Key Takeaways

- Upcoming project completions aim to boost revenue through increased capacity and services amid rising natural gas demand.

- High capital commitments and spin-off adjustments might pressure net margins short-term, while deleveraging strategies target long-term financial strength.

- Strong operational results, effective cost management, and strategic initiatives suggest TC Energy is well-positioned for revenue growth and improved financial flexibility.

Catalysts

About TC Energy- Operates as an energy infrastructure company in North America.

- TC Energy's expectations of reaching mechanical completion on major projects like Southeast Gateway by late 2024 or early 2025, with the commercial in-service by mid-2025, suggest upcoming impacts on revenue growth through increased capacity and services.

- The anticipated rise in North American natural gas demand by about 40 Bcf a day by 2035, driven by LNG exports and other sector developments, supports a favorable outlook on revenue from expanded infrastructure and related services.

- The completion of the spin-off of the Liquids Pipelines business into South Bow may lead to short-term operational adjustments, potentially impacting net margins as the company adjusts its financial structure post-spin-off.

- The company's forecast of placing $7 billion of assets into service in 2024, with another $8.5 billion in 2025, indicates high capital commitments, which may pressure net margins and affect earnings in the short term due to the delay between capital expenditure and income realization.

- TC Energy's focus on deleveraging strategies, including potential asset sales and reducing debt-to-EBITDA ratio, reflects strategic financial positioning that could impact earnings positively in the long term but may constrain short-term financial flexibility.

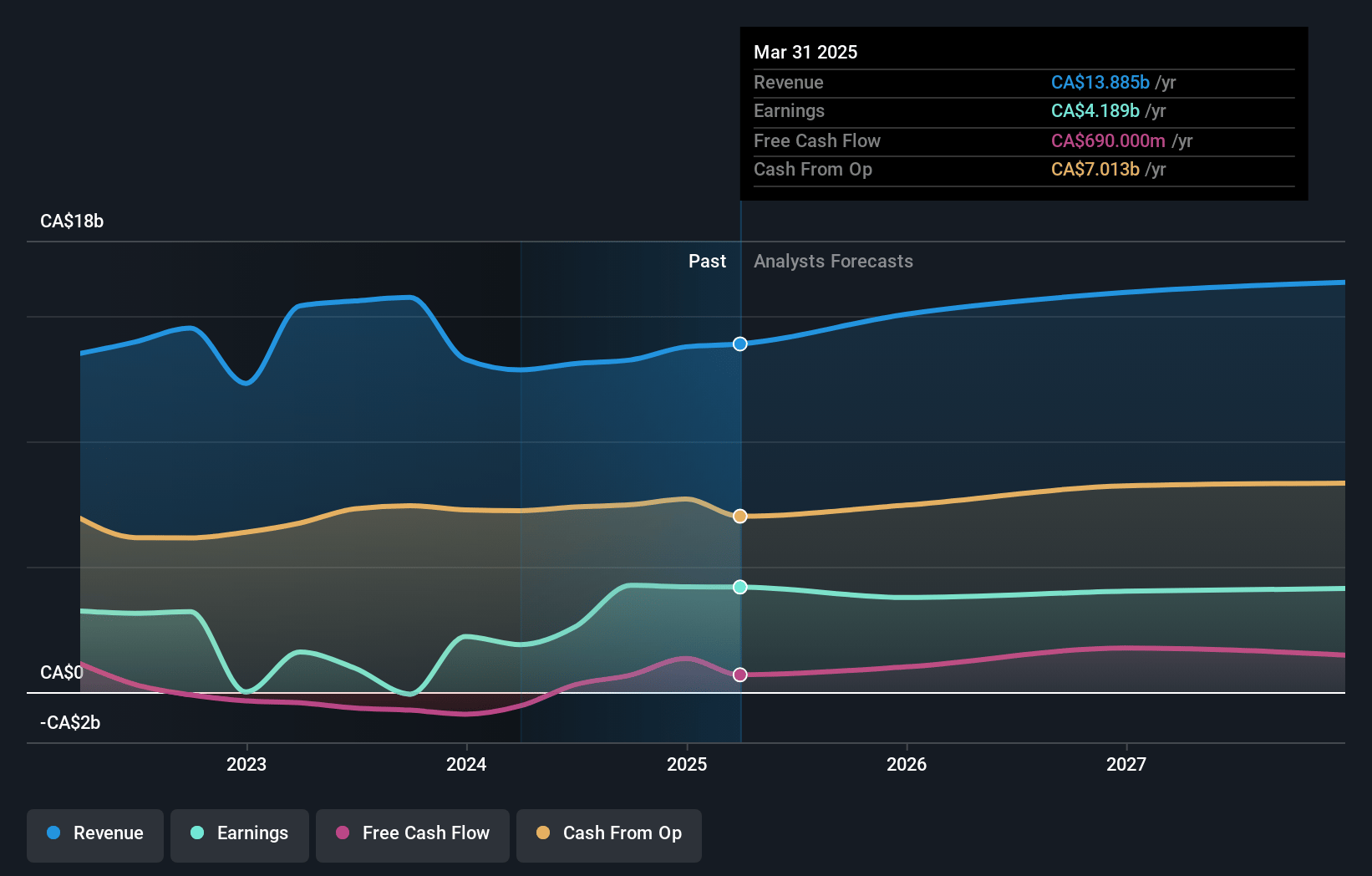

TC Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TC Energy's revenue will decrease by -1.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.6% today to 26.9% in 3 years time.

