Key Takeaways

- Accelerated grid modernization trends and utilities' need for data-centric solutions are expanding Tantalus' market opportunities and recurring high-margin revenue streams.

- Ongoing investments in product innovation and manufacturing diversification strengthen competitive positioning and support long-term stable growth despite industry and regulatory challenges.

- Reliance on North American utilities, rising costs, manufacturing concentration, and evolving industry standards threaten margins, revenue growth, and long-term competitive positioning.

Catalysts

About Tantalus Systems Holding- A technology company, provides smart grid solutions in Canada and the United States.

- Accelerated adoption of grid modernization and electrification initiatives-driven by extreme weather, outages, and the integration of renewables-is pushing utilities to deploy advanced metering and data-centric solutions at a faster pace, directly expanding Tantalus' pipeline and revenue growth potential.

- Expansion and rapid uptake of the TRUSense Gateway and analytics offerings, validated by early customer wins (e.g., EPB, Indiana Municipal Power Agency), are increasing recurring high-margin software and services revenue, supporting gross margin improvements and stable cash flow.

- Strong momentum in order conversions ($44.1M YTD, up 34% YoY) and growing ARR (up 11% YoY) reflect the company's strategic penetration of traditionally underserved municipal/cooperative utilities and create higher revenue visibility moving forward.

- Utility industry's increasing reliance on granular operational data, analytics, and actionable grid insights-propelled by regulatory requirements for outage management, grid resiliency, and cybersecurity-positions Tantalus' differentiated platform to capture a larger share of future industry spend, driving long-term earnings growth.

- Investments in business development, targeted sales/marketing, and strategic manufacturing diversification are expected to increase market share and mitigate tariff risk, supporting both top-line revenue expansion and operating margin resilience over the next several years.

Tantalus Systems Holding Future Earnings and Revenue Growth

Assumptions

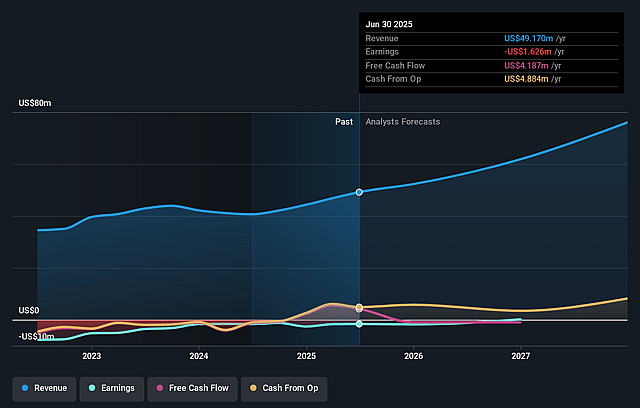

How have these above catalysts been quantified?- Analysts are assuming Tantalus Systems Holding's revenue will grow by 17.9% annually over the next 3 years.

- Analysts are not forecasting that Tantalus Systems Holding will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Tantalus Systems Holding's profit margin will increase from -3.3% to the average CA Electronic industry of 8.0% in 3 years.

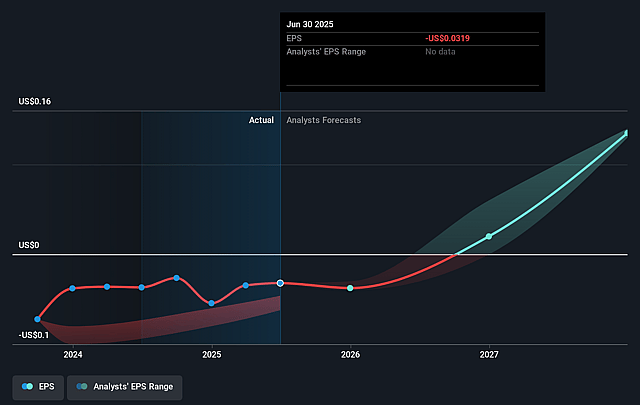

- If Tantalus Systems Holding's profit margin were to converge on the industry average, you could expect earnings to reach $6.4 million (and earnings per share of $0.12) by about August 2028, up from $-1.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.7x on those 2028 earnings, up from -68.9x today. This future PE is greater than the current PE for the CA Electronic industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Tantalus Systems Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's increasing exposure to tariffs on connected devices (with rates rising from 10% to 19% and Tantalus absorbing a portion of these costs) creates sustained margin pressure and could discourage rapid utility adoption of new infrastructure, impacting both near

- and long-term gross profit margin and earnings.

- Heavy reliance on the North American utility market (88% of Q2 revenue from existing customers), combined with utilities' budgeting cycles and potential slowdowns in infrastructure deployment due to cost increases or waning stimulus funding, leaves revenue growth vulnerable to regional economic and legislative risks.

- Rising operating expenses, particularly through increased investments in sales, marketing, and ongoing (though normalized) R&D to support advanced analytics and commercialization of the TRUSense Gateway, may negatively impact net margins if sales growth and recurring revenue don't scale sufficiently or if competitive pressures intensify.

- While the company is ramping up production, dependence on a single manufacturing line in the Philippines exposes Tantalus to risks of further supply chain disruptions, future geopolitical developments, and additional tariff changes; this could lead to cost overruns, delivery delays, and negative impacts on customer satisfaction, contract renewals, and profitability.

- The long-term trend toward integrated, open-source, or standardized solutions for grid infrastructure could erode Tantalus' differentiated value proposition and pricing power, especially against much larger or more diversified competitors, reducing future revenue growth and compressing profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$4.67 for Tantalus Systems Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.52, and the most bearish reporting a price target of just CA$4.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $80.5 million, earnings will come to $6.4 million, and it would be trading on a PE ratio of 33.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of CA$3.02, the analyst price target of CA$4.67 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.