Key Takeaways

- Strategic investments and acquisitions are set to enhance operational scale and diversify revenue sources, positioning Fairfax for future earnings growth.

- International expansion and disciplined investment strategies in burgeoning markets promise premium revenue growth and long-term earnings potential.

- Currency volatility, rising interest rates, and catastrophe losses pose risks to Fairfax's net margins, earnings, and investment returns, along with competitive market pressures.

Catalysts

About Fairfax Financial Holdings- Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

- Fairfax's robust performance in 2024 set the stage for sustained revenue growth, driven by record underwriting income and premium growth in both insurance and reinsurance operations, indicating strengthened operational efficiency and capacity. This growth in premiums is expected to continue contributing significantly to the company's revenue.

- Significant investments and acquisitions, such as Sleep Country, Peak Achievement, and the prospective closing of a 33% investment in Albingia, aim to enhance Fairfax's diversified portfolio and operational scale, potentially boosting earnings and expanding revenue sources in future periods.

- The solid investment portfolio, with improved interest and dividend income, particularly benefiting from high-quality fixed-income securities at elevated yields, suggests a positive outlook for future earnings amid persistent higher interest rates.

- Fairfax's increased focus on international operations, bolstered by the consolidation of Gulf Insurance, offers substantial growth potential. This focus, coupled with robust management teams, positions them for increased premium revenue and market share expansion in burgeoning international markets.

- Fairfax's emphasis on value investing and maintaining a disciplined investment approach, highlighted by strategic investments in fast-growing regions like India, suggests potential for enhanced investment returns which could drive significant earnings growth over the long term.

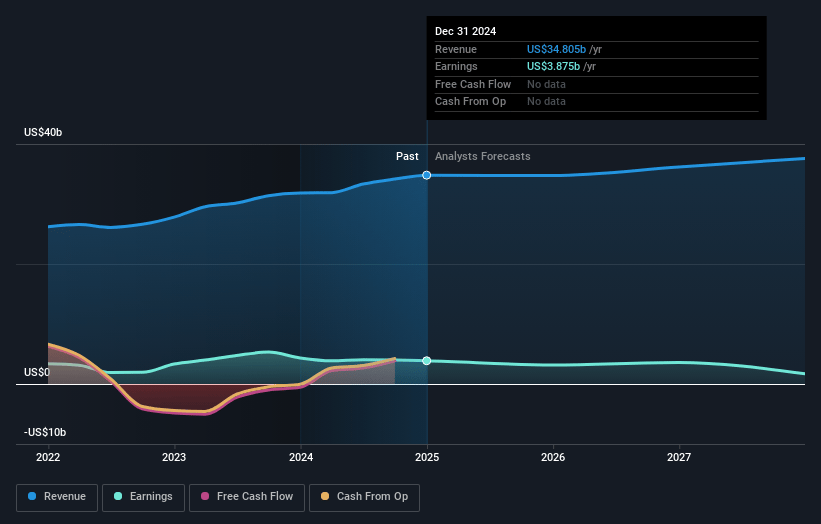

Fairfax Financial Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fairfax Financial Holdings's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.1% today to 7.8% in 3 years time.

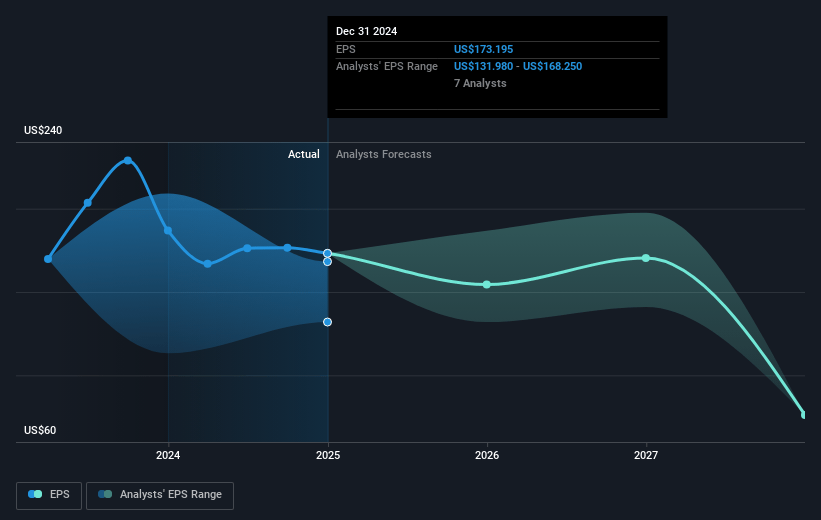

- Analysts expect earnings to reach $3.2 billion (and earnings per share of $142.73) by about April 2028, down from $3.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 8.3x today. This future PE is lower than the current PE for the CA Insurance industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 2.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.87%, as per the Simply Wall St company report.

Fairfax Financial Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant strengthening of the U.S. dollar resulted in currency losses of $477 million, which impacted other comprehensive income and poses a risk to Fairfax's net margins and earnings if this trend continues.

- Rising interest rates caused unrealized losses of $731 million on the bond portfolio, affecting Fairfax's net earnings, and future increases could further impact investment returns and net margins.

- Gulf Insurance reported an elevated combined ratio of 100.9% due to the Dubai floods and purchase price adjustments, which could strain underwriting margins if similar events occur.

- Exposure to significant catastrophe losses, such as the California wildfires, poses a risk with estimated net losses of $500 million to $750 million, potentially affecting future underwriting profit and earnings.

- Competitive pressure in the market, especially highlighted by Zenith's combined ratio of 99.1% due to pricing decreases, could impact profitability and net margins in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$2274.689 for Fairfax Financial Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$2576.5, and the most bearish reporting a price target of just CA$1504.13.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $40.8 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 5.9%.

- Given the current share price of CA$2060.01, the analyst price target of CA$2274.69 is 9.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.