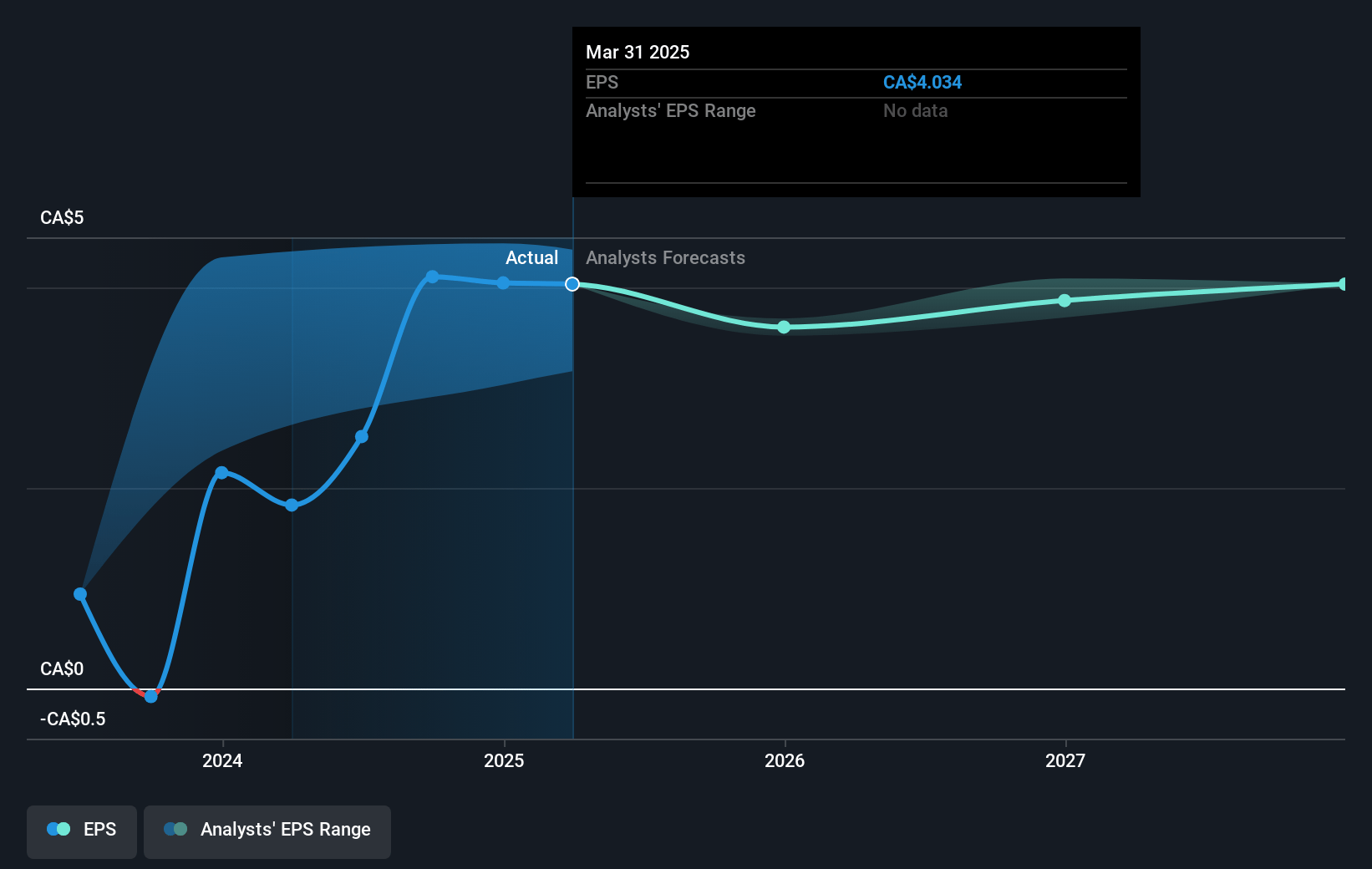

- Analysts expect earnings to reach CA$4.4 billion (and earnings per share of CA$4.25) by about January 2028, down from CA$5.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 13.3x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to decline by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

TC Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TC Energy has shown strong operational and financial results, with a 6% increase in comparable EBITDA for the third quarter of 2024 and expectations for high-end performance for the rest of the year, indicating revenue growth and a strong profit outlook.

- The company successfully reduced project costs on significant initiatives like the Southeast Gateway, which came in 11% under budget. This effective cost management may improve net margins and overall financial flexibility.

- TC Energy forecasts a substantial rise in North American natural gas demand, driven by factors such as LNG exports and utility reliability needs. This forecast underlines potential revenue growth opportunities through infrastructure expansion in a growing market.

- The capital project pipeline, including the completion of the Bruce Power Unit 3 MCR and major projects expected to come online by 2025, could contribute to increased earnings as these projects generate additional revenue streams.

- The company's strategic initiatives, such as deleveraging and maintaining a reliable energy infrastructure, suggest a capability to maintain or improve profit margins, reduce debt levels, and deliver shareholder value, supporting a positive long-term earnings outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$70.3 for TC Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$82.0, and the most bearish reporting a price target of just CA$53.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$16.2 billion, earnings will come to CA$4.4 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 8.9%.

- Given the current share price of CA$65.27, the analyst's price target of CA$70.3 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives