Narratives are currently in beta

Key Takeaways

- Intact Financial expects premium growth and profitability from hard market conditions and Direct Line acquisition, leveraging AI, digital tech, and enhanced distribution.

- Climate risk management efforts and tech investments aim to stabilize margins and boost earnings by reducing losses and improving efficiency.

- Intensifying weather-related risks, competitive pressures, and acquisition uncertainties could challenge Intact Financial's earnings, market share growth, and future profitability.

Catalysts

About Intact Financial- Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

- Intact Financial anticipates benefiting from ongoing hard market conditions, particularly in personal auto and personal property lines in Canada, which should lead to improved revenue growth and profitability through sustained premium increases.

- The integration of advanced AI models in pricing and risk selection is expected to enhance underwriting accuracy, which could improve net margins by optimizing pricing strategies and reducing loss ratios.

- The acquisition of Direct Line in the UK&I is projected to drive significant premium growth and improve operating efficiency through consolidation and leveraging enhanced distribution channels, potentially increasing revenue and earnings.

- Intact's substantial investment in digital engagement and technology is expected to boost efficiency and customer satisfaction, which can increase earnings by reducing claims handling times and customer acquisition costs.

- Continued efforts in climate risk management and partnerships with governments aim to mitigate future catastrophe losses, which could stabilize net margins and support long-term earnings growth by reducing volatility in claims.

Intact Financial Future Earnings and Revenue Growth

Assumptions

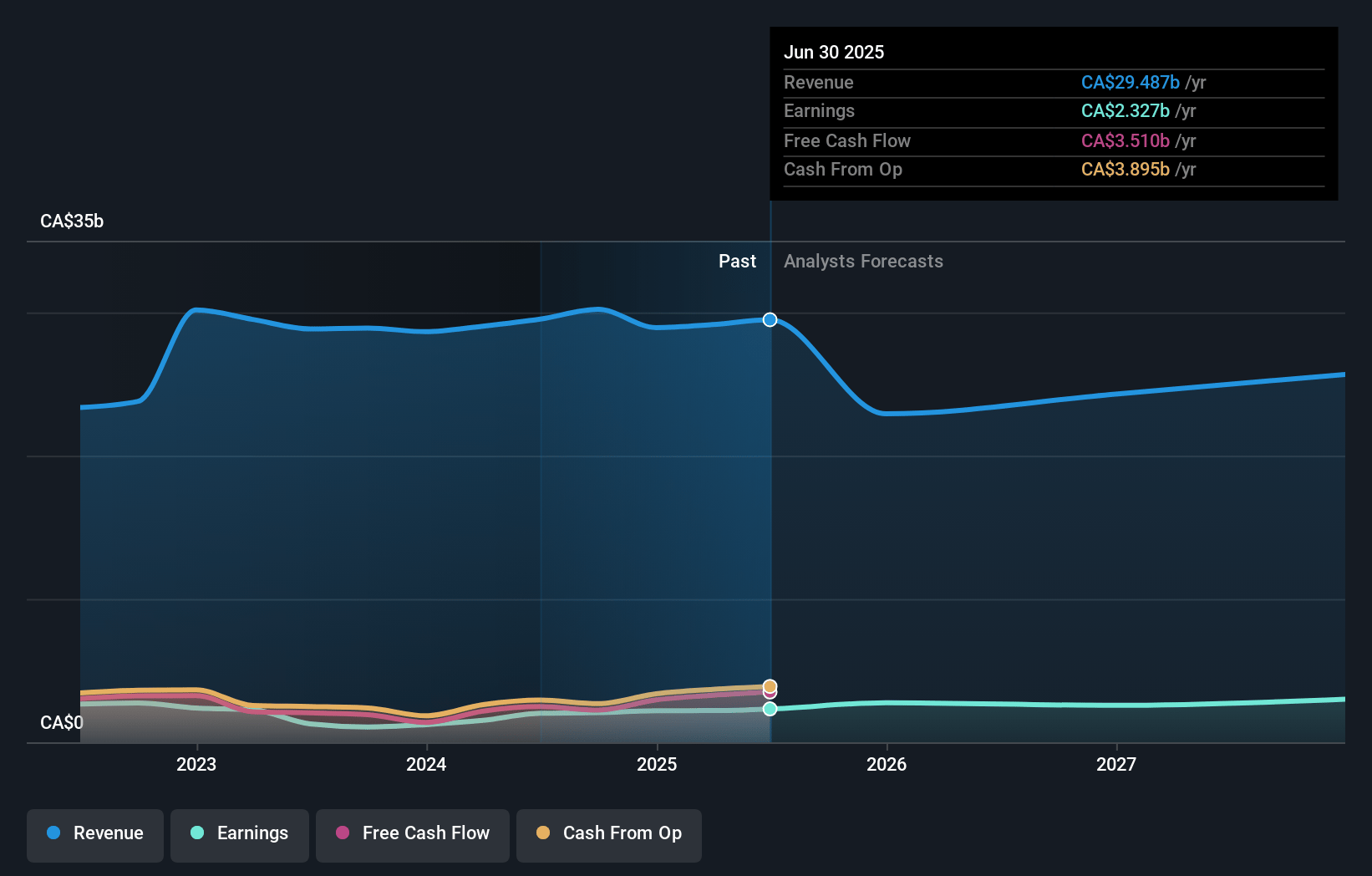

How have these above catalysts been quantified?- Analysts are assuming Intact Financial's revenue will decrease by -9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 11.3% in 3 years time.

