Catalysts

About Dream Unlimited

Dream Unlimited is a Canadian real estate company focused on asset management, large scale community development and income producing properties across high growth markets.

What are the underlying business or industry changes driving this perspective?

- Rapid expansion of the institutional private asset management platform, with assets under management expected to reach approximately $30 billion by 2026, is expected to drive higher recurring fee revenue and operating leverage, supporting sustained growth in net margins and earnings.

- Deep land positions and long dated approvals in high growth Western Canadian cities, including Alpine Park, Coopertown and Homewood, position Dream to respond to structurally rising housing demand and pricing, supporting higher baseline development revenue and development driven earnings from 2026 onward.

- Accelerating lease up and stabilization of newly completed purpose built rental and retail properties, many now above 90 percent occupancy, are expected to translate into stronger NOI growth, higher income property margins and more predictable cash flows.

- Large scale urban residential projects with attractive cost bases, supported by affordable housing incentives, CMHC financing and lower construction costs, are expected to add substantial recurring rental revenue and development profits as they come online, which may enhance earnings quality over time.

- Strong balance sheet liquidity of approximately $328 million and modest near term debt maturities provide capacity to fund growth in Western Canadian developments and income properties through periods of potential economic volatility, which may enable the company to convert its pipeline into higher revenue and resilient earnings.

Assumptions

This narrative explores a more optimistic perspective on Dream Unlimited compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

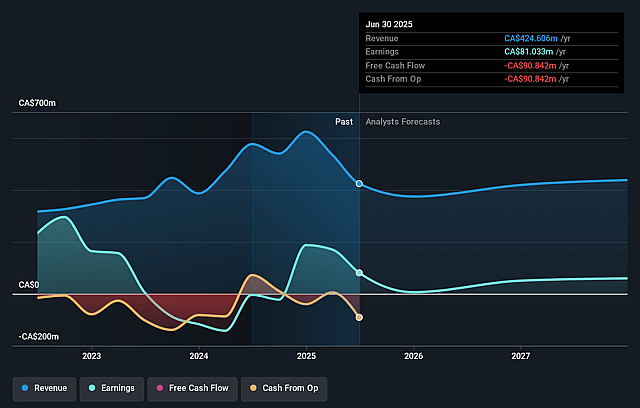

- The bullish analysts are assuming Dream Unlimited's revenue will grow by 2.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 18.3% today to 13.5% in 3 years time.

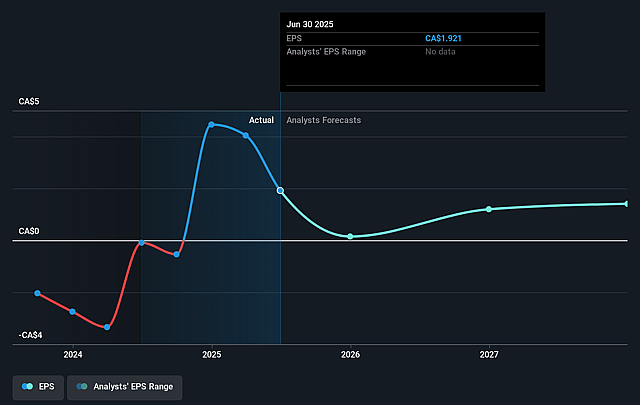

- The bullish analysts expect earnings to reach CA$64.5 million (and earnings per share of CA$1.54) by about December 2028, down from CA$81.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, up from 9.0x today. This future PE is greater than the current PE for the CA Real Estate industry at 7.9x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.85%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Canada’s economy has already fallen roughly 18 percent below its potential GDP per capita trend line, and management expects the next 12 to 24 months may remain challenging. This could dampen housing demand and capital flows into property and funds for longer than anticipated and weigh on revenue and earnings growth.

- Dream’s growth strategy is heavily concentrated in Western Canadian housing and land development. Slower sales, continued buyer uncertainty around tax policy and affordability, or a weaker than expected recovery after 2026 could delay presales conversion and lot sales and reduce development revenue and net margins.

- The business model relies on rising assets under management and higher fee margins in the private asset management platform. However, winning institutional mandates is described as time consuming and uncertain, so any slowdown in client growth, weaker transaction activity or fee pressure could limit AUM expansion and constrain fee based revenue and earnings.

- Large, highly leveraged urban projects held primarily through Dream Impact Trust face weak public market sentiment, higher funding needs and reliance on Dream provided credit. If capital markets or lenders remain unreceptive or project economics deteriorate despite cost savings, this could crystallize losses at the Trust, increase support required from Dream and negatively affect consolidated earnings and net margins.

- Macro financial risks, including potential increases in U.S. interest rates tied to tariff and deficit decisions, could keep borrowing costs elevated in Canada for longer. This would raise financing and refinancing costs on Dream’s developments and income properties and compress net interest spreads, which would pressure net margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Dream Unlimited is CA$38.0, which represents up to two standard deviations above the consensus price target of CA$32.5. This valuation is based on what can be assumed as the expectations of Dream Unlimited's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$38.0, and the most bearish reporting a price target of just CA$27.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be CA$476.7 million, earnings will come to CA$64.5 million, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 8.9%.

- Given the current share price of CA$17.35, the analyst price target of CA$38.0 is 54.3% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dream Unlimited?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.