Key Takeaways

- Digital transformation and strategic acquisitions are expected to enhance efficiencies and earnings through improved client experiences and alternative investment strategies.

- Expansion in Asia and the U.S. dental benefits market aims to drive growth through increased sales and improved earnings.

- Institutional outflows, dental pricing challenges, unexpected credit losses, and competitive pressures in Asia pose risks to Sun Life Financial's earnings and margins.

Catalysts

About Sun Life Financial- A financial services company, provides savings, retirement, and pension products worldwide.

- Sun Life is focusing on digital transformation, including implementing automated platforms across Asia, which is expected to improve client experiences and operational efficiencies, potentially enhancing net margins for the company.

- Growth initiatives in Asia and efforts to expand asset management capabilities, such as launching new actively managed ETFs, should drive revenue growth through increased sales and fee income in international markets.

- The company is leveraging its position in the high-growth U.S. dental benefits market following pricing renegotiations and management actions, providing a path to increased earnings by targeting $100 million in dental earnings by 2025.

- Strategic acquisition and integration activities, like acquiring full interest in InfraRed Capital Partners, are expected to extend Sun Life’s infrastructure investment solutions, which may contribute to higher earnings from alternative investment strategies.

- Sun Life's focus on maximizing efficiencies, including achieving $200 million in savings by 2026, is anticipated to mitigate expense pressures and support improvements in net margins and ultimately enhance earnings growth.

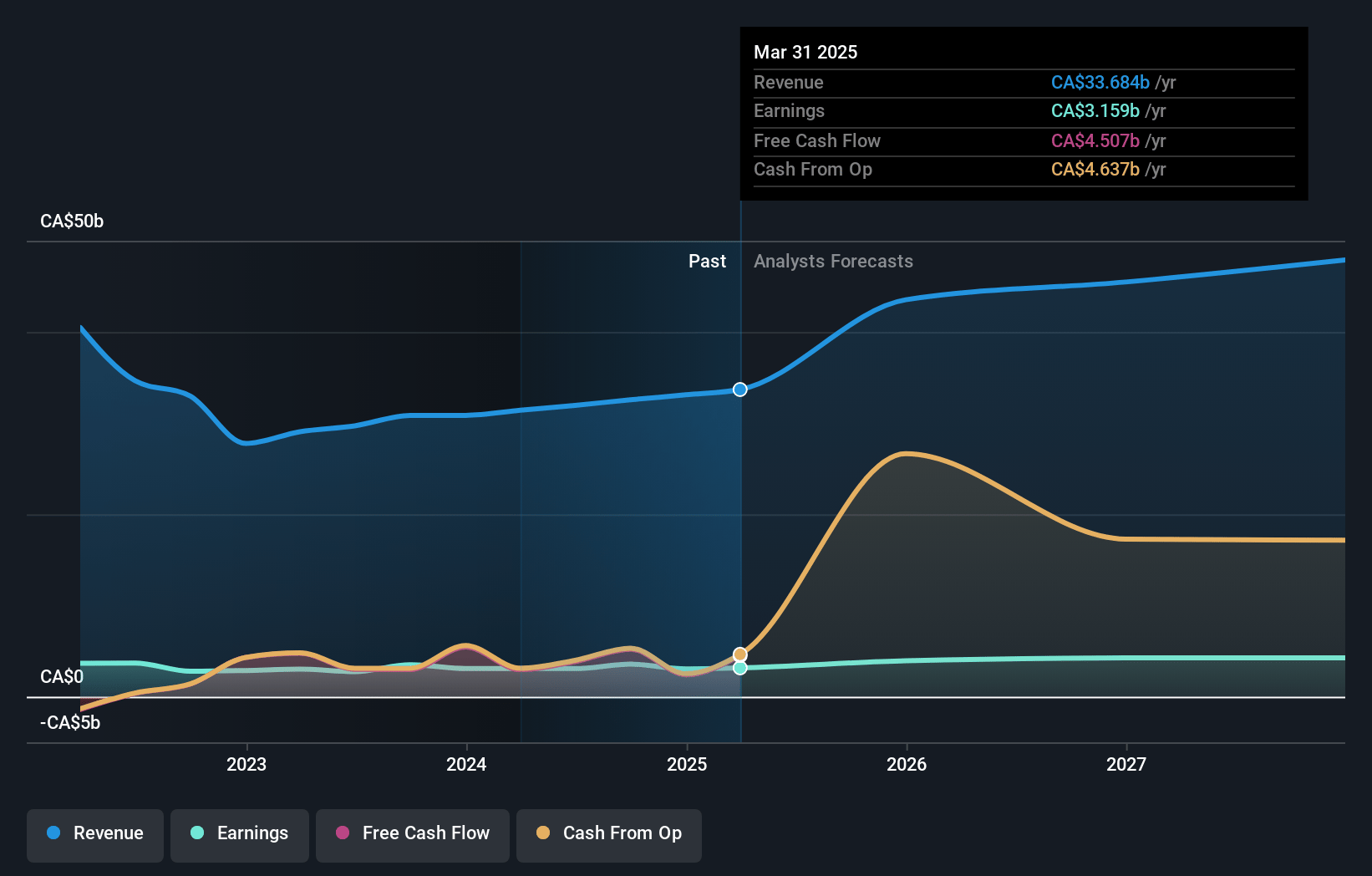

Sun Life Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sun Life Financial's revenue will grow by 15.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.9% today to 8.1% in 3 years time.

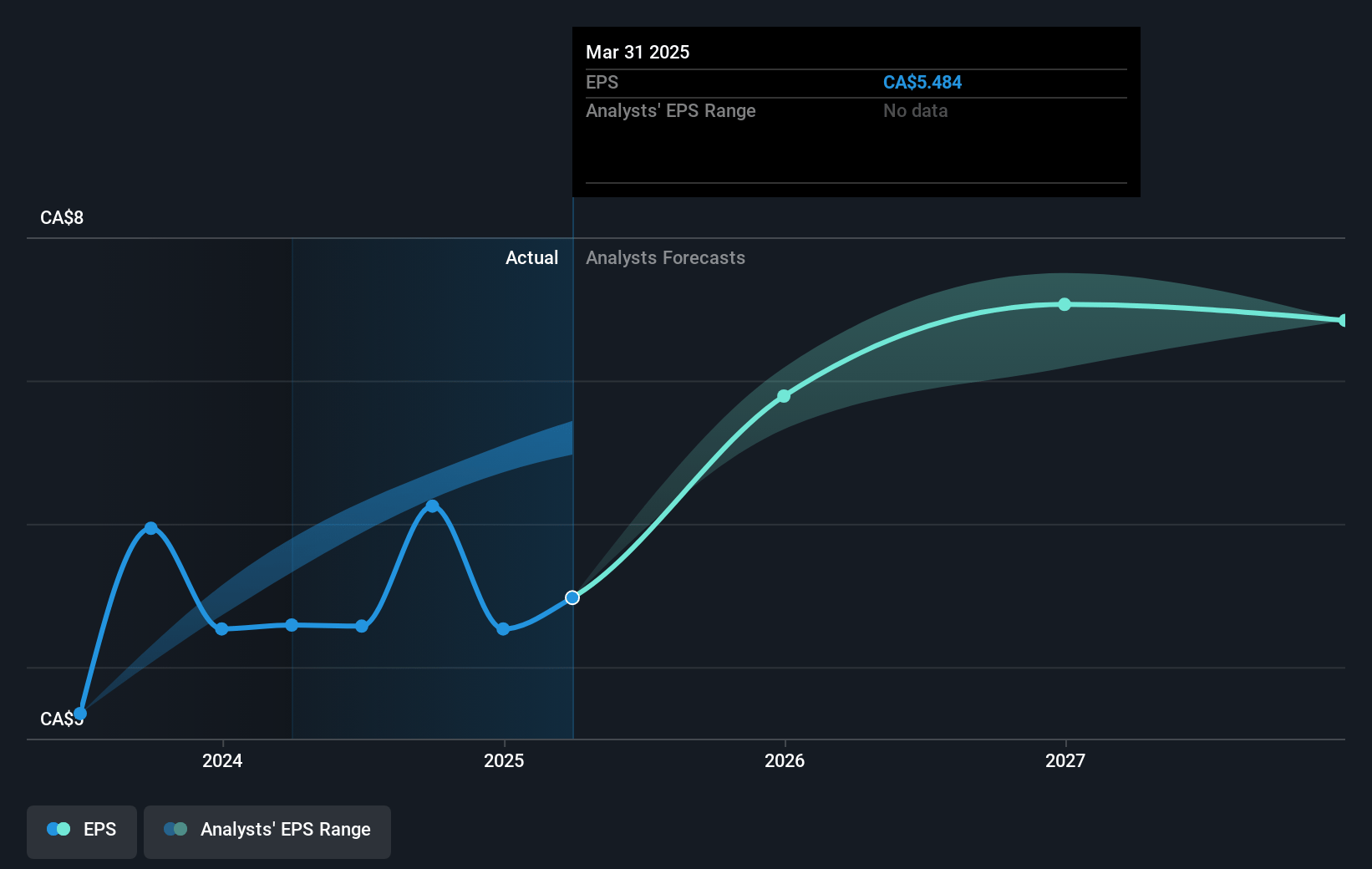

- Analysts expect earnings to reach CA$4.1 billion (and earnings per share of CA$7.37) by about January 2028, up from CA$3.6 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as CA$4.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 13.6x today. This future PE is greater than the current PE for the CA Insurance industry at 12.5x.

- Analysts expect the number of shares outstanding to decline by 1.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Sun Life Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenge with institutional outflows due to portfolio rebalancing and a preference for high-growth tech stocks may continue, potentially impacting MFS's revenue and overall asset management earnings.

- Pricing challenges in the dental benefits market, particularly for Medicaid, and the need to continually adjust premiums could create variability and constraints on future earnings growth in the U.S. business segment.

- Adverse credit impacts and unexpected credit losses, even when isolated to specific sectors or loans, could affect the net margins and earnings if these instances increase in frequency.

- Achieving the ambitious target of $100 million in dental earnings by 2025 may depend heavily on external factors such as state adjustments to Medicaid premiums, which introduces execution risk and uncertainty into future earnings.

- Competitive pressures and the evolving regulatory landscape in Asia may necessitate continued investments in digital and distribution capabilities, potentially increasing operating expenses and impacting net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$89.15 for Sun Life Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$99.0, and the most bearish reporting a price target of just CA$66.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$50.4 billion, earnings will come to CA$4.1 billion, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of CA$84.2, the analyst's price target of CA$89.15 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives