Key Takeaways

- Sustained demand for clean energy, LNG, and marine infrastructure drives robust order growth, strong revenue streams, and high-margin service opportunities for Burckhardt Compression.

- Digital services, operational improvements, and a growing installed base support margin expansion, recurring revenues, and long-term profitability.

- Reliance on cyclical segments, market headwinds in China, rising credit risk, and macroeconomic uncertainties threaten revenue growth, margin stability, and earnings visibility.

Catalysts

About Burckhardt Compression Holding- Manufactures and sells reciprocating compressor technologies worldwide.

- Growing demand for cleaner energy and decarbonization is accelerating global investments in hydrogen, LNG, and alternative fuels infrastructure, supporting long-term order growth for Burckhardt's advanced compression solutions

- likely to boost topline revenues and the services backlog over the next several years.

- Expansion of natural gas and LNG supply chains, particularly in the US, Middle East, and emerging markets, is driving new marine and transportation compressor orders; sustained high order intake for LPG/LNG tankers and related services is expected to support revenue visibility and margin stability.

- Increased delivery of large, long-life compressors is steadily building a substantial installed base, which will drive a higher proportion of recurring, high-margin aftermarket service and digital solution revenues starting in 2026 and beyond, improving net margins and earnings predictability.

- Investments in digital services (like UP! Detect and integration of PROGNOST) position Burckhardt to capture value from the digitalization trend in industrial equipment, differentiating the firm and enabling new, higher-margin service revenue streams that enhance long-term profitability.

- Operational leverage from productivity initiatives (Fit4Growth, factory expansions, and supply chain flexibility) allows for revenue growth without significant increases in fixed costs, supporting continued EBIT margin expansion and strong capital returns as global energy and industrial trends play out.

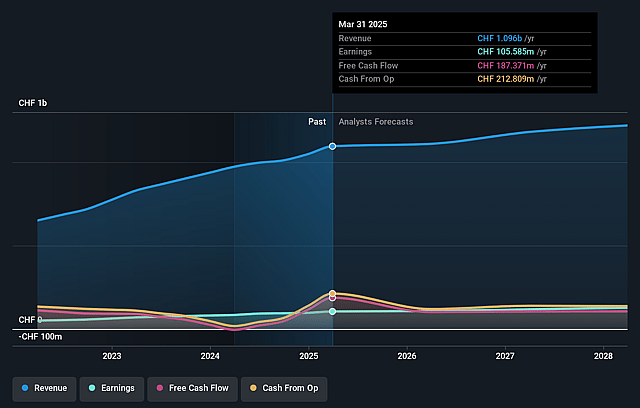

Burckhardt Compression Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Burckhardt Compression Holding's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 10.5% in 3 years time.

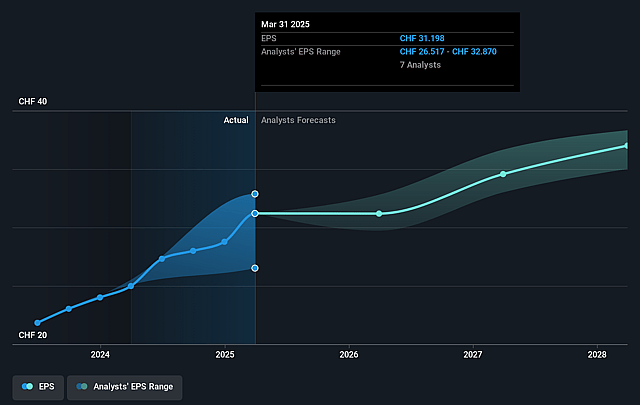

- Analysts expect earnings to reach CHF 128.4 million (and earnings per share of CHF 37.24) by about September 2028, up from CHF 105.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 22.5x today. This future PE is lower than the current PE for the GB Machinery industry at 21.8x.

- Analysts expect the number of shares outstanding to decline by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.01%, as per the Simply Wall St company report.

Burckhardt Compression Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing normalization and potential decline of demand in key segments, such as petrochemicals (solar-related Hyper Compressors) and a recalibrated hydrogen market, suggest mid-term order intakes could decrease, putting pressure on future revenue growth and earnings visibility.

- Increased push for localization and self-reliance in China presents a structural headwind, risking erosion of Burckhardt's market share and limiting pricing power in its largest regional market-potentially impacting both top-line revenues and net margins.

- High dependence on cyclical, large-scale projects and certain high-margin subsegments (e.g., LPG marine, solar-linked Hyper) exposes the company to backlog volatility, project deferrals, and execution risks, leading to possible swings in revenue, cash flow, and earnings.

- Rising overdue receivables (over 90 days) more than doubling year-on-year-in markets like China and India-alongside the need for increasing bad debt provisions, indicates heightened credit risk and may compromise net income and margin stability.

- Exposure to indirect macro headwinds like US tariffs, currency fluctuations (particularly Swiss franc appreciation), and slower GDP growth in key markets adds uncertainty to future demand, price competitiveness, and cost structure, with negative consequences for both revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF728.0 for Burckhardt Compression Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF800.0, and the most bearish reporting a price target of just CHF612.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF1.2 billion, earnings will come to CHF128.4 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 5.0%.

- Given the current share price of CHF704.0, the analyst price target of CHF728.0 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.