engineered solutions to more flexible, component-based offerings is still "just beginning." If these gaps remain, top-line expansion in North America could fall short of targets.

- Dormakaba's operational complexity across multiple geographies, high SKU counts, and diverse product/software platforms presents an ongoing challenge; despite cost and complexity reduction programs, full benefits are not imminent and remaining inefficiencies may inhibit medium-term improvements in net margins and earnings.

- Significant exposure to cyclical construction, commercial real estate, and project-based business creates volatility in revenues, especially as KWO/OEM faced declines driven by trade tariffs and economic uncertainties in North America and China; this cyclicality could undermine sustained revenue growth if end markets weaken.

- Persistent inflationary pressure on raw materials and labor, combined with wage increases in key markets and continued investment needs in service centers and U.S. manufacturing, may compress gross and net margins if not fully offset by price/surcharge increases or efficiency gains, risking earnings growth.

- Dormakaba's catch-up in digital transformation and innovation (e.g., reliance on legacy solutions, delayed go-to-market changes, and recent software/IoT talent hires) lags some competitors, heightening the risk of losing share in high-growth, technology-driven segments and reducing long-term revenue visibility as the industry shifts towards integrated and cloud-based access control systems.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF756.833 for dormakaba Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF862.0, and the most bearish reporting a price target of just CHF650.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF3.3 billion, earnings will come to CHF161.2 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 5.7%.

- Given the current share price of CHF694.0, the analyst price target of CHF756.83 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.