Key Takeaways

- Superior Plus is poised for above-forecast growth and margin expansion through digital optimization, operational overhauls, and service bundling enhancing customer retention.

- Market consolidation, urbanization, and energy transition support sustained top-line and free cash flow gains, with M&A and scale providing further leverage against competitors.

- Heavy reliance on propane amid decarbonization risks, high debt, and slow diversification threaten margins, growth prospects, and long-term financial stability.

Catalysts

About Superior Plus- Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

- Analyst consensus expects Superior Delivers to add $70 million to EBITDA by 2027, but execution momentum and the scale of digital route optimization initiatives could unlock even greater savings and customer acquisition, potentially exceeding this target and accelerating both EBITDA growth and margin expansion beyond current forecasts.

- While analyst consensus highlights capital optimization at Certarus, they underplay how Certarus's operational overhaul and the pending expansion into new high-margin utility and industrial end-markets could result in a step-change improvement in free cash flow generation and higher Certarus EBITDA run rates once energy demand rebounds.

- Superior Plus's entrenched wholesale and logistics network positions the company to capture disproportionate share from rising North American energy demand tied to ongoing urbanization and population growth, supporting sustainable top-line growth and increased route density for higher margins over the long term.

- As the transition from coal and oil to propane accelerates on the back of decarbonization mandates and disaster preparedness, Superior's value-added service bundling (including equipment rental and fixed-price contracts) will cement customer stickiness and drive superior net margin expansion relative to more commodity-focused competitors.

- Superior's disciplined acquisition pipeline and scale advantages in a fragmented propane market set the stage for outsized revenue and EBITDA growth through continued M&A, further increasing operational leverage and potential for double-digit earnings growth as integration synergies are realized.

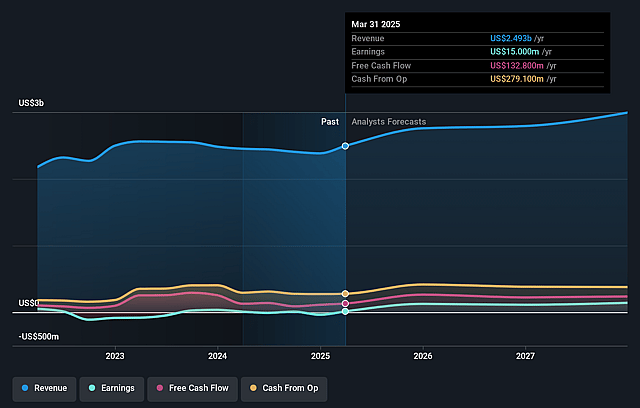

Superior Plus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Superior Plus compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Superior Plus's revenue will grow by 11.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.6% today to 5.0% in 3 years time.

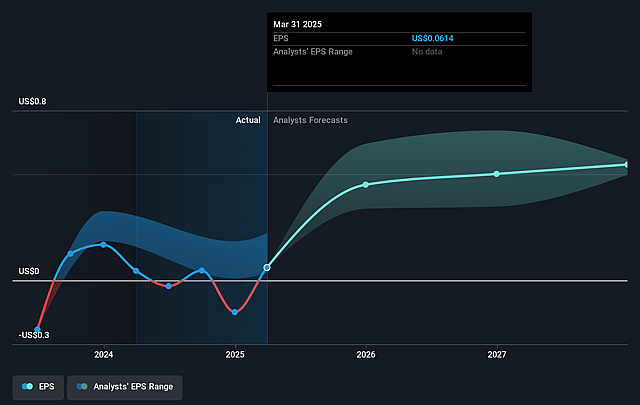

- The bullish analysts expect earnings to reach $173.0 million (and earnings per share of $0.7) by about July 2028, up from $15.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, down from 76.7x today. This future PE is lower than the current PE for the CA Gas Utilities industry at 21.4x.

- Analysts expect the number of shares outstanding to decline by 6.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Superior Plus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Superior Plus faces secular headwinds from decarbonization and global net zero commitments, which could gradually erode propane demand and lead to revenue declines and potential asset write-downs as the world shifts away from fossil fuels.

- Electrification of heating and consumer policy favoring electric heat pumps and renewable energy threaten to shrink the long-term addressable market for delivered propane, risking downward pressure on revenues and customer base.

- Persistently high debt levels and the need for capital to fund operational changes and buybacks may squeeze net income via rising interest expenses, especially as capital market access becomes more costly for fossil fuel-dependent companies.

- Margin pressures in the Certarus CNG segment, as highlighted by ongoing pricing pressures and volatile oil and gas activity, introduce uncertainty to earnings growth and expose the company's reliance on cyclical sectors.

- Superior Plus' slow pace in diversifying beyond its core propane business increases long-term exposure to secular decline; any failure to aggressively pivot toward renewables or alternative energy could limit future growth and compress earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Superior Plus is CA$12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Superior Plus's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$12.0, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $173.0 million, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$7.02, the bullish analyst price target of CA$12.0 is 41.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.