Key Takeaways

- Growing demand for premium experiences and recurring memberships is driving higher per-patron spending and supporting revenue stability.

- Diversification into digital media and location-based entertainment reduces box office reliance and supports long-term earnings growth.

- Declining venue revenues, advertising challenges, film supply risks, high fixed costs, and leadership changes threaten Cineplex's diversification, margin stability, and long-term growth prospects.

Catalysts

About Cineplex- Operates as an entertainment and media company in Canada and internationally.

- Robust consumer demand for premium and immersive theatre experiences, shown by record highs in box office and concession spending per patron alongside surging attendance and 46% of box office coming from premium formats, signals that the unique value of out-of-home entertainment is being monetized more effectively than expected, underpinning higher future revenues and margins.

- Sustained growth in urban foot traffic and recurring visits-backed by a growing CineClub subscriber base (surpassing 200,000, up 10% year-to-date, with increasing annual memberships)-suggests Cineplex is successfully cultivating loyal, high-frequency customers, supporting a more predictable and stable revenue stream.

- Ongoing expansion and strength in diversified business lines, particularly digital media (18% year-over-year project growth and new large US contracts) and location-based entertainment (13% revenue growth from 3 new venues), reduces reliance on box office volatility and provides multiple levers for long-term earnings growth.

- Implementation of organization-wide cost efficiencies and adoption of new digital tools are on track to deliver $10 million in annual run-rate cost savings, reinforcing operating leverage and supporting improved net margin resilience even if box office growth normalizes.

- Strong industry recovery as evidenced by consistent multi-month, high-grossing box office performance and a robust slate of upcoming blockbuster releases is expected to further drive attendance and per-patron revenues, generating positive momentum for Cineplex's top-line and EBITDA.

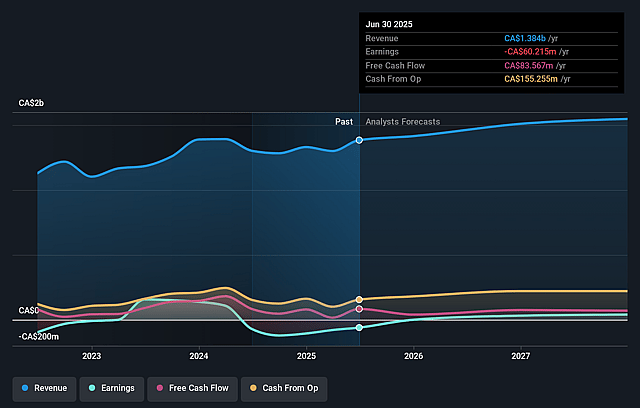

Cineplex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cineplex's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.3% today to 5.0% in 3 years time.

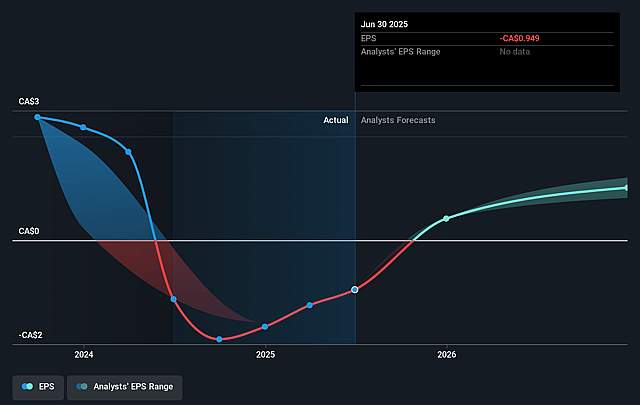

- Analysts expect earnings to reach CA$79.5 million (and earnings per share of CA$4.71) by about September 2028, up from CA$-60.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from -12.8x today. This future PE is greater than the current PE for the CA Entertainment industry at 10.4x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.02%, as per the Simply Wall St company report.

Cineplex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing declines in same-store revenue for the location-based entertainment (LBE) segment (anticipated at 3% to 5% decline for 2025) could signal difficulty in scaling new venues to offset waning guest engagement at existing locations, impacting long-term revenue growth and segment margins.

- Soft and uncertain advertising market conditions, combined with only modest growth in cinema media revenue despite industry challenges, highlight the vulnerability of advertising revenues to economic headwinds, potentially constraining Cineplex's profitability and diversification efforts.

- Heavy reliance on strong, diverse film slates to drive box office performance and premium revenue creates risk if studio content supply contracts or major titles increasingly shift toward direct-to-streaming releases, reducing audience draw and future revenues.

- Persistent high fixed operating costs (including G&A spending and dependence on attendance-based operating leverage) may leave Cineplex exposed to profit margin compression during weaker box office cycles or shifts in consumer behavior away from traditional cinema.

- Impending CEO retirement and leadership transition may introduce strategic uncertainty, risking potential disruption to execution of diversification and efficiency initiatives, thereby impacting investor confidence and possibly limiting medium-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$13.375 for Cineplex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$16.0, and the most bearish reporting a price target of just CA$11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.6 billion, earnings will come to CA$79.5 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 11.0%.

- Given the current share price of CA$12.18, the analyst price target of CA$13.38 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Cineplex?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.