Key Takeaways

- Growing population and urbanization in Western Canada, along with accelerating master-planned projects, are set to drive recurring profits and multi-year earnings growth.

- Diversification through high-margin rentals, expanding asset management, and a focus on sustainability will enhance earnings quality, stability, and long-term asset values.

- Heavy reliance on Western Canadian development and concentrated real estate exposure leave Dream Unlimited vulnerable to regional risks, market volatility, and challenges to earnings stability.

Catalysts

About Dream Unlimited- Dream Unlimited Corp. formerly known as Dundee Realty Corporation is a real estate investment firm.

- Population growth and ongoing urbanization in Western Canada, particularly strong in Alberta and Saskatchewan, are driving increased demand for housing and mixed-use developments; with Dream's large landholdings and approved master-planned communities in high-growth regions, this is expected to consistently boost development revenue and land profit margins for at least the next decade.

- The long pipeline of master-planned communities (Alpine Park, Holmwood, Coopertown) now entering accelerated development phases will lead to a significant rise in predictable, recurring profits from land sales and development-management projects $75 million annually over 10+ years, supporting higher multi-year earnings visibility.

- Continued expansion in high-margin income properties, especially purpose-built rentals in Western Canada, is providing recurring net operating income (NOI) with strong leasing momentum and above-average cap rate spreads, which is expected to drive steady income property revenue and margin growth as new buildings stabilize.

- Substantial growth in third-party asset management (up $2.5 billion in AUM in the past year) is increasing recurring fee-based income (and operational leverage), diversifying Dream's earnings stream and improving earnings quality and stability going forward.

- Strategic alignment with sustainability, infrastructure improvements (Ontario Line and public transit expansions), and government support for affordable housing positions Dream's major holdings and developments to benefit from future value appreciation, tenant demand, and potential ESG-driven premium pricing, positively impacting long-term revenue and asset values.

Dream Unlimited Future Earnings and Revenue Growth

Assumptions

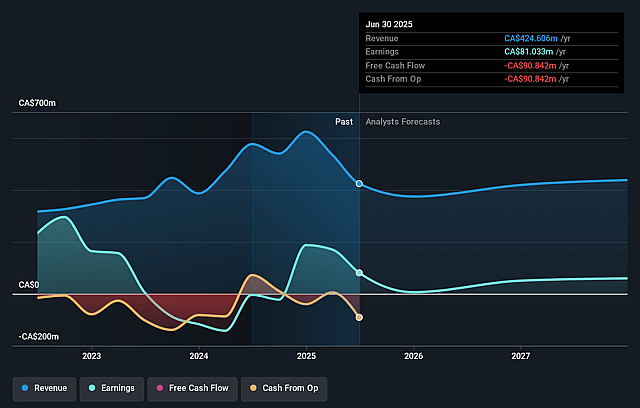

How have these above catalysts been quantified?- Analysts are assuming Dream Unlimited's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.1% today to 12.9% in 3 years time.

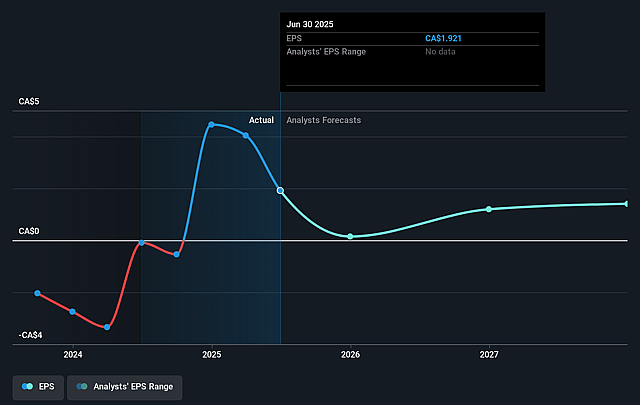

- Analysts expect earnings to reach CA$56.9 million (and earnings per share of CA$1.41) by about September 2028, down from CA$81.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, up from 10.7x today. This future PE is greater than the current PE for the CA Real Estate industry at 9.6x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Dream Unlimited Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on large-scale, long-horizon Western Canadian development projects exposes Dream Unlimited to project execution and market timing risks; unexpected cost overruns, regulatory delays, or a downturn in regional demand could suppress net margins and significantly delay or reduce future earnings.

- Income growth projections depend heavily on consistently strong housing demand in Alberta and Saskatchewan, making the company vulnerable to demographic shifts (such as reduced immigration rates or declining household formation) or economic slowdowns in these markets, which would negatively impact revenue and development profits.

- Despite some asset diversification, Dream Unlimited remains concentrated in the Canadian real estate market, particularly in Western Canada and select Ontario projects; this lack of geographic diversification heightens exposure to regional regulatory changes, local market softness (as already indicated by softened Ontario rents), and overall economic downturns, which could erode recurring revenues.

- Asset management fee income is subject to volatility, as seen with year-over-year performance fee fluctuations and unpredictable timing of new mandates or large transactions; this limits the reliability of this segment as a stable earnings and revenue driver over the long term.

- Ongoing capital-intensive development and expansion of income properties may necessitate higher leverage, especially if project monetization slows; this could increase financing costs, particularly in a rising interest rate environment, compressing net margins and straining the company's liquidity and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$32.5 for Dream Unlimited based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$38.0, and the most bearish reporting a price target of just CA$27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$441.9 million, earnings will come to CA$56.9 million, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 8.4%.

- Given the current share price of CA$20.5, the analyst price target of CA$32.5 is 36.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dream Unlimited?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.