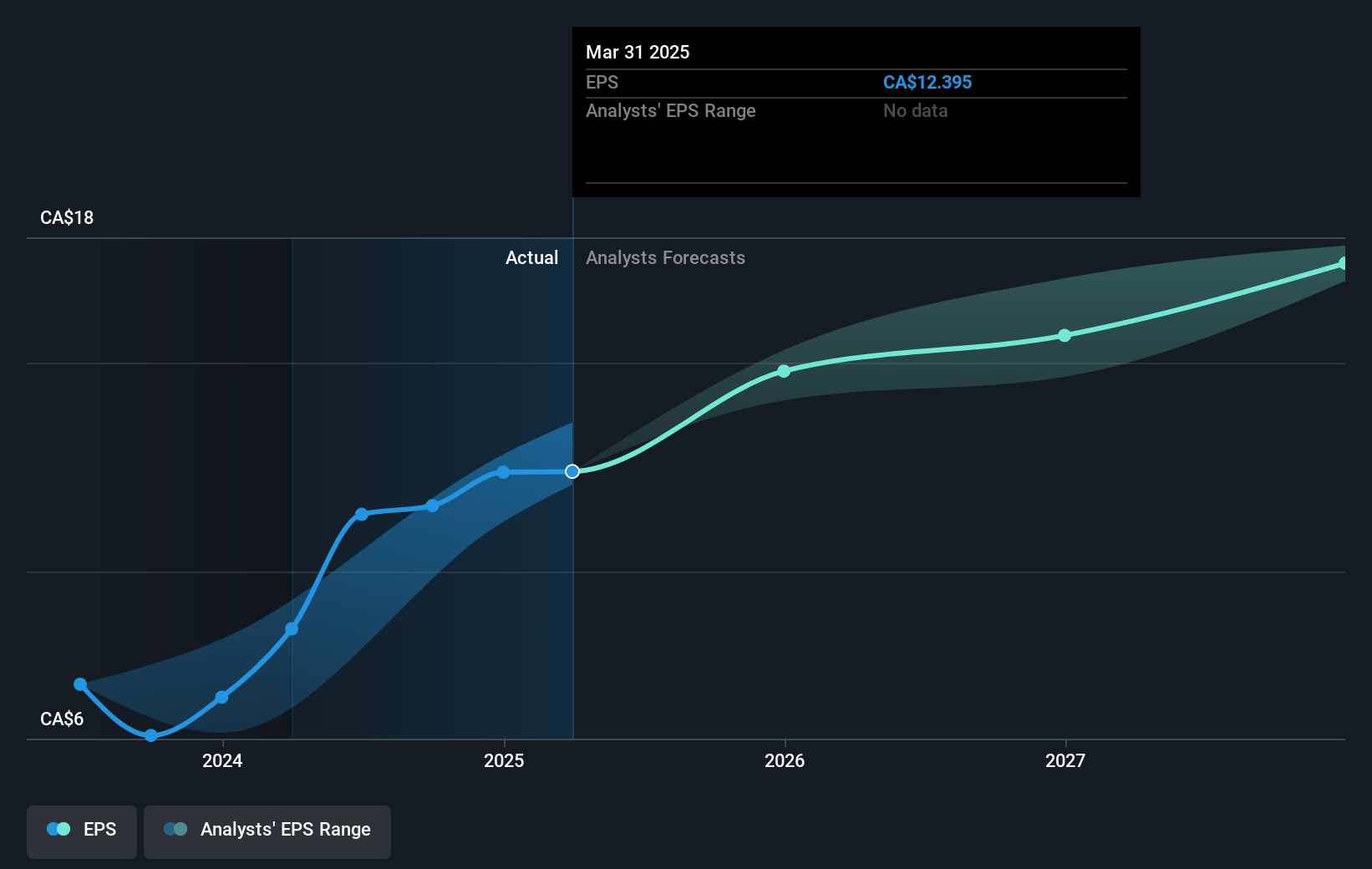

- Analysts expect earnings to reach CA$2.6 billion (and earnings per share of CA$16.91) by about January 2028, up from CA$2.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CA$1.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.9x on those 2028 earnings, down from 22.6x today. This future PE is greater than the current PE for the CA Insurance industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 5.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.69%, as per the Simply Wall St company report.

Intact Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced significant catastrophe (CAT) losses in Q3, including severe weather events in densely populated areas of Canada, which exceeded their annual guidance, potentially impacting near-term earnings and profitability.

- The combined ratio was higher than expected, with CAT losses contributing 22 points, indicating the company's exposure to weather-related risks, which could pressure net margins if these trends continue.

- Despite premium growth in personal auto, profitability in the industry remains challenged, suggesting that hard market conditions could pose threats to revenue growth and sustainability.

- The high level of conservatism in reserves for recent acquisitions like the Direct Line transaction in the UK could make future profitability uncertain, impacting earnings if favorable development does not materialize as expected.

- The company noted increasing pressure from competition, particularly in the large accounts market both in Canada and the UK, which could hinder market share growth and affect future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$286.42 for Intact Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$22.7 billion, earnings will come to CA$2.6 billion, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 5.7%.

- Given the current share price of CA$261.73, the analyst's price target of CA$286.42 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives